-

The Fed’s quarterly Senior Loan Officer Opinion Survey found that demand decreased for both commercial and industrial and commercial real estate loans.

July 31 -

Aggressive restructuring moves and stock buybacks are giving CIT time to remold itself, but it will need to show core-banking growth to stave off calls for the company to sell itself.

May 30 -

This is a good time for bank risk managers and bank regulatory examiners to evaluate the effects of a deepening retail crisis on the financial services sector.

May 19 MRV Associates

MRV Associates -

Construction lending could make a comeback if bankers persuade Congress to reform capital and other complicated rules on so-called high volatility CRE loans. But will regulators go for it?

May 12 -

Stonegate Bank in Florida figured its balance sheet was too small and undiversified to stay independent. But it was choosy in approaching potential buyers and aggressively scrutinized the lead bidder’s loan book.

May 10 -

Banks are increasingly tightening lending standards for commercial real estate loans and are likewise seeing a drop-off in demand, according to a report released Monday by the Federal Reserve Board.

May 8 -

Growth in commercial real estate loans is a big reason the New Jersey bank had a strong quarter.

April 26 -

The Tennessee company has been working to resolve a memorandum of understanding tied to its CRE exposure.

April 4 -

Vacancies and rent-slashing have some banks worried that certain markets are overheating, but others say the decline in nonperforming loans is a sign the sector has never been healthier.

March 3 -

Joseph Ficalora, New York Community's CEO, told analysts that his company could still have a chance to buy Astoria "down the road."

February 7 -

A number of banks are tapping the brakes on commercial real estate lending, giving others an opportunity to make more loans at better terms.

February 3 -

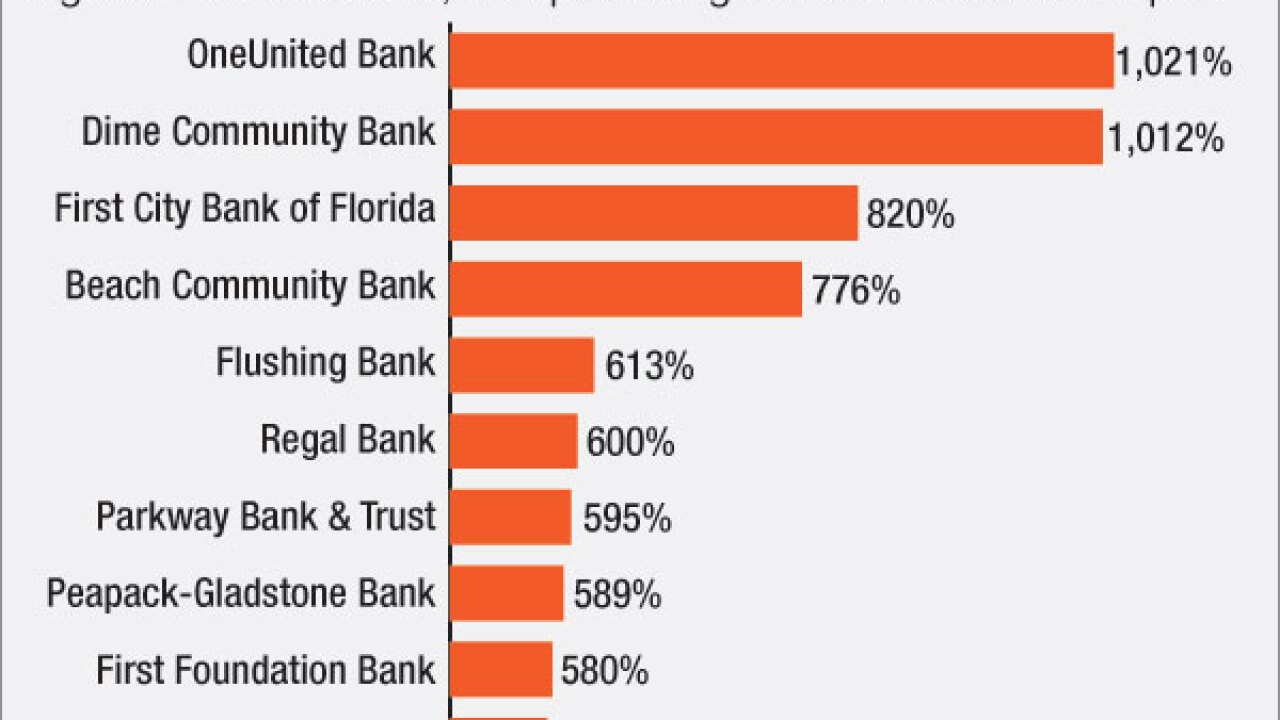

On Sept. 30, 2016. Dollars in thousands.

