-

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

The $126 million-asset credit union selected the new core platform in order to increase automation and cut down on "busy work" for employees.

December 27 -

The three institutions will use a platform from Fiserv to help improve efficiency.

December 20 -

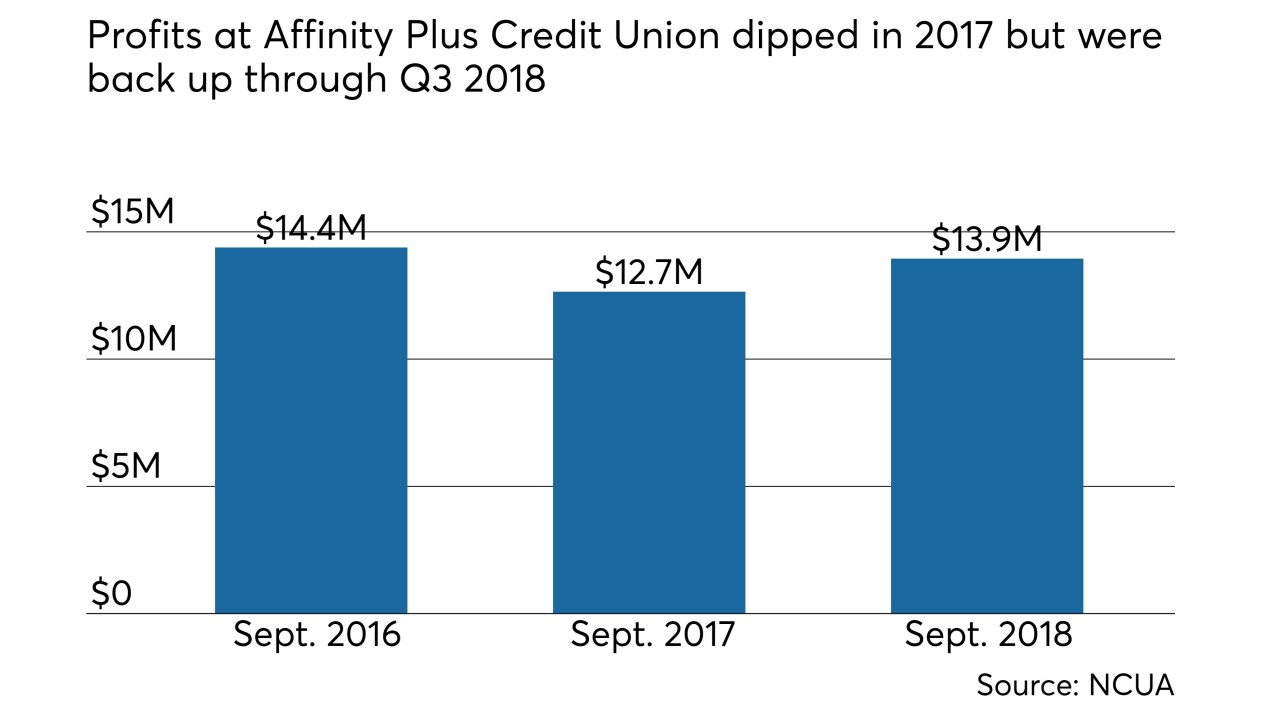

Along with a core conversion, the Twin Cities-area credit union deployed new loan origination systems and online and mobile banking platforms.

December 18 -

The Ponca City-based institution becomes the first credit union in Oklahoma to join CU*Answers.

December 13 -

The banking software company has agreed to acquire Avoka, a software-as-a-service company that helps banks with customer acquisition.

December 12 -

The Memphis-based CUSO, known for its NewSolutions system, signed six credit unions, all with assets under $140 million.

November 13 -

The credit union hsa been a Sharetec client for five years but was stuck in a contract that left it unable to convert until now.

