Credit cards

Credit cards

-

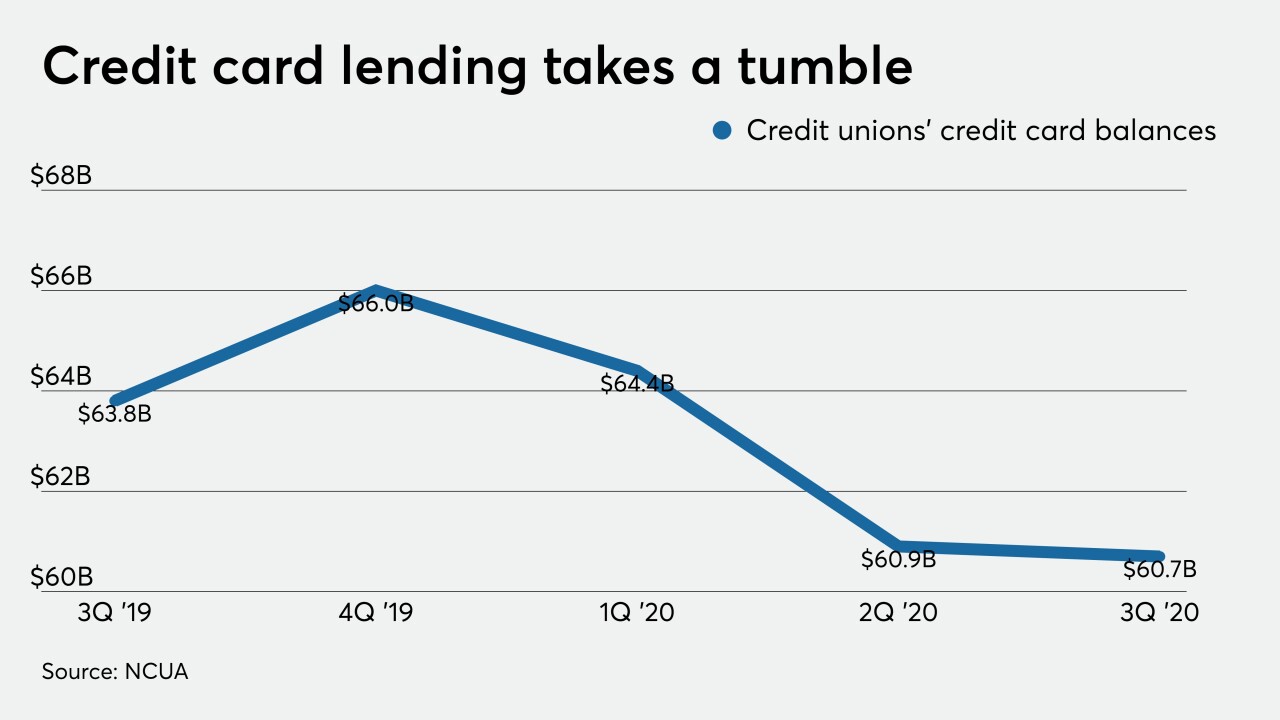

Unsecured personal lending has fallen as many consumers have stashed away cash and paid down credit card balances during the pandemic. The trend probably won’t reverse course anytime soon.

February 18 -

Wells Fargo is opting to keep its private-label credit card unit after reaching out to potential buyers last year, according to a person with knowledge of the matter.

February 9 -

On Sep. 30, 2020. Dollars in thousands.

February 8 -

Citigroup will refund an additional $4.2 million to some credit card customers who were overcharged years ago.

February 8 -

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4 -

On Sep. 30, 2020. Dollars in thousands.

February 1 -

Like other card issuers, the Stamford, Conn., company expects current trends — soft loan demand but strong credit quality — to reverse later this year as the economy emerges from the pandemic-induced recession.

January 29 -

City National Bank is working with the fintech startup Extend to further boost contactless payments at the point of sale for business employees through the launch of a virtual Visa commercial credit card.

January 29 -

Allowing employees to work from home until the holiday will give Amex the chance to monitor the speed with which vaccines are distributed, CEO Stephen Squeri said in a memo to workers.

January 29 -

Walmart’s warehouse unit Sam’s Club is introducing digital features and new rewards tiers to modernize its Synchrony-issued Mastercard.

January 28 -

Capital One Financial is the latest credit card issuer to release loss reserves because its loans have performed better than expected during the pandemic.

January 27 -

U.S. credit card delinquencies reached record-low levels in 2020, as Americans took advantage of stimulus checks and adjusted their spending habits, according to a new report.

January 22 -

Consumers have largely kept up with their payments during the pandemic, but Discover chief Roger Hochschild says he expects defaults to rise as structural changes in the economy lead to more layoffs of white-collar workers.

January 21 -

Payments activity “snapped back” in the fourth quarter and should lift revenue the next few quarters, CEO Brian Moynihan said.

January 19 -

Goldman Sachs Group Inc. signed a deal to take over General Motors' credit card portfolio.

January 15 -

The online lender founded by Renaud Laplanche is now a full-fledged challenger bank that can offer generous checking terms because, it says, it can count on its loans for profits.

January 14 -

In the pandemic age, banks are getting creative in a bid to keep affluent customers.

January 13 -

Walgreens is collaborating with Synchrony to roll out a cobranded credit card with an eye on the convergence of digital tools for spending and health care.

January 13 -

Synchrony wasn’t unscathed by the pandemic — consumer spending slowed during the first half of the year — but its mix of private-label and cobranded cards for everyday items suffered far less than other issuers' cards that emphasized luxury and travel.

January 12 -

Japanese card issuer and acquirer JCB International has worked with real-time payments software provider ACI Worldwide to launch a web API-based payment service.

January 12