-

The founders of the South Carolina bank, which liquidated after lavish spending and losses depleted its capital, paid a total of $55,000 in fines and face restrictions on future employment.

February 24 -

The banking industry's top advocacy groups can't support giving credit unions capital-raising alternatives, but they are trying to understand the NCUA's complex proposal before filing comment letters against it.

February 22 -

A month into the comment period, NCUA has yet to receive a single response to a proposal that could provide credit unions easier access to market capital. The issue is unusually complex, experts say.

February 21 -

Many customers at Neighborhood National Bank in San Diego offer check-cashing services that draw attention for Bank Secrecy Act compliance.

February 17 -

CapGen, once a vocal critic of management, will cut its holdings to as little as 3% of shares outstanding.

February 15 -

National charters have fallen out of favor in recent years, but that isn't deterring David Dotherow from pursuing one for his Florida de novo.

February 10 -

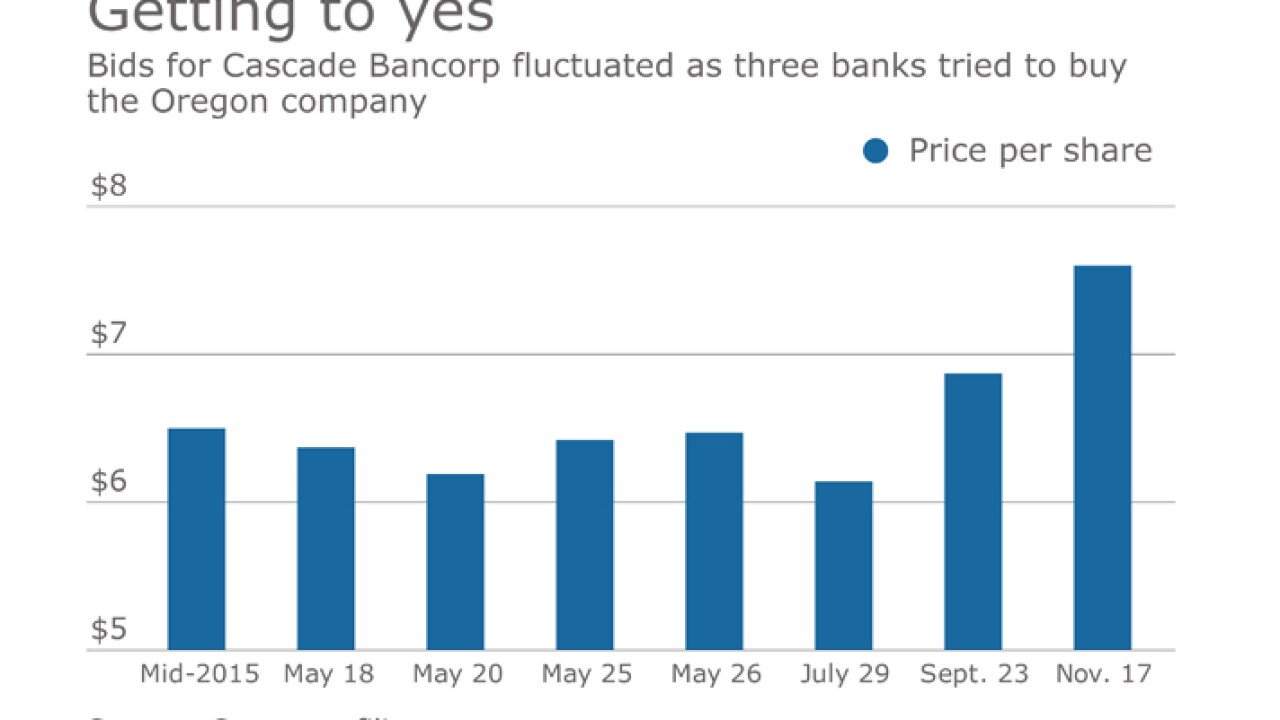

First Interstate missed out on two chances to snag Cascade before agreeing to buy the company in November, showing the importance of staying in touch with a target.

February 2 -

Oaktree and Thomas H. Lee will still have large positions in the company after the planned sales.

February 2 -

Old Line will have more than $2 billion in assets when it completes the acquisition, its fourth since 2011.

February 1 -

Royal Bancshares in Pa. made tough choices to avoid collapse during the financial crisis

January 31 -

The Louisiana company's call report also indicates that a steep fourth-quarter loss is looming

January 31 -

PNC will add an extra $300 million to its stock buyback program, taking advantage of a little-known Fed rule.

January 31 -

Frank Leto, Bryn Mawr’s CEO, called the acquisition of Royal Bancshares of Pennsylvania a “logical choice” for his company.

January 31 -

The French company will still have a majority stake after selling 25 million shares.

January 31 -

The company said it could use proceeds for repaying debt and acquisitions, among other things.

January 27 -

The merger will create a bank with more than $4 billion in assets.

January 26 -

First Merchants in Muncie, Ind., has agreed to buy Arlington Bank in Upper Arlington, Ohio.

January 25 -

The $1.9 billion deal – the industry's largest announced in 2017 – will create a bank with nearly $20 billion in assets.

January 23 -

The South Carolina company plans to use proceeds for acquisitions and organic growth.

January 20 -

About $12 million of the proceeds will go toward exiting the Small Business Lending Fund.

January 18