-

The bank’s clients now have a simpler alternative for logging in to treasury management and other commercial accounts, part an effort by bankers to offer business customers more convenient high-tech services that are still secure.

March 14 -

Trustonic aims to monetize its services by supporting authentication methods such as biometrics, and managing tokens for high-value transactions,

February 27 -

Mobile is taking the spotlight as fraudsters shift to account takeovers and e-commerce fraud in the wake of EMV chip cards taking hold at the physical point of sale.

February 9 -

Consumers still primarily use cards and shop at brick and mortar retailers. Merchants need to take that into consideration when forming a technology strategy.

February 9 Diebold Nixdorf

Diebold Nixdorf -

As Facebook users increasingly deal with personal and payment data, the social media giant is turning to the Security Keys standard hosted through the Faster Identity Online Alliance for stronger authentication.

January 26 -

A pair of technology entrepreneurs hopes the flexibility provided by mobile technology and open development tools can finally kill off the stale authentication method.

January 24 -

Rather than killing off the plastic card, smartphones are strengthening it. Many issuers' card accounts are more valuable than ever, with perks made possible only through the development of smartphone apps.

January 20 -

Some vendors have begun offering authentication platforms through which biometrics and other authentication tools can be plugged into any or all channels. TD Bank is sold on this concept, but others are not completely sure.

January 12 -

Merchants should check operating systems, since the PC-based operating systems which run most legacy point of sale software have security flaws and are targets for malware.

December 13 Revel Systems

Revel Systems -

In short order, Mastercard, Visa and now Amex have made rapid strikes designed to not only bolster identity protection for online commerce, but to make that protection nearly invisible to the consumer.

December 6 -

As the holiday shopping season kicks off, retailers are preparing for an influx of payment volume from shoppers and scammers alike. Here are a few of the problems they face.

November 28 -

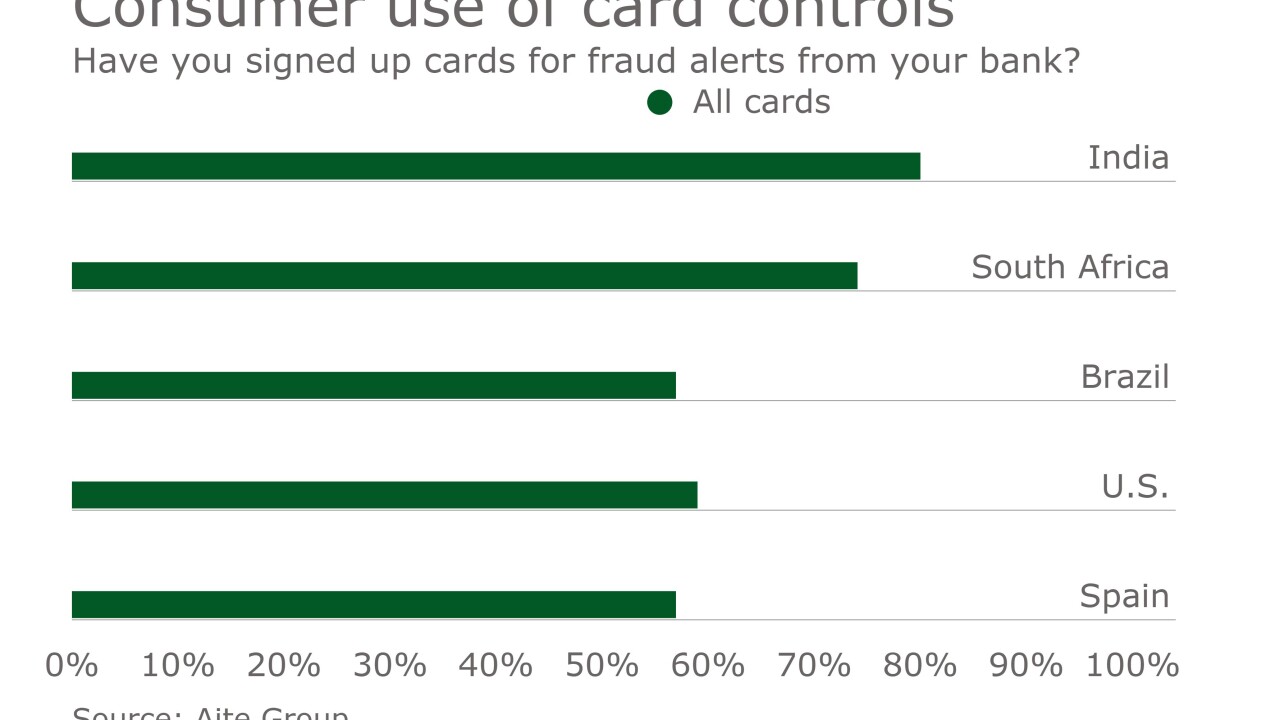

Mobile apps that allow consumers to control their payment cards are becoming more popular as banks use payment security as a way to build customer relationships.

November 22 -

Mastercard will launch its “selfie pay” system in the Asia-Pacific region next year, expanding the global reach of its biometric identity-verification service for online payments to more markets as part of a gradual worldwide rollout.

November 17 -

Digital payments security provider V-Key will protect the cloud-based payments network of Ant Financial Services Group (Alipay) with its virtual secure element software.

November 14 -

Consumers may wholeheartedly trust the biometric security built into their smartphones, but banks could be doing more to protect them.

November 9 -

Samsung Electronics has entered a commercial software license and distribution agreement with fingerprint software company Precise Biometrics.

November 8 -

Citibank has launched Touch ID sensor authentication for its iOS mobile banking users in Hong Kong.

November 7 -

Tesco Bank has confirmed that over the weekend, some of its customers' accounts were subject to online criminal activity, in some cases resulting in money being withdrawn fraudulently.

November 7 -

Payments technology is showing up in places that were unimaginable just a few years ago. That creates new opportunities for merchants and banks, but also new opportunities for fraudsters.

November 4 -

While some banks allow existing customers to

pay by selfie, BBVA is using them to get new customers.November 3