-

From giveaways to budgeting tips and more, here's how credit unions are helping members have a romantic Valentine's Day, no matter how big or small their price point.

February 14 -

A small legal case in California brings a warning to banks: Be careful who you report for fraud.

February 14 -

Despite some declines, payments fraud remains a major concern for credit unions. Here's how experts suggest tackling the problem.

January 26 -

One New Jersey credit union is starting 2018 with an unexpected crash course in fraud prevention, but there may only be so much anyone can do to curtail the problem.

January 26 -

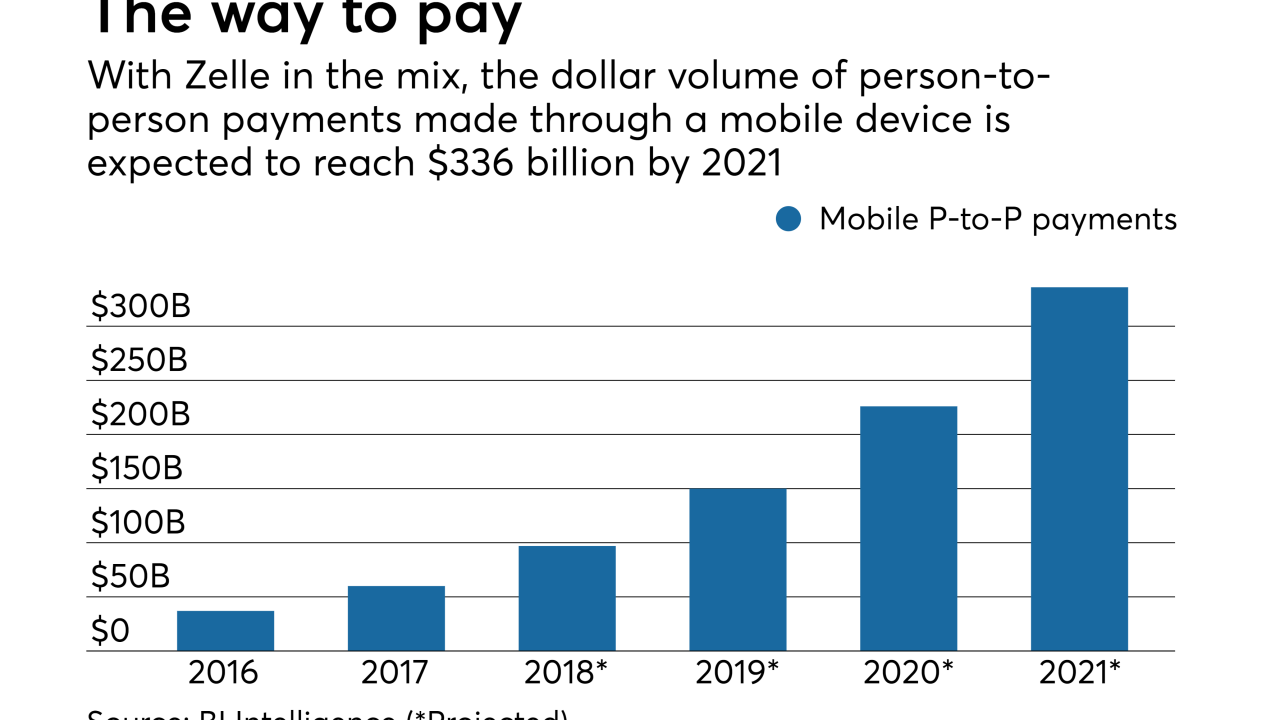

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Seven trade associations — including those representing banks and credit unions — sent a joint letter to Congress outlining data security standards for entities that handle financial data.

December 21 -

The right platform can detect unusual behaviors and block fraudulent transactions as they occur, while still allowing real customers to make legitimate transactions without interruptions, writes Dave Excell, CTO and co-founder of Featurespace.

November 28 Featurespace

Featurespace -

Credit unions are taking steps to ward off fraud as holiday shopping season gets underway.

