-

National Credit Union Administration board member Rick Metsger says a federal judge overstepped the court's bounds when striking down portions of the agency's field-of-membership rule, but stopped short of saying the regulator planned to appeal the decision.

April 5 -

The one thing more valuable to consumers than their bank accounts might be their internet access — and a new version of the ‘Trickbot’ trojan targets both.

April 4 -

Efforts by financial institutions to track "beneficial ownership" data in advance of a regulatory deadline next month is complicated by the challenge of getting customers to cough up the information.

April 4 -

Banks have not yet finished with the wave of lawsuits stemming from the financial crisis. There are ways they can better ward off those threats next time around.

April 4 Bilzin Sumberg

Bilzin Sumberg -

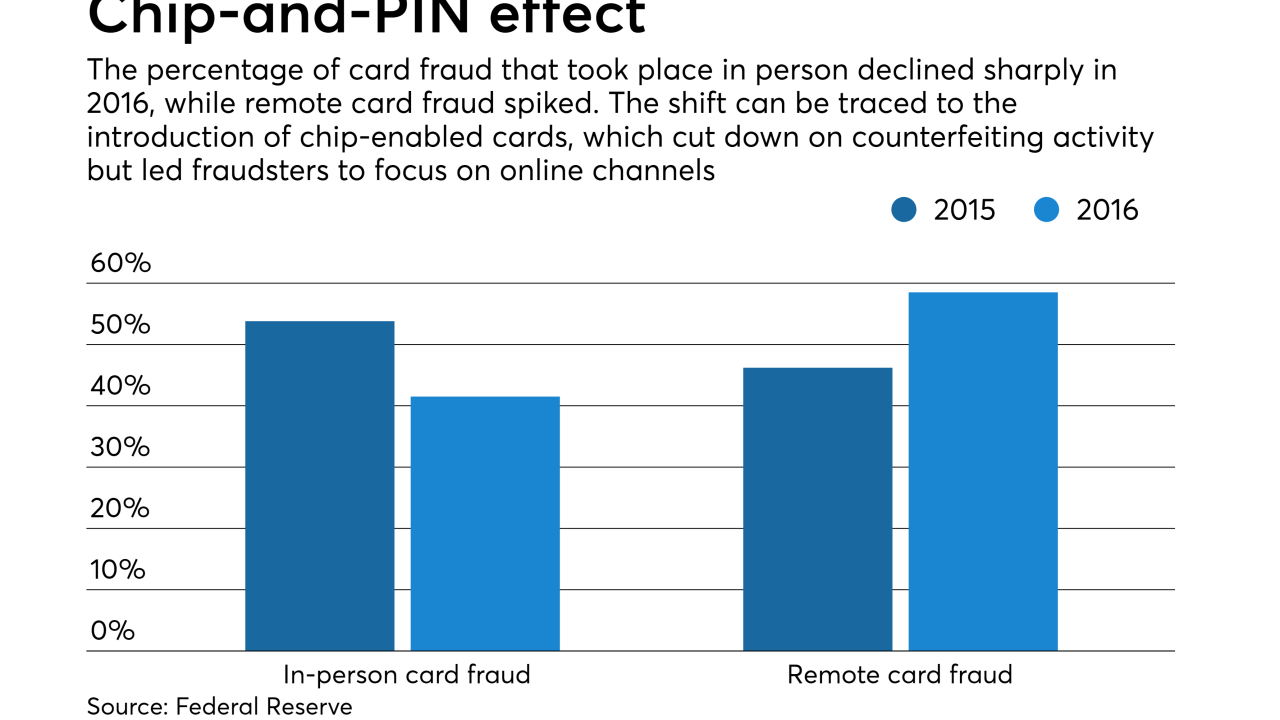

The central bank is taking a lead role in trying to combat the longstanding problem. A broad study by the Fed aims to measure the extent of payments fraud and to foster more collaboration in thwarting it.

April 3 -

If the National Credit Union Administration appeals a judge's decision against part of its rule, it could help the ABA potentially upend other provisions.

April 2 -

Washington Federal, which is working through Bank Secrecy Act issues, also allowed Anchor to consider offers from other potential buyers.

April 2 -

The trio of former credit union employees all pleaded guilty to various charges of fraud and theft.

April 2 -

The concept of privacy is evolving in the digital age in ways that demand new attention from policymakers. As stewards of considerable personal information, banks should prepare to take part in this debate.

April 2 Dorsey & Whitney

Dorsey & Whitney -

A court agreed with HomeStreet that Blue Lion Capital failed to comply with the company's advance-notice bylaw when it submitted director nominations and shareholder proposals.

April 2 -

A federal judge struck down two provisions of the National Credit Union Administration's embattled field of membership regulation as "manifestly contrary to statute," while upholding two others.

March 29 -

A federal judge has upheld two provisions from NCUA's revised field-of-membership rule but struck down two other measures related to population centers.

March 29 -

The announcement comes after a Federal Reserve Board task force issued a report in September that said it would further examine options for modernizing the U.S. payments system.

March 29 -

The investigation targeted 36 residential mortgage-backed securities deals involving $31 billion worth of loans, more than half of which defaulted, according to the Justice Department.

March 29 -

For Remington Outdoor Co., one of the oldest firearms makers in the U.S., not even going bankrupt is easy these days.

March 29 -

Two Democrats on the House Oversight Committee asked the panel's Republican chairman to issue a subpoena for documents related to Stephen Calk, whose bank made loans to former Trump campaign manager Paul Manafort.

March 28 -

The mastermind behind malware attacks that programmed ATMs to spit out cash on demand and caused more than 1 billion euros ($1.2 billion) of losses has been arrested in Spain.

March 26 -

Attorney General Jeff Sessions made headlines in January when he tightened federal marijuana enforcement. But the good news for financial institutions looking to service the pot industry is that the rest of the government has responded with a shrug.

March 23 -

A new kind of ATM fraud has begun to hit U.S. financial institutions. Here's how to protect your credit union.

March 23 -

Employees at the second-largest Indian bank falsified documents in a scheme that ultimately cost the institution at least $2 billion. Some argue a distributed ledger would have helped prevent or minimize the fraud.

March 21