Digital banking

Digital banking

-

Many assume that a smart contract is something totally new. However, banking has used imperfect implementations of smart contracts for at least three decades.

November 17 -

The digital-advice startup SigFig has now teamed up on robo-advisory offerings with Wells Fargo and UBS, while BlackRock's FutureAdvisor has lined up agreements with U.S. Bancorp, BBVA and others.

November 15 -

Refusing to let innovators experiment in a permissive environment keeps regulators in the dark, and ultimately, prevents progress in financial services.

November 15 -

KeyCorp integrated First Niagara just a couple of months after the deal closed. CIO Amy Brady says coordination between business leaders and the tech team paved the way.

November 14 -

Affirm, which has raised $525 million since launching in 2012, would like to expand its services and begin taking deposits.

November 11 -

Mobile phones are only going to become a bigger part of how banks interact with their customers, so several institutions are looking to enhance that experience. They are focusing on better ways of opening accounts, verifying identities, interacting with customers and offering new services and features. Here are some of the improvements announced this year.

November 11 -

While remittances may pose higher risks than services like bill pay, they are absolutely necessary in an age of unprecedented migration. It's high time state and federal regulators update the rules to help inspire banks to re-risk.

November 11 -

Citigroup has made some of its application program interfaces available for third-party developers.

November 10 -

Banks have been waiting on Justice Department guidelines on how to make their websites compliant with the Americans with Disabilities Act, but many are being advised to take action now or face lawsuits from disabled customers.

November 10 -

UpLift is the latest Silicon Valley startup seeking to peel off a slice of the $1 trillion credit card market.

November 10 -

Machine learning can revolutionize online financial management tools by not only tracking payments, but creating a way to change payment habits in the future, says John Frankel, a founding partner of the New York-based ff Venture Capital.

November 10 -

Bill.com has gained traction in recent years with a few large banks that market its electronic bill payment service for businesses, but reaching a wider audience has been tough because small businesses are a tough nut for banks to crack.

November 9 -

Threats to the industry's control over payments were apparent before PayPal became popular. However, risks are even more visible and real today.

November 9 -

The only tactic for survival is brutal honesty. So let's accept the very real risk of disappearing and do the heavy lifting required to persevere.

November 9 -

Cultural issues, budget constraints and legacy technology often keep banks from converting their tech aspirations into a reality.

November 7 -

Tesco Bank has confirmed that over the weekend, some of its customers' accounts were subject to online criminal activity, in some cases resulting in money being withdrawn fraudulently.

November 7 -

Recipients of the 2016 FinTech Forward awards discuss the various factors that are keeping banks from fully embracing the digital world the way startups do.

November 7 -

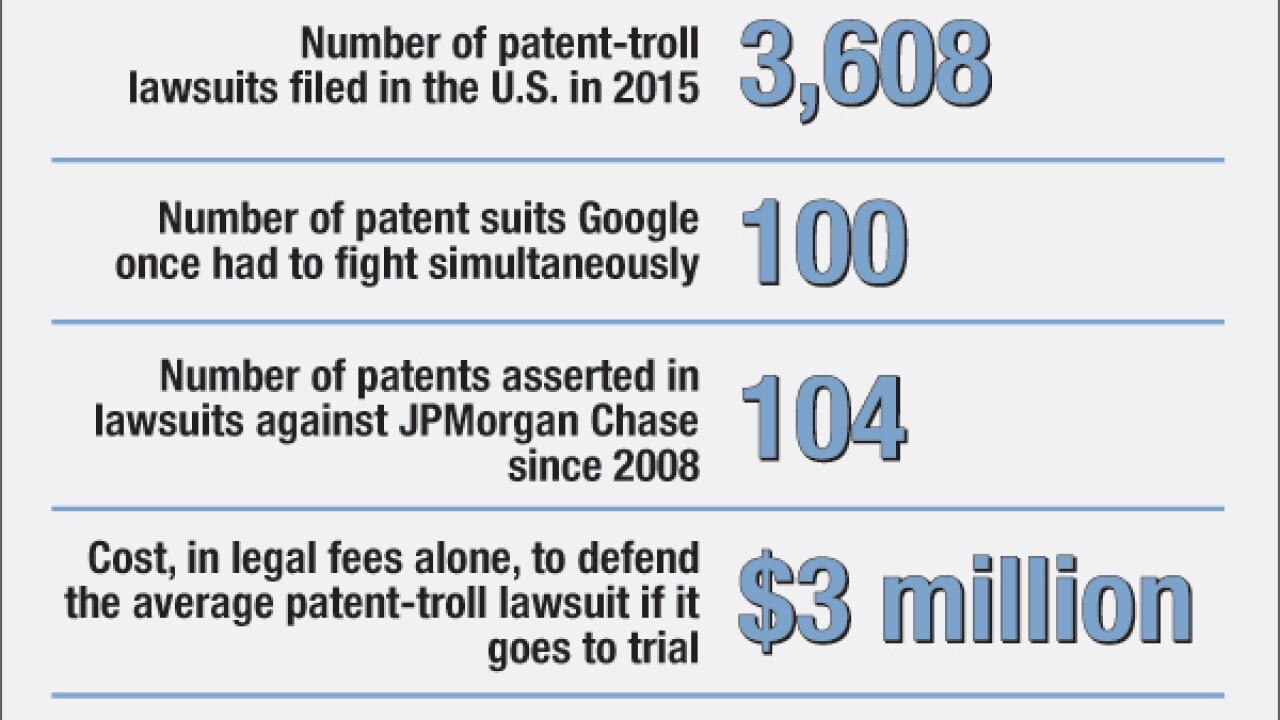

Patent-troll litigation costs American companies $29 billion a year, and fintech startups as well as big banks are now in the crosshairs. A growing number are banding together to defend themselves.

November 4 -

Recipients of the 2016 FinTech Forward awards say banks and startups looking to collaborate can overcome their cultural differences by focusing on the customer experience and their complementary strengths.

November 4 -

The spotlight on unethical sales practices at banks has likely led customers to consider abandoning their financial institution, yet too many factors stand in the way of making a switch.

November 4