-

Synovus is widely regarded as one of the industry’s most admired companies, and it is up to Liz Wolverton to ensure that it does not rest on its laurels.

September 25 -

Hannah Grove has made it her mission to "eradicate jargon" at State Street, in an effort to make the company more acceible to its customers and easier for the public to trust.

September 25 -

MUFG Union Bank is counting on Wendy Breuder — a proven revenue generator — to use her considerable analytical skills to find meaningful cost savings through the consolidation and relocation of office space.

September 25 -

As Fifth Third's chief administrative officer, Teresa Tanner has overseen big changes in employee benefits and led the process to relaunch the bank's brand.

September 25 -

Under Herena’s leadership, BNY Mellon is making significant progress in attracting and retaining top talent.

September 25 -

Andrea Smith is leading an effort to address income inequality in Bank of America's hometown.

September 25 -

Fearless Girl is controversial, stirring up both passionate fans and harsh critics. But State Street's chief marketing officer, Hannah Grove, could not be happier about the impact it is having.

September 25 -

Taking the temperature of your corporate culture can pay big dividends, according to Rogue Credit Union.

September 22 -

Brookline will pay $56 million in cash and stock for First Commons in a deal that will add $324 million in assets.

September 21 -

Miller will step down from the Lincoln, Neb.-based credit union in February of next year.

September 21 -

Umpqua Bank is testing a system that would make text-chat, video and voice banking more personable by staffing them with branch workers during their downtime.

September 21 -

Dread the annual performance review? At Consumers CU, they do it a minimum of four times a year. The result: stronger employee engagement.

September 21 -

San Diego County Credit Union doubles down on sponsorships, inks stadium naming rights deal.

September 20 -

The cash acquisition allows First American to expand its operations in Kenosha, Wis.

September 20 -

Focusing on talent development and staff engagement paying dividends at the $775 million credit union.

September 20 -

CU shortens name, makes several changes to branches to improve communication.

September 19 -

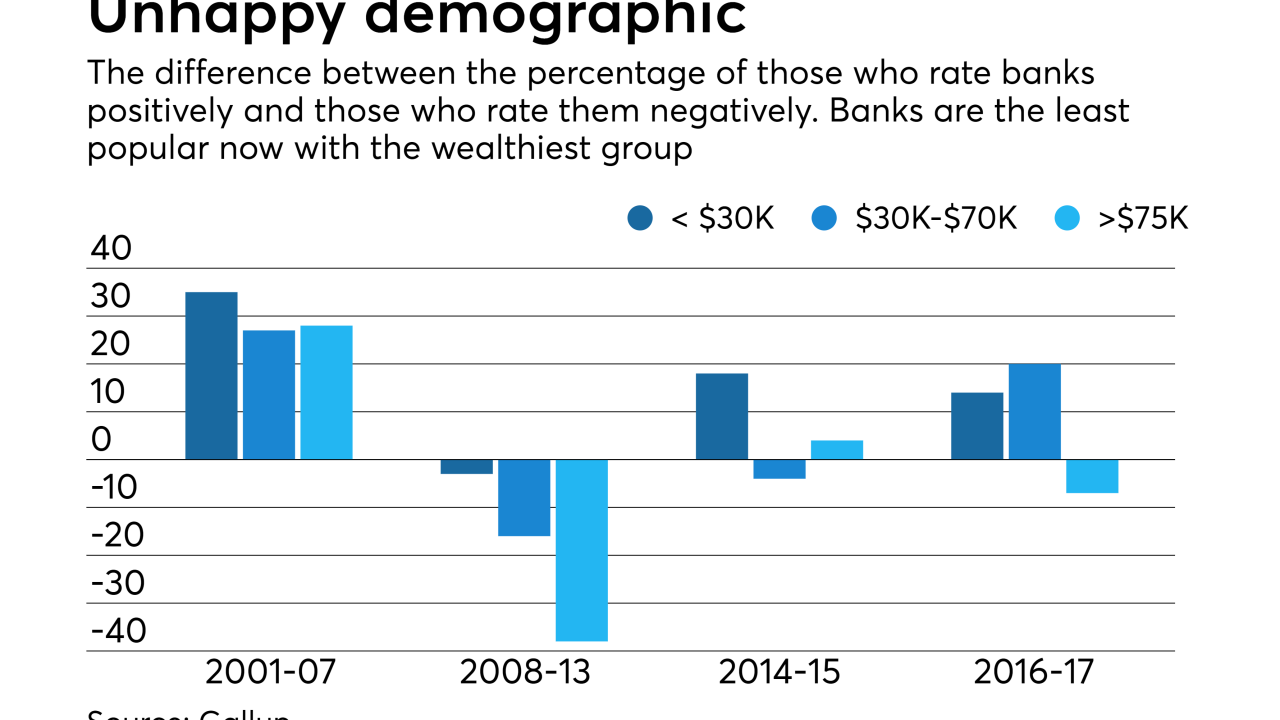

While the banking industry is winning over low- and middle-income groups, it is still trying to regain the trust of high earners who were stung during the financial crisis.

September 19 -

Executives' pastry-fueled walkabouts give employees opportunity to ask questions, share observations with top leaders.

September 19 -

The Connecticut bank's president, John Ciulla, will succeed longtime CEO Jim Smith, who is retiring after three decades on the job.

September 19 -

The Dallas company has extinguished talk of a potential sale after aggressively cutting costs over the past year. But concerns about its future — including its ability to find new sources of revenue — remain.

September 18