-

The New York bank will double in size while gaining greater access to Long Island and low-cost deposits that should come in handy as interest rates rise.

March 7 -

Merger will join two CUs originally chartered to serve telephone company employees.

March 3 -

The bank will have $700 million in assets under management after it buys HJ Wealth Management in Pennsylvania.

March 2 -

Merger effective March 1 after 90% of Martin FCU's membership voted in favor of the move.

March 2 -

Iberiabank is making the biggest deal in its history in Miami, an area known for boom-bust cycles and a condo market that stung banks during the crisis.

March 1 -

Union of North Island CU and California CU creates $2.8 billion institution.

March 1 -

Tiny Hudson Municipal lost more than $30,000 during each of the last two years.

February 27 -

Some advisers are urging acquirers to strike while they have strong currencies, while others are warning about the risk of overpaying. Sellers, meanwhile, must be wary of a correction after months of surging prices.

February 24 -

Tiny $17 million Touchstone Federal Credit Union has two branches and 2,291 members, and will merge into a credit union with more than $1 billion in assets.

February 22 -

West Town will pay $24.6 million in cash and stock for Sound Banking. The deal will close later this year.

February 17 -

The deal comes months after First Merchants bought a minority stake in Independent Alliance.

February 17 -

Texas Trust and Qualtrust CUs have announced their intention to merge under the Texas Trust banner.

February 15 -

Progress will pay $42 million to expand in Birmingham, Ala., adding branches in a market where it hired a lending team last year.

February 14 -

Heartland will gain 12 branches around Denver and Boulder after it buys the $1.4 billion-asset Citywide.

February 14 -

Summit CU in North Carolina has completed its acquisition of Corning Cable Systems CU and is building a new branch to accommodate increased business as a result of the merger.

February 9 -

Clayton Bank and American City Bank are owned by Clayton HC and have a combined $1.2 billion in assets.

February 9 -

The $227 million Valor Federal Credit Union lost more than $2.2 million in 2016 prior to its acquisition by the $21 billion Pentagon Federal Credit Union.

February 8 -

The moves show a commitment to bigger markets and make it easier for analysts and investors to visit management.

February 7 -

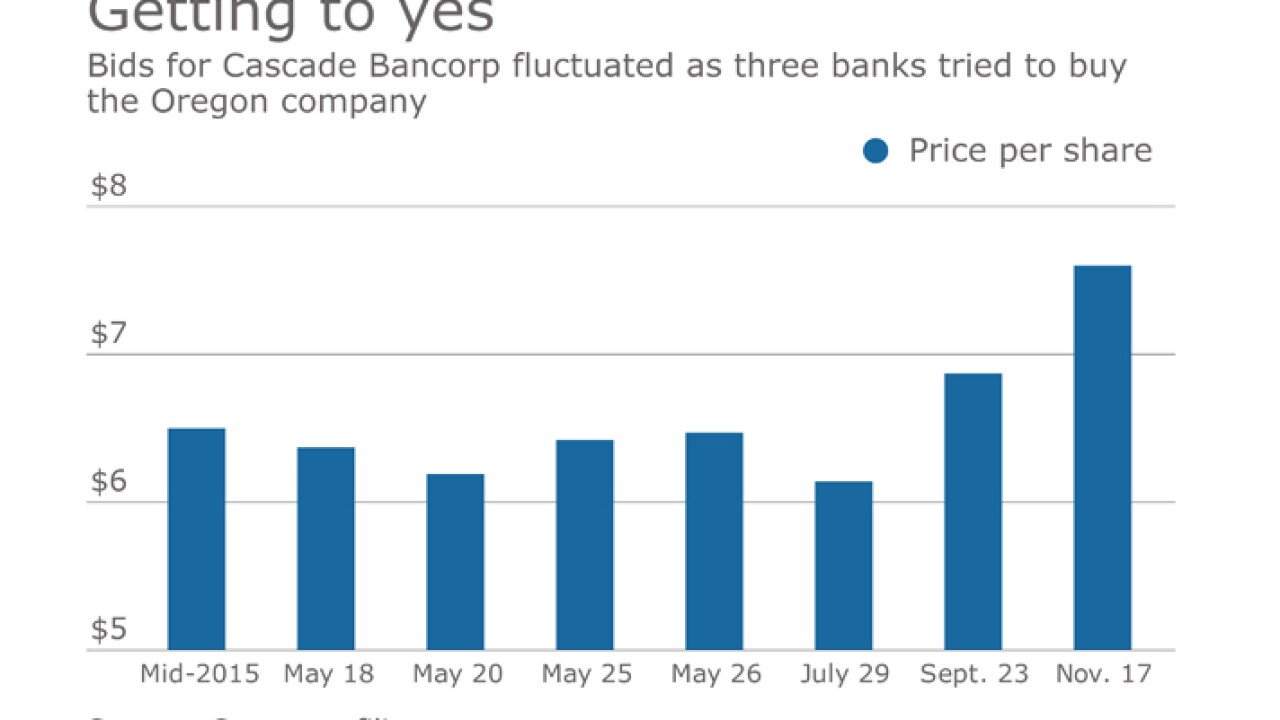

First Interstate missed out on two chances to snag Cascade before agreeing to buy the company in November, showing the importance of staying in touch with a target.

February 2 -

Over the last five years, the credit union also saw a 66% rise in membership, 204% increase in auto loans and a 26% uptick in real estate loans.

February 2