-

Chaney was CEO of Hancock Holding in Mississippi for nearly a decade, overseeing a period of substantial growth.

February 6 -

Martin Breland, who is only the second CEO in the Maryland-based credit union’s history, will be succeeded by current EVP Rick Stafford.

February 3 -

Wayne Bunker is set to retire this month after 35 years with the credit union.

February 3 -

While most ads for the big game are shrouded in secrecy, the credit union unveiled three spots and asked the public to choose which one should run Sunday.

February 3 -

The U.S. government and banks face similar challenges in implementing a biometrics identity system. Both should study what other countries are already doing.

February 2 -

CoastHills chairman earns military honor and other awards, promotions and new hires at credit unions across the country.

February 2 -

Over the last five years, the credit union also saw a 66% rise in membership, 204% increase in auto loans and a 26% uptick in real estate loans.

February 2 -

Richard Muskus Jr., who joined Patriot in 1995, previously served as the company's chief lending officer.

February 2 -

Old Line will have more than $2 billion in assets when it completes the acquisition, its fourth since 2011.

February 1 -

The Las Vegas-based CU has returned more than $56 million to members since 2001.

February 1 -

Cambridge Blockchain, a startup that bills its technology as a solution for banks to the competing regulatory imperatives of transparency and privacy, has raised $2 million through a convertible note.

February 1 -

A quartet of officers move to the C suite with recent promotions and other CU professionals in the news.

January 31 -

The initiative would add payments to the country's national identity system, but the government wants more time to review Mastercard's proposal.

January 31 -

Royal Bancshares in Pa. made tough choices to avoid collapse during the financial crisis

January 31 -

The president's executive order reflects a lack of trust in the identity information shared between countries. In theory, blockchains are tailor-made to solve this problem, but current systems may not be up to the task.

January 31 -

Smith will be succeeded by VP Jason Deitz.

