-

Rich Baich, Wells Fargo's security chief and newly appointed security advisor to the White House, shares attack types he’s worried about and top defenses.

December 18 -

The objectives of a Financial Crimes Enforcement Network rule requiring financial institutions to collect “beneficial ownership” details are laudable, but the regulation can be subverted by unscrupulous customers.

December 18

-

Richard Harra was also fined $300,000 for painting a false picture of the bank’s financial health at the height of the financial crisis.

December 18 -

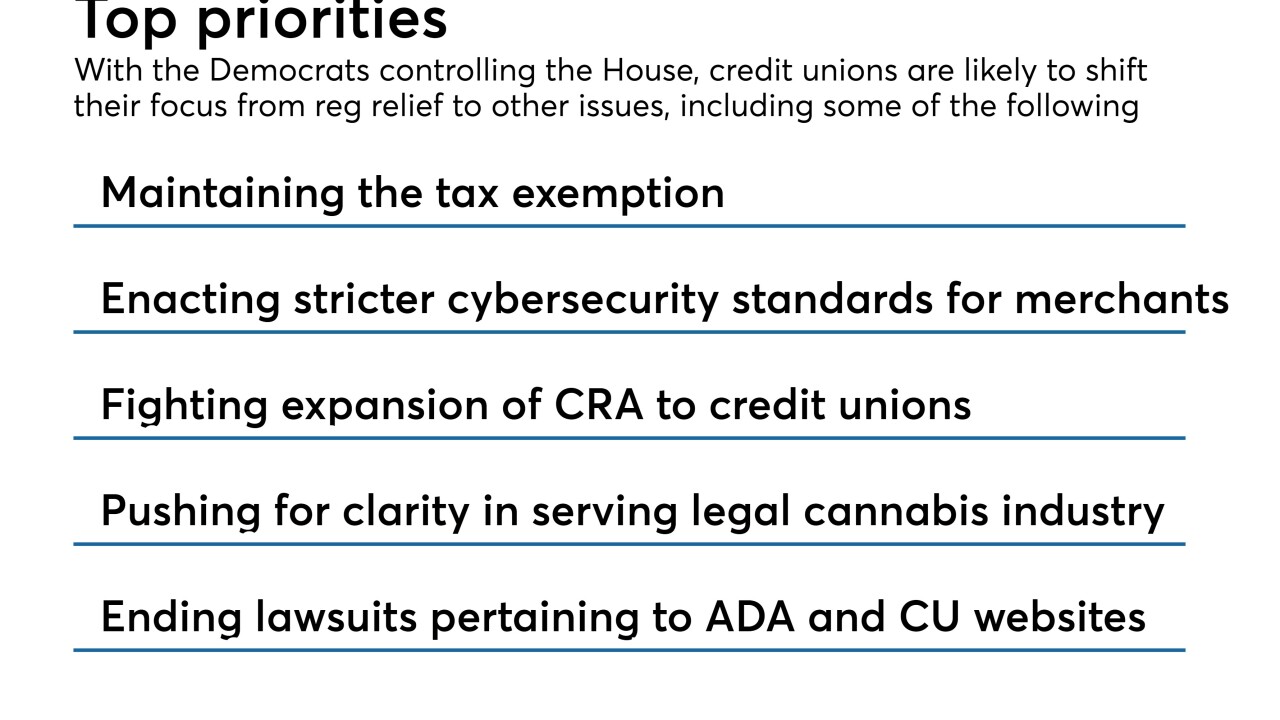

With control of the House changing hands in January, credit unions are set to shift their focus from regulatory relief to cybersecurity and fighting CRA.

December 18 -

Malaysia files criminal charges against Goldman Sachs over 1MDB; Wall Street banks hit by market volatility while small banks face margin compression.

December 17 -

Despite continued growth and regulatory victories, this year saw challenges on a number of fronts that could have lingering – and even negative – consequences for the industry in 2019 and beyond.

December 17 -

One week after NCUA filed its own appeal brief, three major organizations banded together in support of the expanded field-of-membership rule

December 14 -

Sen. Elizabeth Warren is joining with a fellow Senate Democrat Chris Van Hollen in seeking a Banking Committee investigation of Deutsche Bank's compliance with U.S. safeguards against money laundering.

December 13 -

The two agencies seek to end the acrimony with the companies they regulate; the government is trying to make it easier for the wounded Deutsche Bank to merge with rival Commerzbank.

December 13 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

U.S. prosecutors have accused four alleged Puerto Rican drug traffickers with the murder of banker Maurice Spagnoletti, seven years after he was gunned down on a San Juan highway as he drove home from work.

December 12 -

More acquainted with the quick decision-making style of the banking world, the comptroller of the currency found a policymaking environment in D.C. that moves at a slower pace.

December 12 -

The Marriott incident will open the door to loyalty program fraud, account takeover and myriad other risks, writes Michael Reitblat, co-founder and CEO of Forter.

December 12 Forter

Forter -

A number of credit unions have been hit with lawsuits that claim they have charged members overdraft fees despite there being sufficient funds in checking accounts.

December 11 -

While fraud is a year-round concern, credit unions need to be extra vigilant during the holiday season.

December 11 Advanced Fraud Solutions

Advanced Fraud Solutions -

ACI Worldwide is the latest to adopt technology from Israel-based BioCatch that monitors shoppers’ behavior to spot irregularities signaling potential fraud.

December 10 -

An institution in California calling itself Indian Federal Credit Union purports to be operational but does not have all the required regulatory approvals.

December 10 -

Credit card fraud is on the rise in the U.K. with more than $2 billion being stolen from credit and debit cards over the past twelve months, an increase of 38% on the previous year. But while large scale data breaches have been heavily blamed for this surge in crime, ex-fraudster Tony Sales says one of the most pertinent reasons is a persistent lack of understanding within the financial industry of how criminals operate.

December 10 -

Blockchain backers concede the hype is turning off bankers; Mulvaney's CFPB name change could cost industry millions of dollars; the one banking bill Congress might actually pass next term; and more from this week's most-read stories.

December 7 -

The regulator claimed Congress has already granted it the authority to define field-of-membership areas.

December 7