November 27 -

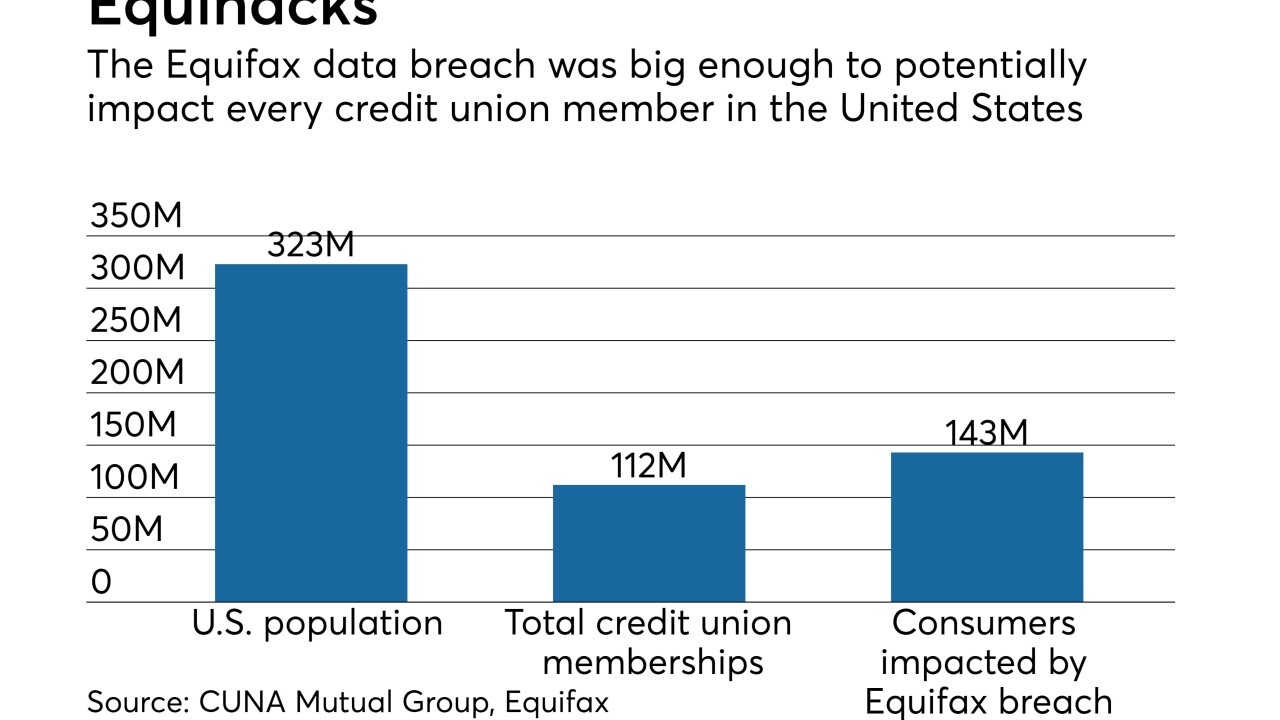

The massive data breach impacted nearly half of all Americans, and credit unions will now need to be on guard for a variety of fraud types that could arise as a result.

October 10 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

Though many of its policies were in place before news of the Equifax breach came out, Mountain America Credit Union is doubling down on its approach to protecting member data.

October 2 -

Push Payments' Travis Dulaney discusses the Fed task force report; Brian Roemmele talks voice pay.

August 3 -

Machine learning can allow customers to take control of their data-driven decision making, including fraud, writes Mark Goldspink, CEO of The ai Corporation.

August 1 The ai Corporation

The ai Corporation -

More e-commerce and multi-channel merchants are accepting payments from mobile devices, even though they haven't addressed all of the security gaps inherent to the technology.

June 29 -

U.S. banks and credit unions face a tricky calculus in deciding whether to adopt expensive technology aimed at reducing online fraud.

June 22 -

U.S. banks face a tricky calculus in deciding whether to adopt expensive technology aimed at reducing online fraud.

June 21 -

With internal and external fraud increasingly in the news at financial institutions, attendees at the Michigan Credit Union League's Annual Conference & Exposition explained how their credit unions are working to mitigate these threats.

June 13 -

In the wake of allegations against subprime auto lender Santander Consumer, attendees of CU Direct’s DRIVE Conference discuss steps credit unions are taking to protect against fraud risks.

June 6 -

It's time for credit unions, industry stakeholders and the movement's 107 million members to speak up and tell Congress to get serious about protecting members' data from retailer data breaches.

June 5 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

Recent NCUA prohibition orders have included restitution payments ranging from $14 million to $18 million, but it remains to be seen whether such stiff penalties will curb the incidence of fraud at CUs.

June 1 -

Family Savings CU helped police catch a suspect in a crime spree worth more than $43,000, but analysts say card skimming remains so pervasive that it may be nearly impossible to stop.

May 18