January 31 -

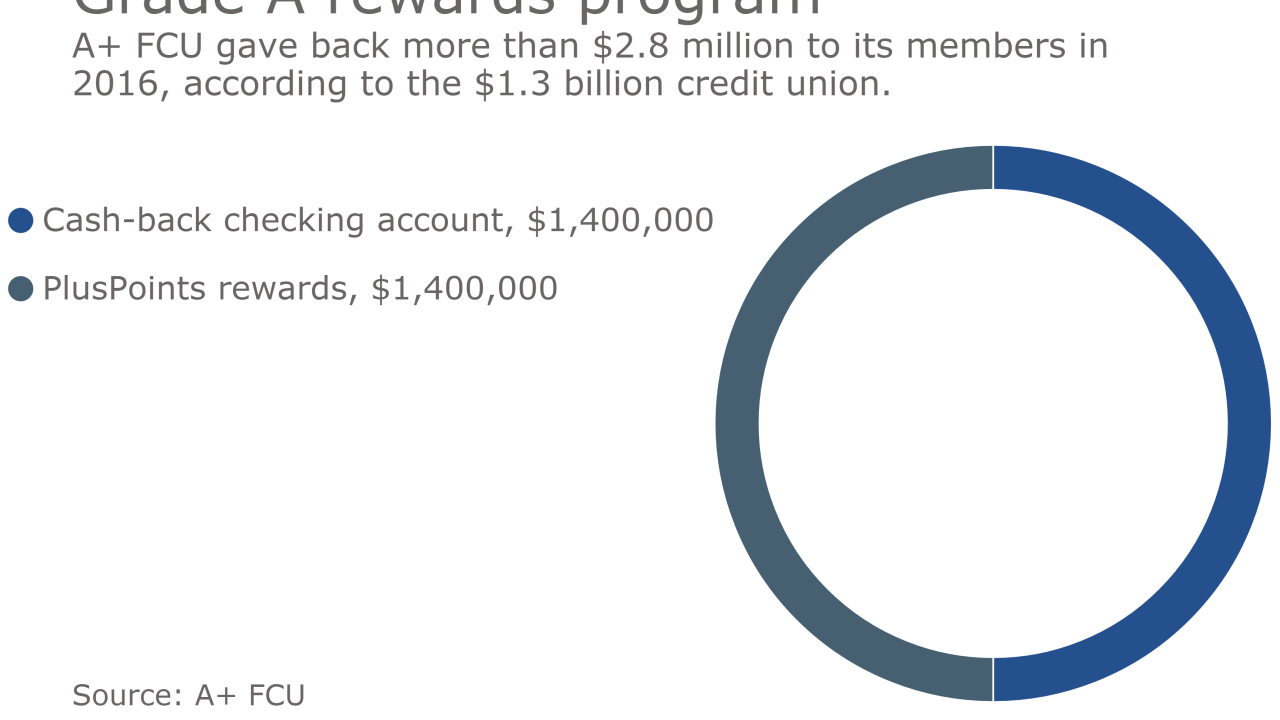

The $1.3 billion CU rewarded members for using their A+ FCU debit card, as well as interest rate discounts on loans and higher rates on certificates.

January 31 -

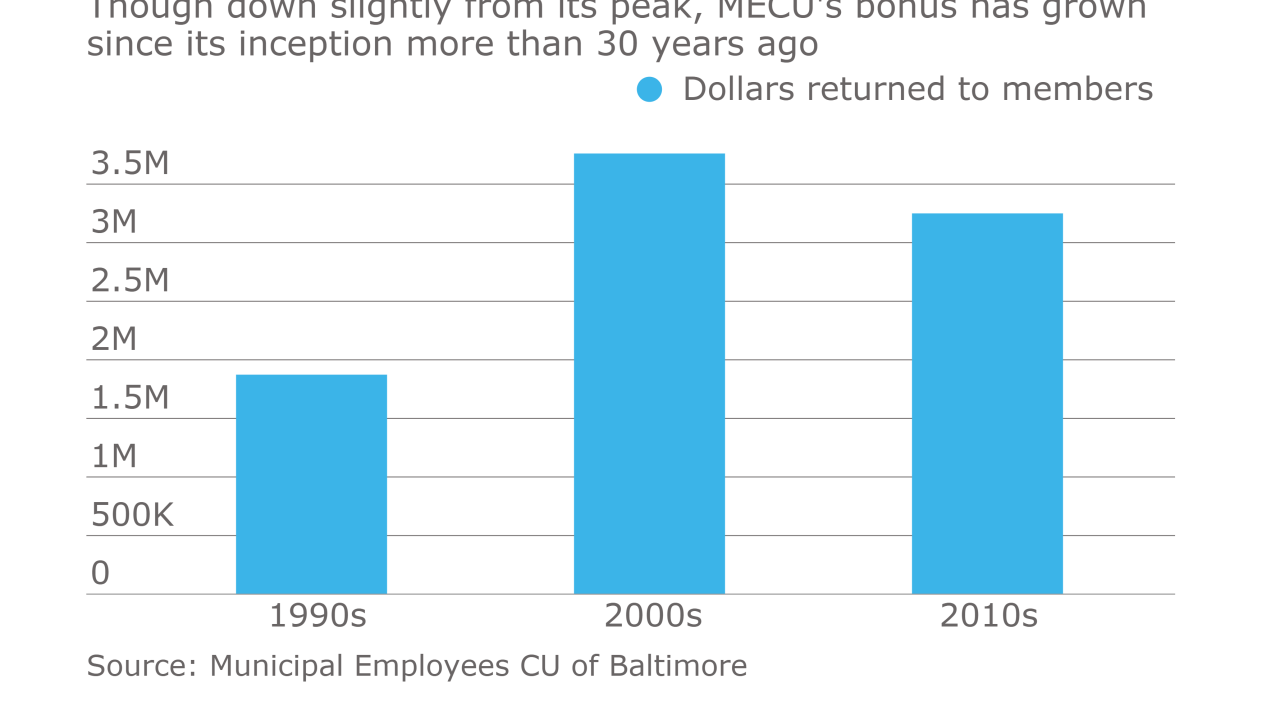

The $1.2 billion CU has returned more than $80 million to members over the last 36 years that it has been issuing annual bonuses to its membership.

January 31 -

The Livingston, N.J., company took a big hit in the fourth quarter as it continued to divest certain business lines and restructure its operations.

January 31 -

Wendell Bontrager, formerly a regional president at Old National, will oversee operations, lending at strategy at Equity.

January 30