January 31 -

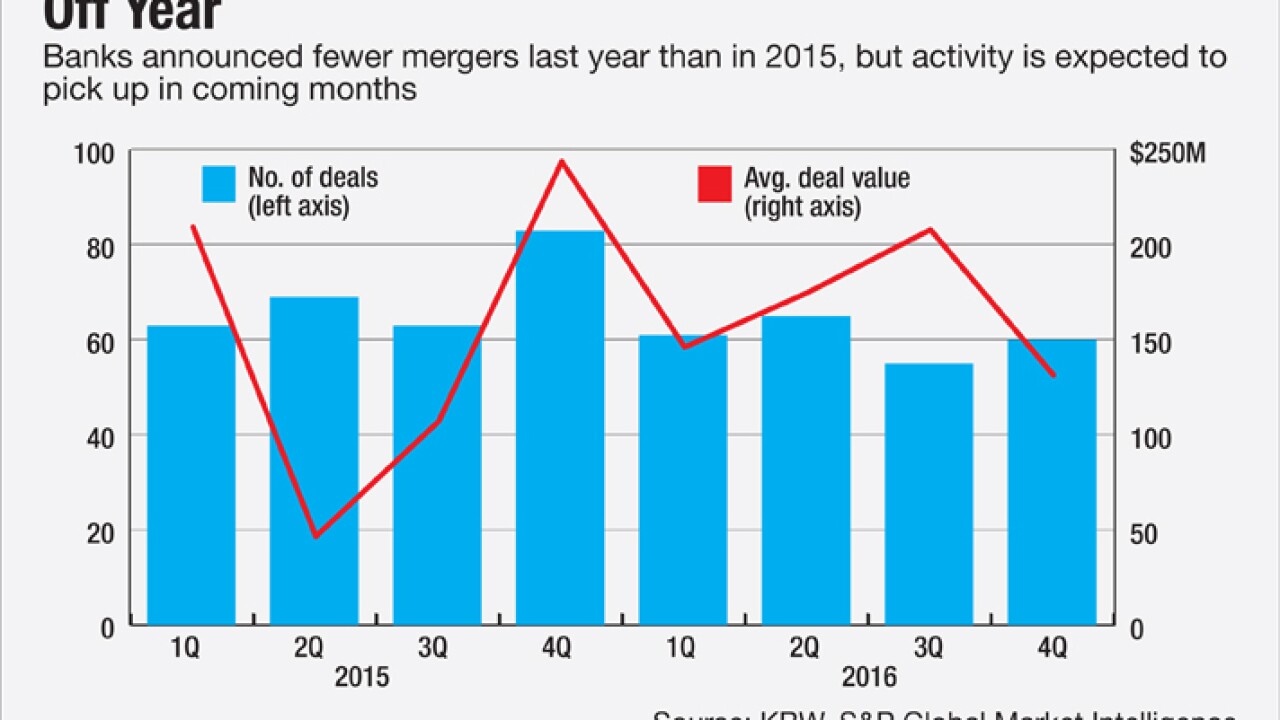

There is optimism that consolidation could bounce back from a lackluster 2016 as bank stocks rally. At the same time, expectations of regulatory easing and tax reform could entice more banks to stay independent, at least in the short term.

January 11 - New Jersey

Weakness in the energy sector and a surge in new construction are pushing up vacancy rates at offices and hotels, leading to a spike in delinquencies on loans tied to them. The safer bet, bankers say, is lending on industrial properties.

January 5 -

First Midwest Bancorp will move its headquarters to Chicago from Itasca, Ill., next year. The $11.6 billion-asset company will open an 80,000-square-foot office in the spring of 2018.

January 3 -

Kenneth Mahon, the new CEO of Dime Community Bank, wants to reduce the 152-year-old institution's multifamily exposure by diversifying into other asset classes. But finding new business amid already fierce competition could be an immense challenge for Dime and other community banks in 2017.

December 30 -

The commercial-and-industrial loan space is overheated, higher rates could stifle mortgage refinancings, and subprime auto delinquencies are on the rise. Bankers could be fighting these fires and more in the new year.

December 29 -

Chemical CEO David Ramaker has a wide range of options diversify business lines, expand organically in several Midwestern states, pursue M&A or all of the above following his recent acquisition of Talmer. But new challenges accompany Chemical's higher profile, too.

December 28 -

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

So now what? New York Community Bancorp and Astoria Financial have been mum about why they nixed their merger agreement, or where they go next, but the companies have a surprising number of options in the current climate.

December 20