-

Cambridge Blockchain, a startup that bills its technology as a solution for banks to the competing regulatory imperatives of transparency and privacy, has raised $2 million through a convertible note.

February 1 -

The initiative would add payments to the country's national identity system, but the government wants more time to review Mastercard's proposal.

January 31 -

The president's executive order reflects a lack of trust in the identity information shared between countries. In theory, blockchains are tailor-made to solve this problem, but current systems may not be up to the task.

January 31 -

Facebook now lets users log in using a physical token. If banks gave consumers this option, it would strengthen the security of online accounts — or at least bolster their image.

January 26 -

The wave of new technology for CFOs should include easier invoicing and a user experience that resembles consumer e-commerce.

January 20 Tungsten Network Finance

Tungsten Network Finance -

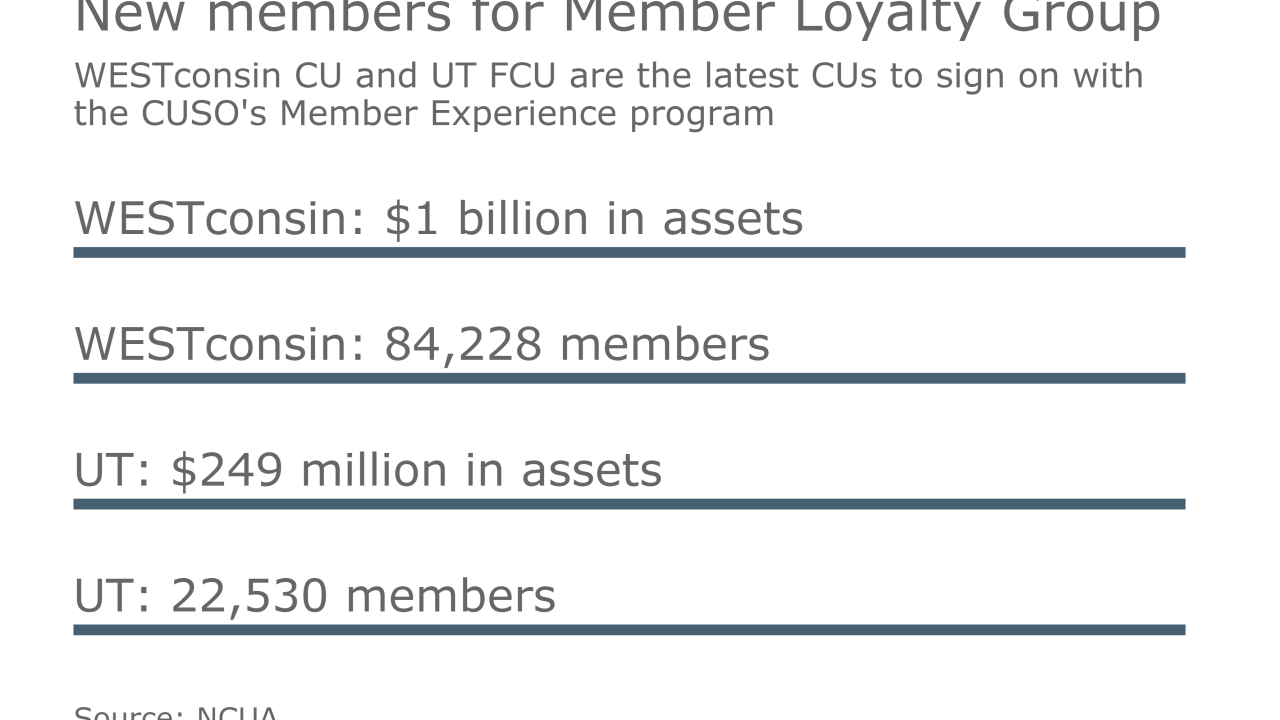

WESTconsin CU and UT FCU have selected Member Experience, which uses Net Promoter Score methodology to improve members’ experiences and drive growth.

January 17 -

Some vendors have begun offering authentication platforms through which biometrics and other authentication tools can be plugged into any or all channels. TD Bank is sold on this concept, but others are not completely sure.

January 12 -

A 2018 deadline to automate government payments is fast approaching. Only with a mix of technology solutions and cooperation among agencies can that deadline be met.

January 6 CloudTrade

CloudTrade -

Mobile app photo IDs have had mixed success, but Credntia's betting an overall spike in mobile technology will lead to robust use of its app.

December 9 -

Mobile wallets can be the single location for not just cards, but a wide variety of financial and customer services that banks provide.

December 7 VirtusaPolaris

VirtusaPolaris