Digital banking

Digital banking

-

The Pennsylvania bank run by Sam Sidhu is updating its platform to support real-time payments for cryptocurrency companies and will offer embedded finance and banking-as-a-service to fintechs.

December 16 -

The proceeds will support Silvergate’s network that facilitates cryptocurrency transactions and a leveraged lending product that provides loans collateralized by bitcoin.

December 8 -

The Georgia bank estimates that it will save $12 million annually by shutting down 40 branches.

December 7 -

By acquiring First Sound Bank in Seattle, the fintech would control the strategic direction of the combined company and won't have to share revenue, CEO Luvleen Sidhu says.

December 6 -

Citizens Financial Group, which has offered instant financing for the Xbox All Access program since 2019, will now provide point-of-sale loans for Microsoft PCs, tablets and other products and services.

December 6 -

Coming out of the pandemic, traditional banks will have just two years to update their business models or they risk falling behind more innovative peers and aggressive upstarts, the consulting giant warns in a new report.

December 3 -

Professional Holding CEO Dan Sheehan is dismissive of off-the-shelf bank technology. “Whatever we’re getting in a box, the next hundred competitors are going to be able to get.”

November 23 -

N26 and Monzo halted or delayed expansion plans here largely because competition for customers was already intense and obtaining a banking license proved difficult.

November 19 -

Wilson created an app from scratch in the middle of a large merger, he's setting up “client journey rooms” where customers co-create technology with technologists, and he's moving the bank forward into cloud computing.

November 18 -

The digital-only bank, which entered the U.S. about two years ago, said Thursday that it is closing roughly 500,000 customer accounts here and will prioritize growth in Eastern Europe.

November 18 -

No matter the outcome of the confirmation battle over Saule Omarova — the Biden administration nominee for comptroller of the currency whom many bankers view as too liberal — policymakers must still resolve this fundamental question: Are banks public utilities or private companies with special privileges?

November 17 -

Lincoln Parks at Heritage Bank in Georgia built from scratch its social media following, a digital-only way to open accounts and (in 48 hours) a Paycheck Protection Program lending system. For these and other efforts, Parks is a runner-up for American Banker’s Digital Banker of the Year.

November 16 -

The company, whose software is used by four of the top five U.S. banks, says it will use the money to improve its identity verification and fraud detection technology.

November 9 -

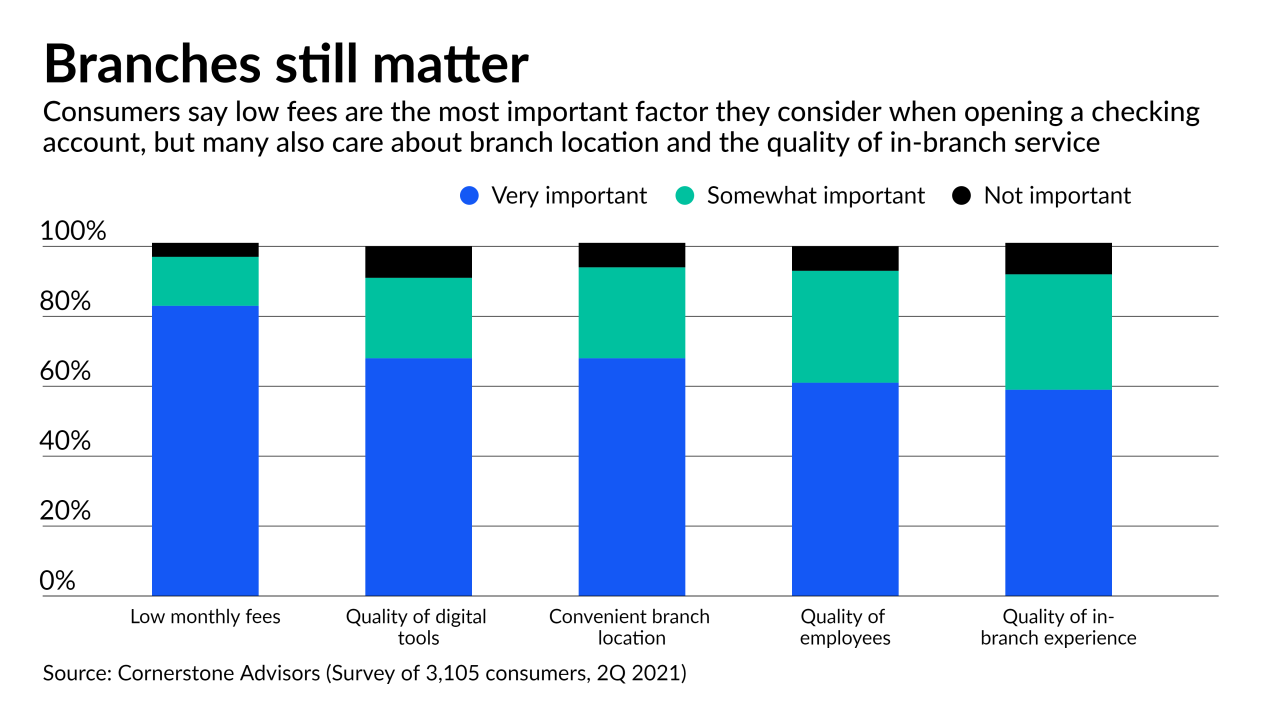

Even as the pandemic has hastened adoption of digital banking, industry officials say branches remain vital points of contact with consumers.

November 8 -

Many of the consumers who embraced online and mobile channels during the pandemic are seeking help from human bankers more than ever, according to research from Cornerstone.

November 5 -

Despite some bumps in the early days of the Paycheck Protection Program, small businesses report that they had positive experiences with lenders. Savvy banks are channeling the good vibes to generate more revenue from a sector that has sometimes been overlooked.

November 4 -

Hispanic adults are underbanked compared with their white counterparts, according to the Federal Reserve. Challenger banks such as Tend and Viva First are reaching out to this population with bilingual services and low-cost money transfers.

November 4 -

Accrue Savings is introducing a savings account that is tied to specific retailers, allowing customers to gradually accumulate the amount they need to buy an item and earn cash rewards for making progress toward their goals.

November 3 -

The speed of money movement represents the future - success for those who deliver, challenges for those who don't

November 3 - AB - Technology

FV Bank will let users hold crypto and traditional currencies in the same account. It says it can do that because it’s licensed in the U.S. territory as a bank and a digital-asset custodian.

November 1