-

POPin Video Banking Collaboration offers video chat and simultaneous collaboration between financial institutions and the consumers they serve.

February 15 -

Erminia Johannson's promotion is part of an effort by BMO Financial to generate more revenue from its U.S. operations.

February 15 -

As regulators look to update the Community Reinvestment Act, they should better integrate online and mobile banking activity as part of exam performance.

February 15 Consumer Bankers Association

Consumer Bankers Association -

The bank joins a small group of companies that believe short-term forecasts will ultimately help customers build healthier financial lives.

February 13 -

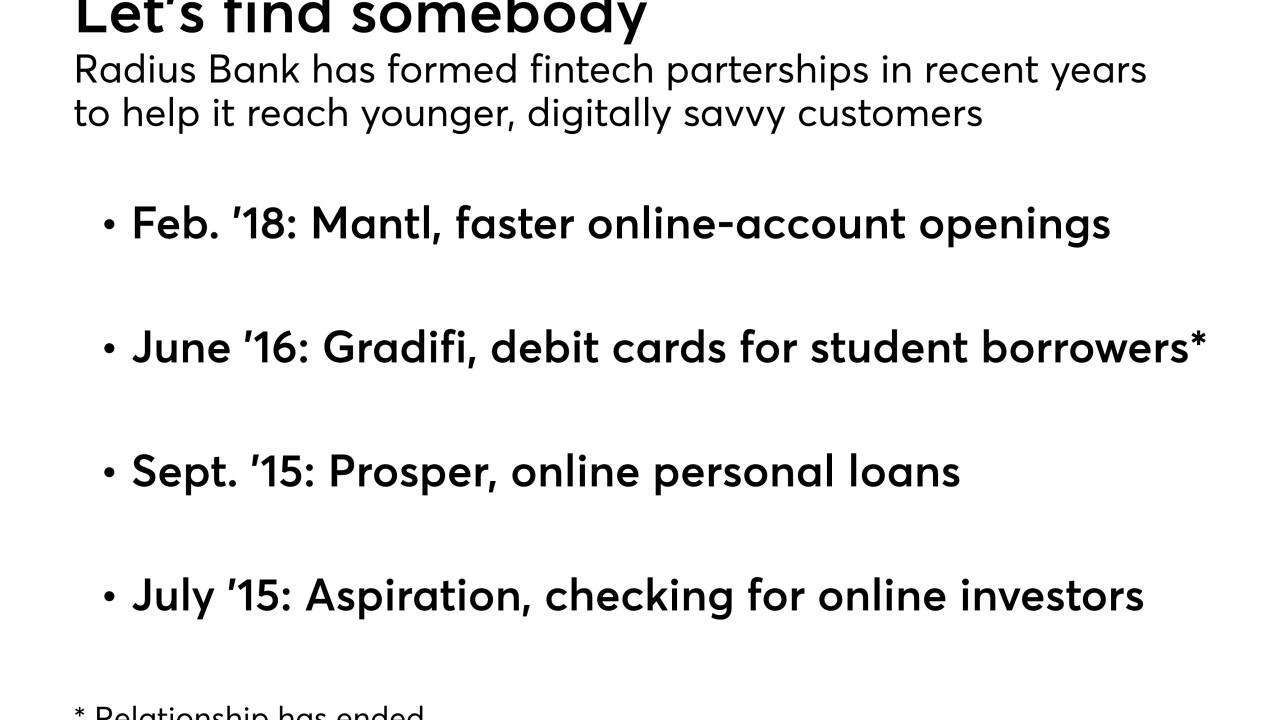

Its latest partner, Mantl, has built software that lets consumers open accounts in four minutes. In such alliances Radius seeks expertise it lacks, gets heavily involved in product development, and tries to balance the spirit of innovation with the demands of compliance.

February 7 -

As it secures new funding and creates a joint venture in Japan, Moven says it is close to becoming a full-fledged U.S. “challenger” by purchasing a traditional bank.

