Community banking

Community banking

-

Lake Michigan Credit Union’s deal for Encore Bank would give it a total of 10 branches on the Florida Gulf Coast.

August 8 -

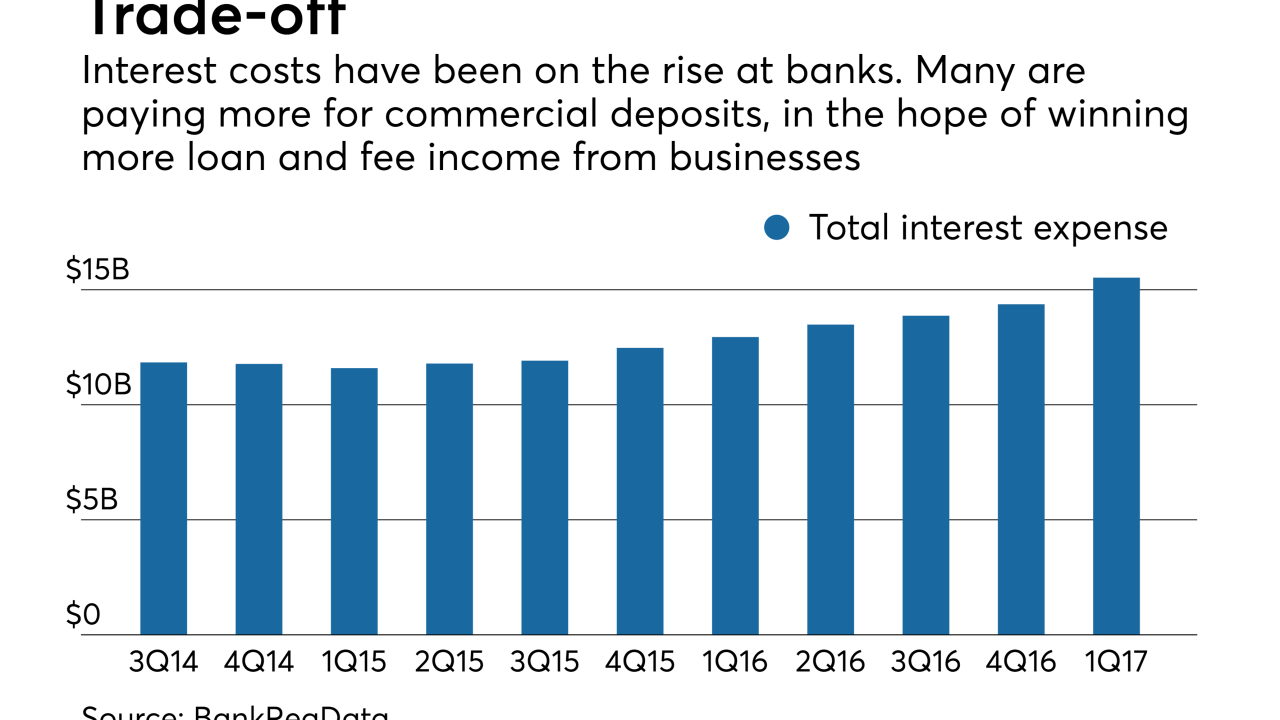

Many banks are adopting an “it takes money to make money” approach, paying more interest on deposits in exchange for loan growth, fee income and customer retention.

August 7 -

Supporting the Ronald McDonald House, Habitat for Humanity and other ways credit unions are making a difference in the communities they serve.

August 7 -

Investar Holding has reached an agreement to acquire BOJ Bancshares for $22 million, helping it expand in its home market of Baton Rouge.

August 7 -

A 10-year low in commercial banks’ chargeoffs bodes well for avoiding another crisis, but what it means for growth is another matter.

August 7 -

Supporting soccer teams, foster parents, aspiring scholars and other causes.

August 4 -

Marvin Schoenhals had been the Delaware company's chairman for 25 years. He stepped down as CEO in 2007.

