-

The story of MPESA, Kenya’s mobile money system, and how it came to partner with banks to give all people access to financial services.

February 9 -

Mobile is taking the spotlight as fraudsters shift to account takeovers and e-commerce fraud in the wake of EMV chip cards taking hold at the physical point of sale.

February 9 -

The digital personal financial management company is eyeing Europe as it expands its geographic footprint.

February 7 -

With another $60 million in writedowns, BBVA Compass has taken $90 million in goodwill impairment charges related to its $117 million acquisition of the neobank Simple.

February 3 -

The unit of Customers Bancorp considers the visualization and animation features of its new app, which will show users if their money is dwindling or growing and where it's going, special enough to apply for a patent.

February 3 -

Home improvement lender EnerBank USA expects half of its loans will be originated on the app it built *in-house*, which promises near-instant approvals.

February 3 -

The delay has analysts worried that Customers Bancorp will also postpone the sale of BankMobile, which was slated to take place during the first quarter.

February 3 -

Arkadi Kuhlmann, the founder and CEO of the neobank Zenbanx who pioneered branchless banking at ING Direct, explains why he stopped pursuing a bank charter and made a deal with Social Finance.

February 1 -

The acquisition should allow the San Francisco-based online lender SoFi to fulfill a long-standing goal: offering a deposit account to its young, upwardly mobile customers.

February 1 -

Customers Bancorp says it expects to announce a deal to divest its BankMobile unit within 60 days. It could be an attractive target for a bank with strong loan demand.

January 30 -

From frictionless payments to improved underwriting models, connected cars will rewrite the rules for how and where banks interact with their customers.

January 29 -

Connected cars are going to create new revenue streams, not just for automakers, but also for financial services providers.

January 29

-

BMO Harris Bank is providing its customers with a branded P-to-P payment app, continuing a trend of developing mobile payment and banking services.

January 25 -

The Cincinnati bank will be advised by QED Investors on its fintech strategy .

January 20 -

Jim Van Dyke, CEO of futurion, discusses the correlations between mobile deposit features, the ratings of those features, and app adoption.

January 19 -

A consortium of fintech companies have formed a new industry group to advocate for better data sharing via open APIs.

January 19 -

The Office of the Comptroller of the Currency could make the Community Reinvestment Act’s spirit relevant in a digital age so long as it builds the right framework for chartered fintech companies.

January 18 D-N.Y.

D-N.Y. -

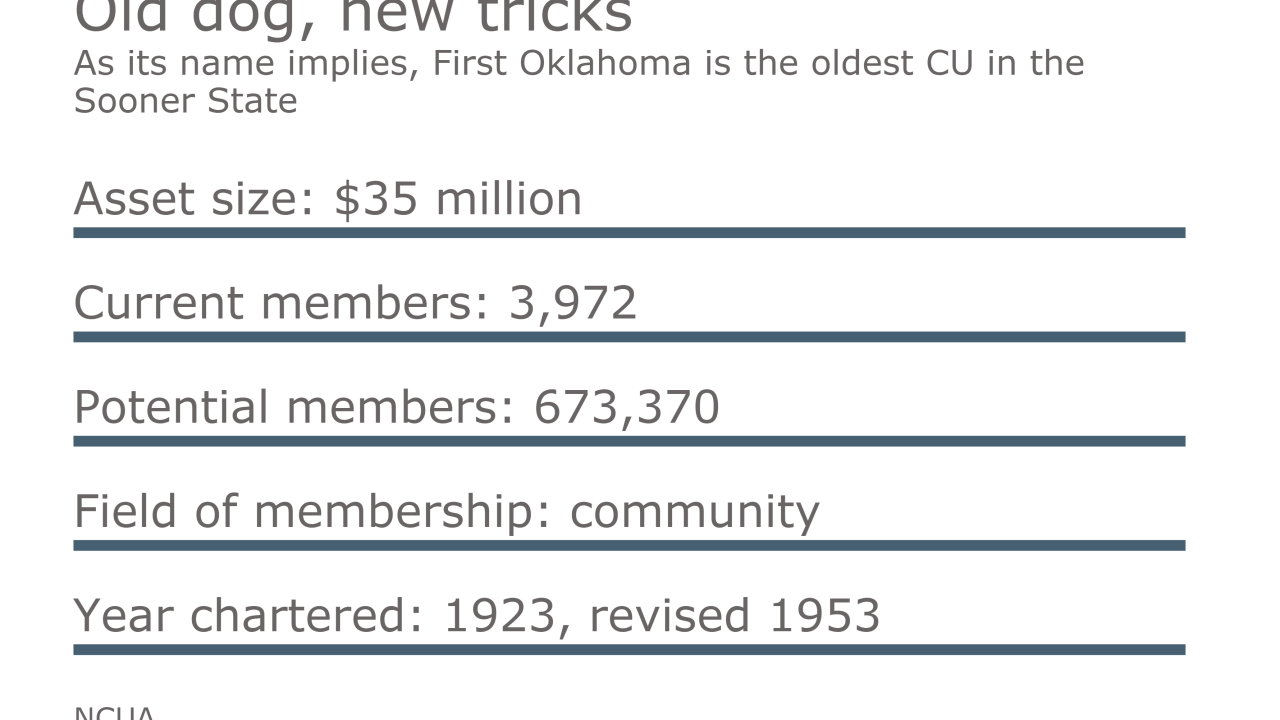

As its name implies, First Oklahoma is the oldest CU in the Sooner State.

January 17 -

The growth of digital channels is changing bank M&A values, forcing buyers to focus less on branches and more on the volume of customer data.

January 10 -

Joint accounts sometimes seem stuck in another era. Here's how to modernize them.

January 10