-

As part of its financial inclusion campaign, Mastercard has partnered with Moneytrans to launch remittance-linked checking for migrant workers with a goal of obtaining 1 million users by 2025.

March 5 -

Afterpay has found an opening in the U.S. by targeting the millennials who don't have a credit card to use at the point of sale.

February 28 -

Black-owned OneUnited is getting grief for its depiction of the abolitionist on a debit card; the bank plans $4.5 billion in cost cuts, with 35,000 jobs cut.

February 18 -

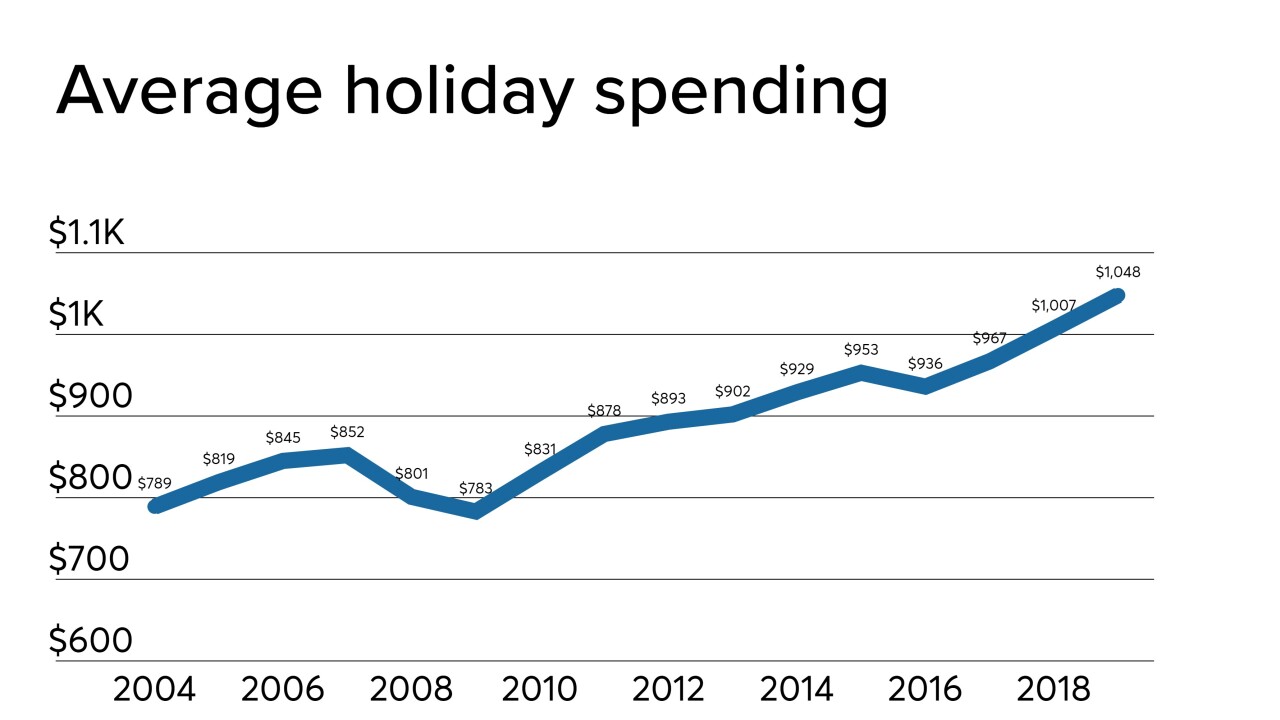

A new report from PSCU shows increases in spending levels and transaction volumes, along with a surge in mobile wallet usage during the holiday shopping season..

February 6 -

Seeking to clarify how merchants and banks should handle PIN debit transactions, the Accredited Standards Committee X9 and PCI Security Standards Council have created a unified standard.

January 22 -

Providing simple and rapid claims payouts is a competitive feature in the property and casualty insurance industry. Both Visa and Mastercard see insurance payouts as a use case for their respective card-to-card transfer services, Visa Direct and Mastercard Send.

January 22 -

The specific impetus for the Federal Trade Commission's inquiry into Visa and Mastercard's debit transaction routing processes is not entirely clear, but it likely stems from the effect that advanced payments technology has had on Durbin amendment compliance.

January 15 -

Mastercard has appointed Raj Seshadri as president of its data and services organization, succeeding Kevin Stanton, who starts a new role as chief transformation officer.

January 13 -

A recent report from the CUSO shows an increase in spending, in line with recent predictions from the National Retail Federation

December 24 -

Targeting about 1.5 million Canadians who routinely visit the U.S. for extended periods — especially during the winter — TD Bank is collaborating with Visa to enable debit push payments for easier cross-border funds movement.

December 23 -

New data from CO-OP Financial Services shows the Christmas season could be a bright one for credit unions and their card portfolios.

December 11 -

European challenger bank N26 is adding a range of promotional incentives for using its debit card as it expands in the U.S.

December 10 -

The challenger bank might use the proceeds from its latest funding round to buy other fintechs that would allow it to add more products and services, its CEO said.

December 6 -

American shoppers were quick off their marks early in the holiday-shopping season as retailers rang up the best sales increase since 2013, led by online purchases, according to a BofA Merrill Lynch Global Research report.

December 5 -

One recent study finds consumers have flipped their point-of-sale preference from credit to debit. That could be a sign of fears about a possible economic downturn.

November 27 -

Yale researchers have recommended several consumer banking products and services that could help those with mental health challenges manage their money.

November 26 -

Visa and Mastercard are once again in the crosshairs of U.S. antitrust regulators over policies that can prohibit merchants from routing card transactions over alternative debit networks.

November 13 -

The adoption of payment cards over cash varies by nation, but debit ruled nearly everywhere on the continent.

November 8 -

The restriction on how often a borrower’s account is debited was supposed to be relatively straightforward, but one lender is trying to fight that provision.

October 29 -

Card processor i2C Inc. has formed an alliance with Ecard, a prepaid debit card targeting travelers that's accepted on both Discover and China’s UnionPay network.

October 29