-

Speaking at a press conference, Federal Reserve Chairman Jerome Powell said the bank’s risk management failures have required a dramatic overhaul of its processes.

March 20 -

With heightened scrutiny from regulators and the public for wrongdoing, financial institutions need to put more focus on preventing mistakes in the first place.

March 20 KYC Solutions Inc.

KYC Solutions Inc. -

Even as regulations are getting tougher, criminals are getting more sophisticated and creative, writes Ron Teicher, CEO of EverCompliant.

March 20 EverCompliant

EverCompliant -

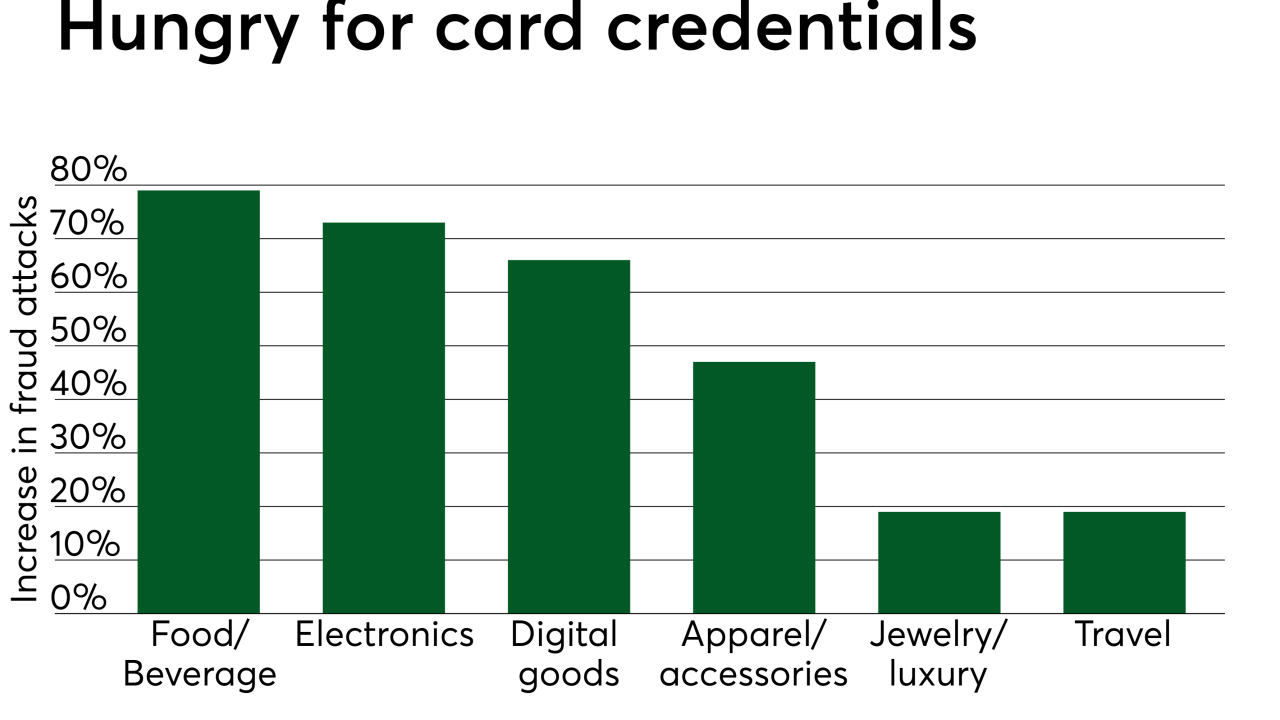

Fraud attacks against online food and beverage businesses in the U.S. increased by nearly 80 percent in the past year, as fraudsters have decided that dining establishments are the perfect places to test stolen card credentials.

March 20 -

The state's financial regulator says Fast Money Loan charged consumers interest rates and fees above the state's usury cap, and operated unlicensed storefronts.

March 19 -

Reports of improper charges by perpetrators who know the victim soared last year. Issuers and card networks are failing to tighten security, clearly label transactions and police chargebacks, critics say.

March 19 -

The online lending industry has turned to the courts, Congress and now federal banking agencies in an effort, thus far fruitless, to blunt the impact of a 2015 appeals court ruling.

March 18 -

A number of credit unions have faced lawsuits alleging their websites failed to meet the standards of the Americans with Disabilities Act.

March 18 -

Given the size of the deal — which includes about $9 billion of Worldpay’s debt on top of a $34 billion bid — the pressure’s on to build a global powerhouse that can counter other major fintech mergers announced in the past weeks. FIS must also emerge as a nimble rival to the startups that threaten the old order.

March 18 -

Mastercard Inc. is concerned that India’s strict data localization rules could compromise its ability to detect frauds and money laundering in the domestic payments system.

March 18 -

An overwhelming amount of transactions can cause noncompliant payments to fall through cracks. New technology such as AI can be helpful, says Josephine McCann, a senior marketing associate at AppZen.

March 18 AppZen

AppZen -

PricewaterhouseCoopers settled a lawsuit in which the FDIC accused it of negligence in its role as external auditor for Colonial Bank. But FDIC board member Martin Gruenberg objected because the firm did not accept blame.

March 15 -

Federal regulators normally hesitate even to name specific institutions, but the Office of the Comptroller of the Currency appears to be taking a different tack with Wells.

March 15 -

A proactive and preventive security strategy will go a long way to building consumer trust and ensuring continued loyalty, writes Maria Allen, global head of financial services for Unisys.

March 15 Unisys

Unisys -

With regulators and policymakers studying their every move, financial institutions need to put more focus on preventing mistakes in the first place.

March 15 Ludwig Advisors

Ludwig Advisors -

The 65 people laid off in late February is only the beginning, report says; Bank of America CEO also tackles mortgages, the economy and gender issues.

March 15 -

Municipal IDs help marginalized groups, such as undocumented immigrants, open checking accounts and become credit union members but concerns over regulatory compliance linger.

March 15 -

Regulators have taken a critical look at AML controls and handed out significant fines to financial institutions found to be lacking, according to Chad Hetherington, global vice president of professional services for NICE Actimize.

March 15 NICE Actimize

NICE Actimize -

Seven years after James Gutierrez left Oportun Financial and started a competitor, the acrimony sparked by the divorce is coming into public view.

March 14 -

House Financial Services Committee Chairwoman Maxine Waters said the CEO's 2018 bonus was "outrageous and wholly inappropriate" and called for his removal.

March 14