August 3 -

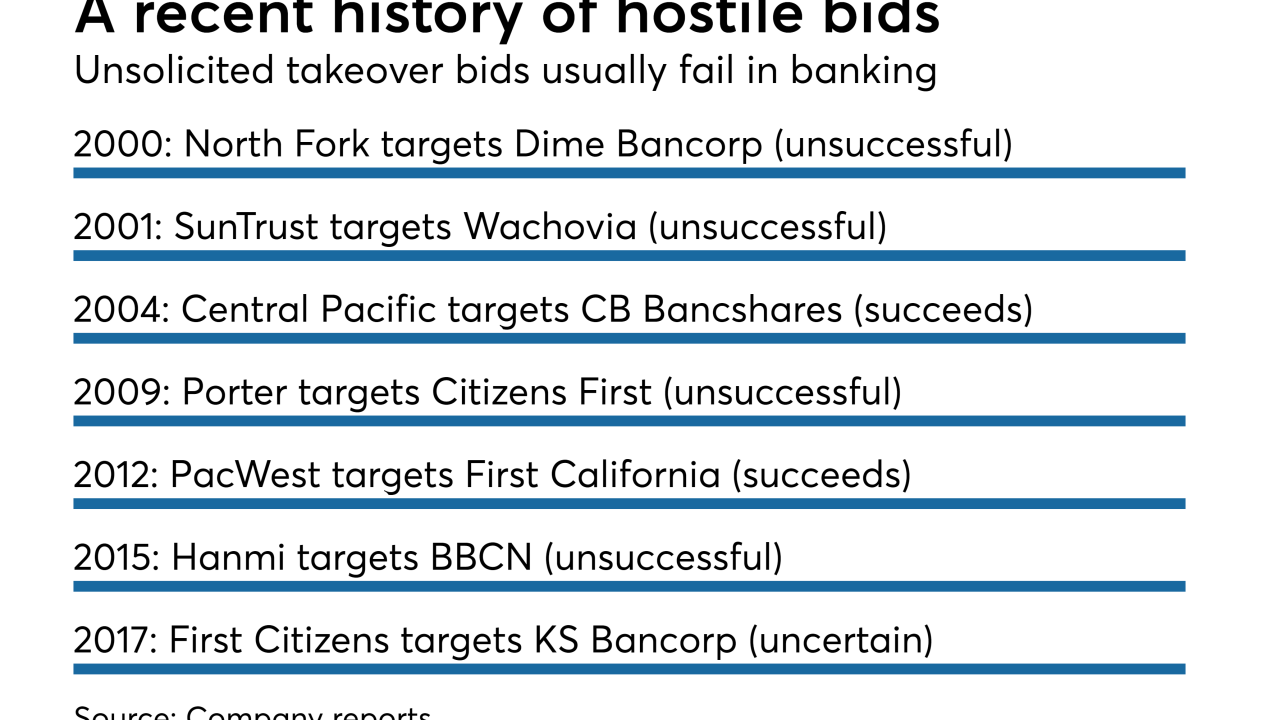

The key to an unsolicited bid is to avoid looking like a bully. That requires clear communication with a target's investors, employees and clients — along with any other banks you might eventually want to buy.

August 3 -

The South Pacific island's leaders have a creative solution to fix their cash-based economy that hasn't been done in the U.S. in nearly a century. But will regulators approve?

August 3 -

The Federal Reserve Board has to have a community banker among its members. But that may be complicating the president's ability to fill vacant seats at the central bank.

August 2 -

The Texas company agreed to buy Liberty Bancshares on the same day it completed its purchase of the $1 billion-asset Sovereign Bancshares.

August 2 -

The ranks of mutually owned banks are in decline. Survivors say sharper marketing, better access to capital and lower barriers to entry could stop the bleeding.

August 2 -

Accolades, awards, assistance and more ways credit unions are giving back to the communities they serve.

August 2 -

The company will pay $51 million for Bank of Napa, adding two branches and nearly $250 million in assets.

August 2 -

Doug Bowers said the company has moved beyond past issues, including corporate governance shortcomings and the abrupt departure of his predecessor, and is ready to bring in more loans and core deposits.

August 1 -

Rising taxes, declining population and the political landscape in Illinois have led several bankers to put more money and resources into nearby states.

August 1 -

Core deposit growth might be the best indicator of which banks will have true staying power in the years ahead.

August 1 -

The company said that Dennis Shaffer, its president, will succeed James Miller at the end of this year.

August 1 -

The company agreed to buy County First Bank in a cash-and-stock transaction.

August 1 -

The South Pacific island's leaders have a creative solution to fix their cash-based economy that hasn't been done in the U.S. in nearly a century. But will regulators approve?

July 31