January 31 -

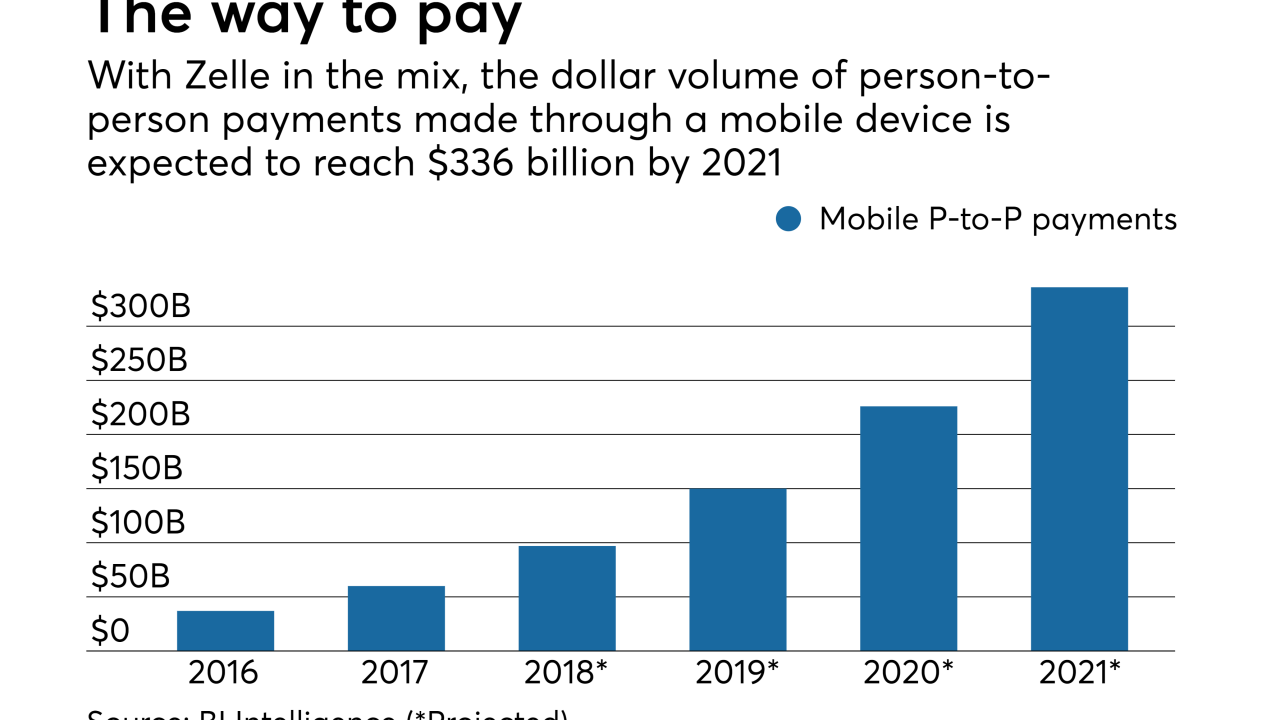

While Zelle is working hard to become the Venmo for grown-ups, it is also pushing into retail payments, particularly in opportunities for displacement of cash and check and where funds are needed in minutes rather than days or weeks.

January 29 -

The bank tweeted that website and mobile app service were restored after an outage that lasted much of the day.

January 25 -

Digital alerts for clients aren't new, but they can still provide small banks a platform to reach new markets and appeal to younger clients.

January 25 -

The addition of Bob Savino as chief product officer comes as BankMobile is poised to spin off from Customers Bancorp and merge with Flagship Community Bank.

January 24 -

Few fees, automated savings and social media engagement all reel in the 23- to 37-year-old set and present a competitive threat to big, traditional banks, according to CEO Chris Britt.

January 23 -

Millennials are more bank-savvy than they’re given credit for, according to a new survey sponsored by Bank of America.

January 23 -

As customers become more tech-savvy, the bank said it no longer needs to prod them to use its digital products by offering discounts. Account holders can avoid fees by enrolling in direct deposit.

January 22 -

The anxiety that a crook is using a lost or stolen card can be a powerful lure to mobile technology, Citigroup has learned.

January 18 -

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Executives at U.S. Bancorp and Bank of America plan to use their tax savings to ramp up spending on new technology to stay competitive — but they sought to reassure investors that they would not abandon cost control.

January 17 -

Fast growth in use of the bank's instance of the person-to-person payments product indicates it could one day rival Venmo.

January 12 -

U.S. Bank, Bank of America and other firms are looking toward the day when the ultimate virtual assistant arrives, one capable of being personalized and working on any device.

January 11 -

Capital One became the latest bank to feel customers' online wrath last week after reports that some customers were being charged twice for debit card activity. But it was hardly alone.

January 10 -

First it was coffee and car service, and now it could be cashier’s checks and debit cards. Matt Krogstad left his bank job to build tech that lets bank customers order products at the press of a button and pick them up at a branch or get delivery.

January 10