November 7 -

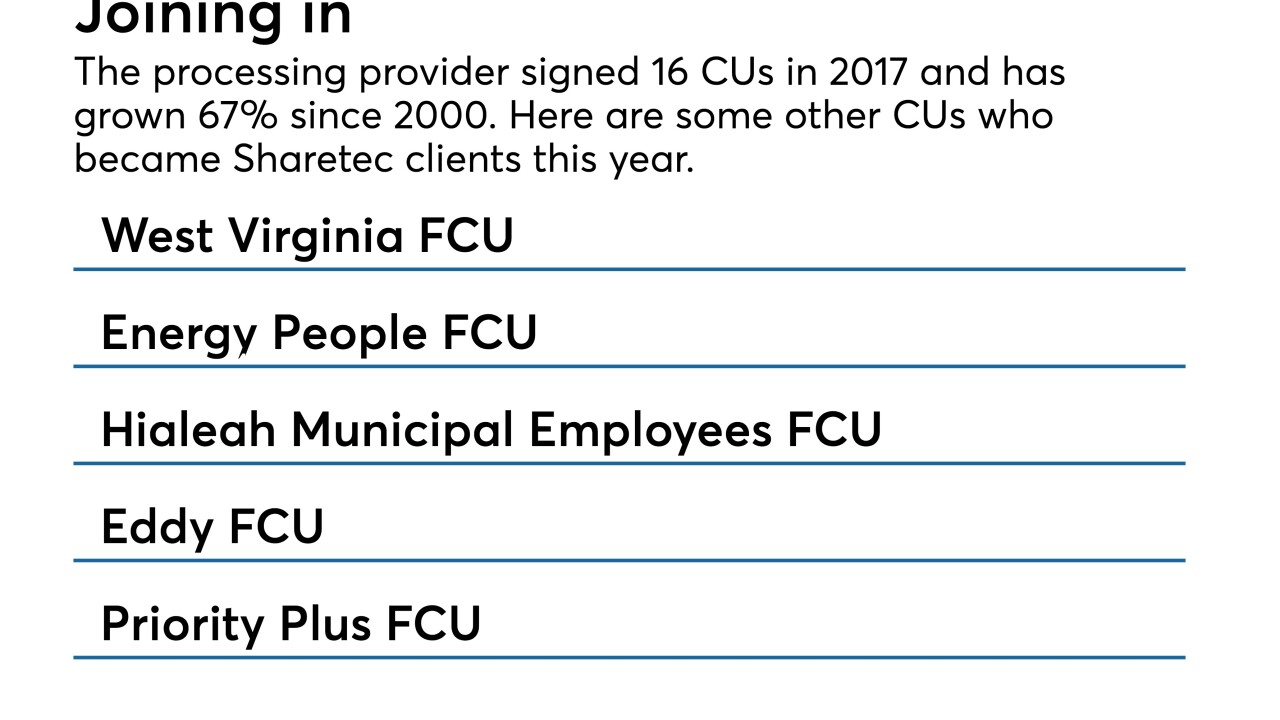

Unlimited third-party integrations and the system's design were some of the draw for the credit unions who signed up for the platform.

November 5 -

Serverless computing has its proponents — Capital One and BBVA among them — but the service hasn’t yet proven it can fulfill general systems needs in banking.

November 2 -

The Maine-based institution will convert to the CU*BASE platform during the first quarter of next year.

November 2 -

The advocacy group argues that major core processors are not helping small banks keep pace with customers' technology demands.

November 1 -

The small New Mexico-based institution will now be able to offer services like mobile banking and online loan applications.

November 1 -

SigFig is partnering with Citizens Bank to launch an advice platform in its effort to become a direct competitor to legacy core systems providers.

October 30 -

The New Jersey-based credit union aims to increase its technological offerings as a result of the conversion.

October 24 -

The association has invited FIS, Fiserv and Jack Henry to join a committee tasked with helping smaller institutions modernize technology.

October 23 -

The credit union in San Diego expects to increase its efficiency and add products and services once the switch is complete.

October 22 -

The Miami-area credit union is the latest to migrate to Sharetec's core banking platform.

October 10 -

The $25 million-asset credit union has already seen new efficiencies since moving to the new platform.

October 5