-

Consumer Financial Protection Bureau Director Richard Cordray said his possible political ambitions did not affect the small-dollar rule, while declining to spell out if he was running for office.

August 30 -

The Pay It Plan It feature allows customers to create payment plans for individual purchases, similar to personal loans. The plans include a fixed fee and no interest.

August 30 -

As Republicans policymakers pursue efforts to revamp the Consumer Financial Protection Bureau and replace its leadership, state agencies are already preparing to fill any vacuum that might ensue if the CFPB steps back.

August 30 -

Following short-term disruptions from Harvey, Texas bankers expect a long-term lift to the local economy; Buffett’s company officially becomes the bank’s largest shareholder.

August 30 -

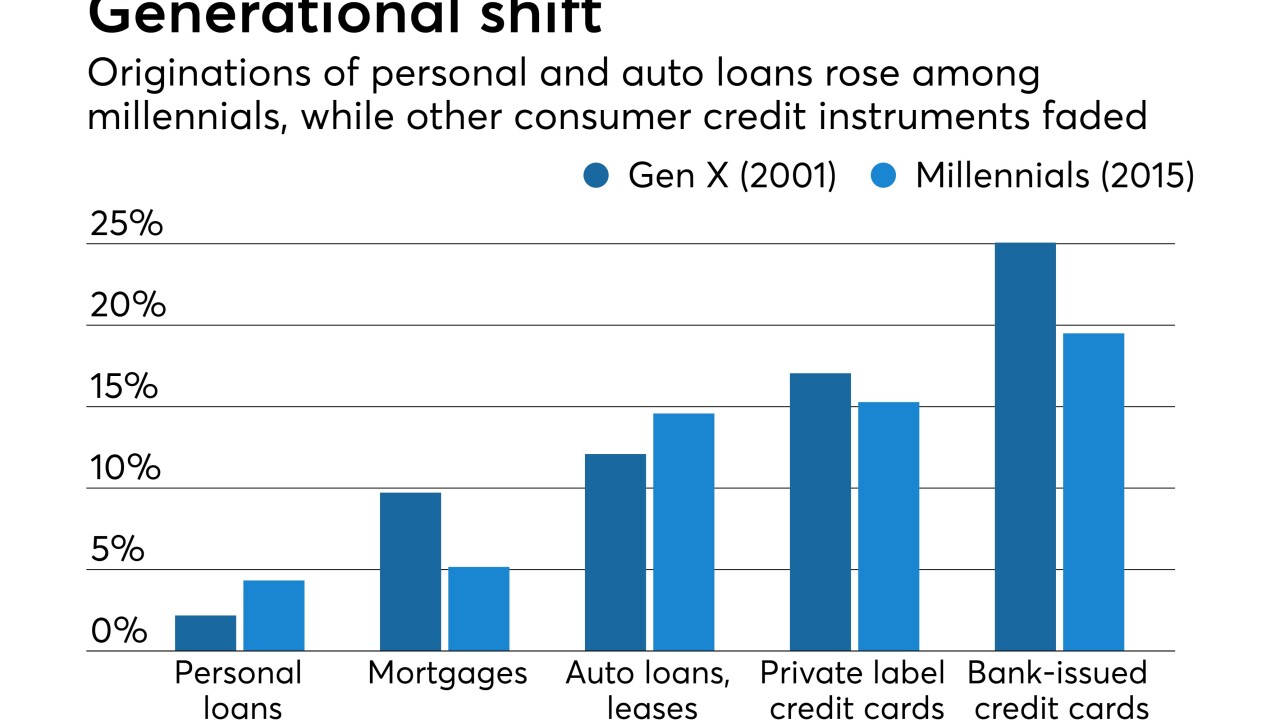

Sure, personal loans have a long way to go to catch up in market share with other forms of consumer credit, but millennials are relying more heavily on them than their Gen X predecessors while paring back on credit cards and mortgages. Online lenders are a big reason, and banks are exploring ways to adjust to changing habits.

August 30 -

The Canadian bank blamed flat profits at its U.S. business, which includes Chicago-based lender BMO Harris Bank, partly on Washington gridlock that has stalled pro-business reforms.

August 29 -

The startup, which offered credit lines of up to $1,000, hoped to tap into the millennial generation's frustration with overdraft fees.

August 29 -

The Consumer Financial Protection Bureau’s likely decision to pare back its final rule on small-dollar lending may help guard it against a congressional rollback and pave the way for bankers to return to the space.

August 29 -

House Financial Services Committee Chairman Jeb Hensarling, R-Texas, wrote a letter to CFPB Director Richard Cordray calling on him to clarify whether he is running for political office.

August 29 -

In the coming year, bankers in Puerto Rico will need to keep an eye on how steep cuts in government spending will affect the island’s consumers, says José Rafael Fernández, CEO of OFG Bancorp.

August 29 -

CFPB and OCC are looking at auto lenders’ policies regarding so-called GAP insurance; banks want greater collateral from retailers.

August 29 -

Powell downplayed fears about subprime auto lending, saying he aims to improve Santander Consumer's compliance culture, beef up customer services and expand its relationship with Chrysler Capital.

August 28 -

It is reasonable to rethink the role of state usury laws in national credit markets, but there should not be any erosion of consumer protections.

August 28 Georgetown University

Georgetown University -

Scott Powell will lead the auto lender while continuing to serve as CEO of Santander Holdings, the U.S. division of the Spanish banking giant Banco Santander.

August 28 -

Republicans are already accusing CFPB Director Richard Cordray of misusing his job as a fundraising platform while many agency allies want him to stay.

August 25 -

U.S. Bank and Wells Fargo to use Blend software to speed up mortgage origination processes; Robert Kaplan wants to keep stress tests on big banks.

August 25 -

SAFE FCU managed to set new auto loan volume records with a recent promotion. That growth dovetails with what's happening at credit unions across the country.

August 24 -

The uplifting story of another Virginia statue — this one honoring the first black female to charter a bank — is well-timed. Plus, JPMorgan Chase's O'Connor on laboring over Libor and U.S. Bank's Lawler on getting people to do the right thing.

August 24

-

Austin, Texas-based CU has seen growth in auto, mortgage and commercial lending.

August 24 -

The credit card issuer paid $95 million to settle charges it offered inferior terms to customers in American territories; Mitsubishi UFJ wants to become a top 10 U.S. bank.

August 24