-

The Consumer Financial Protection Bureau issued a request for information Thursday on the bureau’s public reporting of consumer complaints, which has long vexed the financial services industry.

March 1 -

An omnichannel payment platform offers customers a unified shopping experience across whichever channel they decide to make a purchase, whether via point-of-sale in-store, online, mobile or even telephone, writes Nick Aceto, senior vice president of technology for CardConnect.

March 1 CardConnect

CardConnect -

Given the rapid pace of change across the industry, it’s wise for banks to focus on improving customer service rather than chasing the strategies of their rivals.

March 1

-

Scores of customers have been unable to use digital channels to access accounts for more than a week, and many have taken to social media to voice their displeasure with TD’s response to the outage. The lesson for other banks: Test new platforms, and test them again, before making them live.

February 20 -

How do you eliminate "pain points" in the banking experience, increase wallet share and improve loyalty? Companies like Ally, USAA and Bank of the West are believers in tracking the customer journey to find the answers.

February 1 -

Consumers are more than willing to share retail payment information, geolocations, as well as Uber, OpenTable, Facebook, and Twitter information. However, they have high expectations for what they receive in return, writes Lisa Woodley, vice president of FSI customer experience for NTT Data Services.

January 29 NTT Data

NTT Data -

There are a number of tactics and solutions organizations can employ to shut down the favored methods of fraudsters, including the use of bots and device compromise, writes Michael Lynch, chief strategy officer at InAuth.

January 25 InAuth

InAuth -

The move comes at a time when banks are becoming more aggressive in acquiring or investing in financial technology companies.

January 17 -

Capital One became the latest bank to feel customers' online wrath last week after reports that some customers were being charged twice for debit card activity. But it was hardly alone.

January 10 -

First it was coffee and car service, and now it could be cashier’s checks and debit cards. Matt Krogstad left his bank job to build tech that lets bank customers order products at the press of a button and pick them up at a branch or get delivery.

January 10 -

Banks have been in full cost-cutting mode in recent years, but with profits expected to increase substantially as a result of tax reform, all analysts and investors want to know is how they plan to spend their tax savings.

January 5 -

When taken in the context of the complete invoice and payment cycle, manual payments not only have higher processing costs to the provider and supplier, but also result in delays between processing and making payments, writes Darci Guerrein, vice president of payment operations for GHX.

January 5 GHX

GHX -

Commercial customers, including small businesses, seem ready to pay up to shift to faster, more sophisticated electronic invoicing and payments, and enterprising banks that provide them the technology to do so could find it lucrative.

January 2 -

SMBs are choosing virtual cards as their preferred form of electronic payments because they solve many of their payment challenges, while also helping them avoid the costs associated with custom software solutions designed for larger businesses, writes Blair Jeffery, COO of Noventis.

December 18 Noventis

Noventis -

JPMorgan Chase get a new branch banking leader; Trump's anti-Wells tweet stokes concerns; blockchain, GSE survival, and more in this week's top stories.

December 15 -

Covault has begun offering a digital identification and virtual safe deposit box service to banks and others. Similar efforts have failed before, but its backers say mobile apps and the cloud have made the service more practical.

December 13 -

We entrust tech firms with vast amounts of information about our daily lives, with an expectation that they will safeguard it. But have we become too casual in the trust we place with them in exchange for more personalized experience and convenience?

December 13 AARP

AARP -

We entrust tech firms with vast amounts of information about our daily lives, with an expectation that they will safeguard it. But have we become too casual in the trust we place with them in exchange for more personalized experience and convenience?

December 8 AARP

AARP -

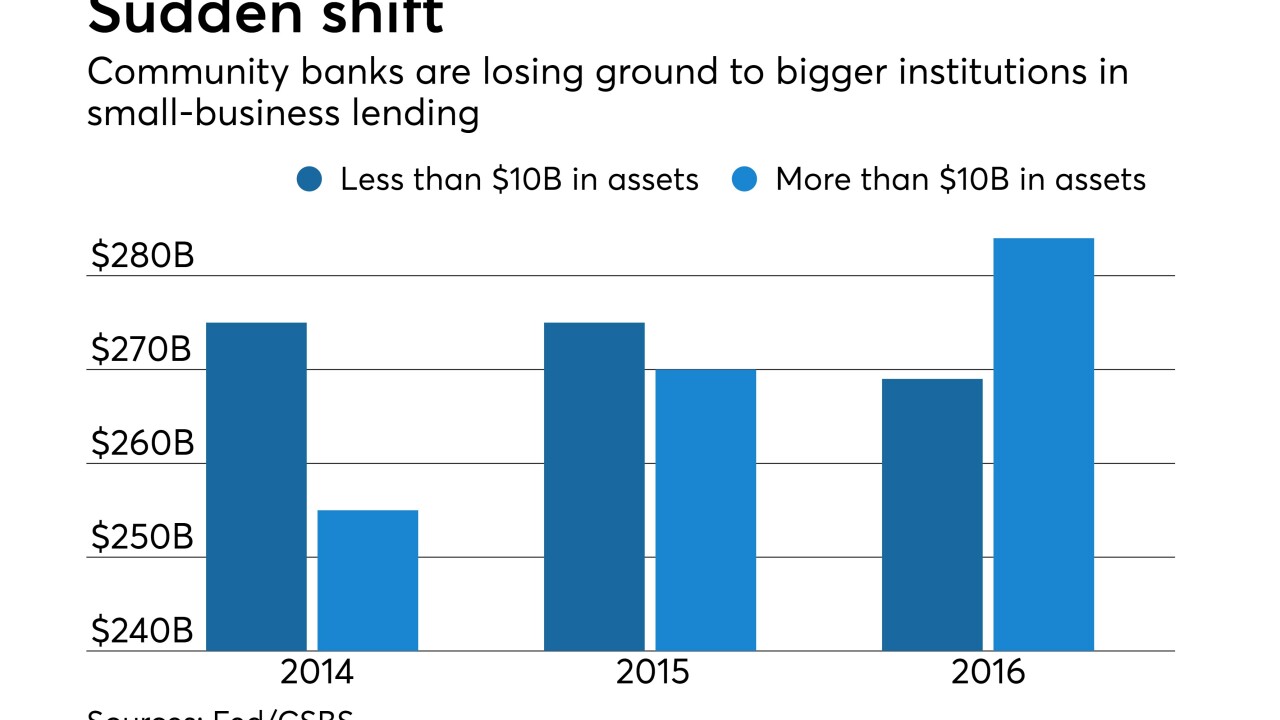

Bigger rivals are making inroads into small banks' bread-and-butter business line, yet the leaders of three community banks say they just need to keep doing what they do best — personal service — but work harder at it and incorporate new technology.

December 6 -

After two century-old community institutions merged in 2010, they never suspected it would take seven years before their operating systems got along.

December 6