-

Lawmakers and the credit union regulator have packed schedules this week as both groups attempt to wrap up their 2020 business before the holidays.

December 14 -

The Gainesville, Fla.-based credit union has converted from a federal to a state charter and will debut its new brand identity early next month.

December 11 -

Ayn Talley will step down in January, to be succeeded by the credit union's longtime executive vice president.

December 11 -

The credit union regulator's monthly meeting will cover the agency's budget proposal and subordinated debt, among other items, along with taking another shot at an overdraft proposal that was rejected earlier this year.

December 11 -

Anna Lo, a former NCUA examiner who previously led Pacific Transportation FCU, will take the helm next month, following the retirement of longtime CEO Lourdes Cortez.

December 11 -

The process will see the state's largest credit union split its president and CEO roles until longtime chief executive John Reed retires in January 2023.

December 10 -

Irene Oberbauer spent 12 years in the credit union movement and was SDCCU's first female CEO, serving from 2007 until her retirement in 2010.

December 10 -

To improve a declining rating in the annual American Consumer Satisfaction Index, credit unions may have to make hefty investments in technology upgrades, something most of them can't afford.

December 10 -

Amy Nigrelli will serve as CMO of the Albuquerque-based credit union, one of two recent personnel moves there.

December 9 -

Canoga Postal's merger plans mark the second consolidation in a month for institutions serving USPS employees.

December 8 -

Thanksgiving may have already passed, but there's still plenty of room for gratitude in member communications.

December 8 Hallmark Business Connections

Hallmark Business Connections -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

This could be the final opportunity for Congress to extend a pair of key measures for credit unions that took effect earlier this year.

December 7 -

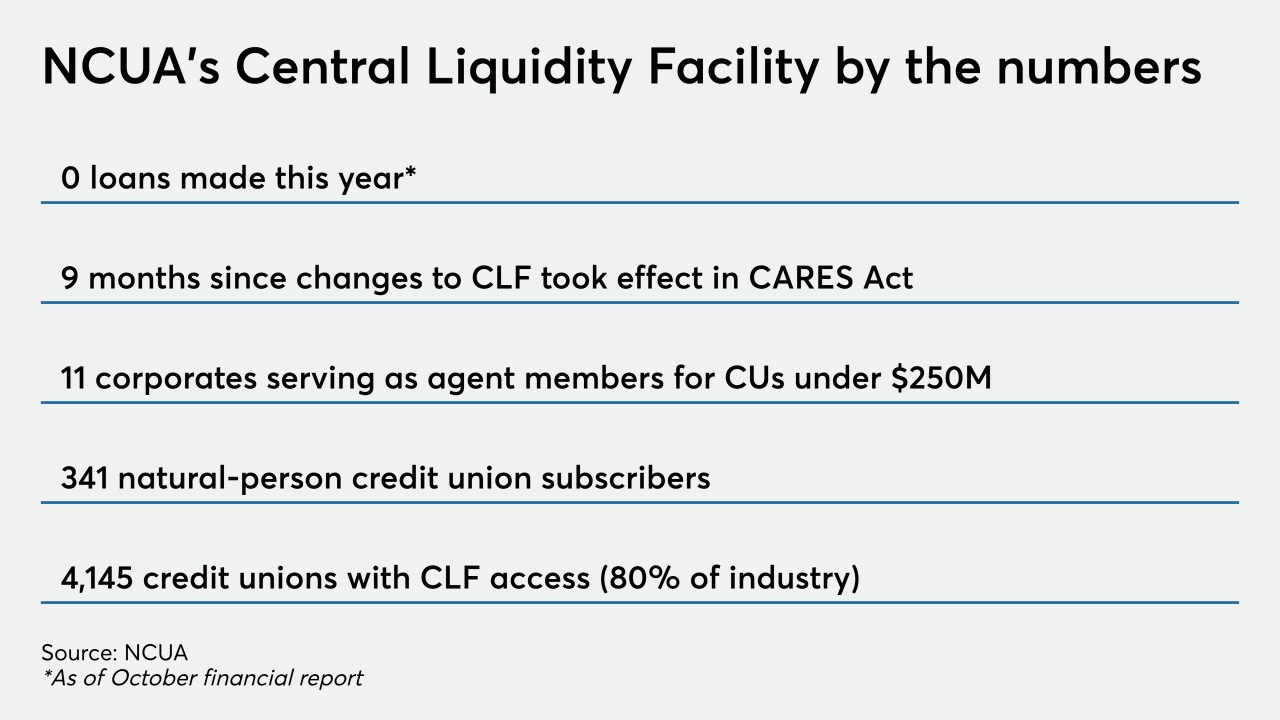

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

Acquirers shelved plans to buy banks this year as the coronavirus became widespread, but a combination of factors could spur the confidence to restart those conversations in the months ahead.

December 4 -

New analysis from S&P shows credit unions near $1 billion of assets and above continuing to dominate the industry's performance in the Paycheck Protection Program as some CUs dedicate a substantial portion of their portfolios to the effort.

December 3 -

Members of tiny Gloucester Municipal CU are set to vote early next year on whether to join Metro Credit Union.

December 3 -

-

Fran Godfrey, who has spent more than 35 years at the Michigan-based institution, will step down at the end of January.

December 1 -

CEO James Schenck says the institution's military focus means it must provide services for a group of consumers who move every few years. That has helped it focus more on mobile services and less on brick and mortar.

December 1