-

Loan officers whose habits are attuned to the refi market need to improve their relationship game to make it in this business, NBKC Bank's Dan Stevens told attendees at Digital Mortgage 2018.

September 17 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 9 -

Housing confidence hit an all-time high as more consumers report it's a good time to sell, while also anticipating a rise in home prices but a drop in mortgage rates, according to Fannie Mae.

May 7 -

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13 -

The maximum loan amount for Federal Housing Administration mortgages will go up in more than 3,000 counties for 2018.

December 7 -

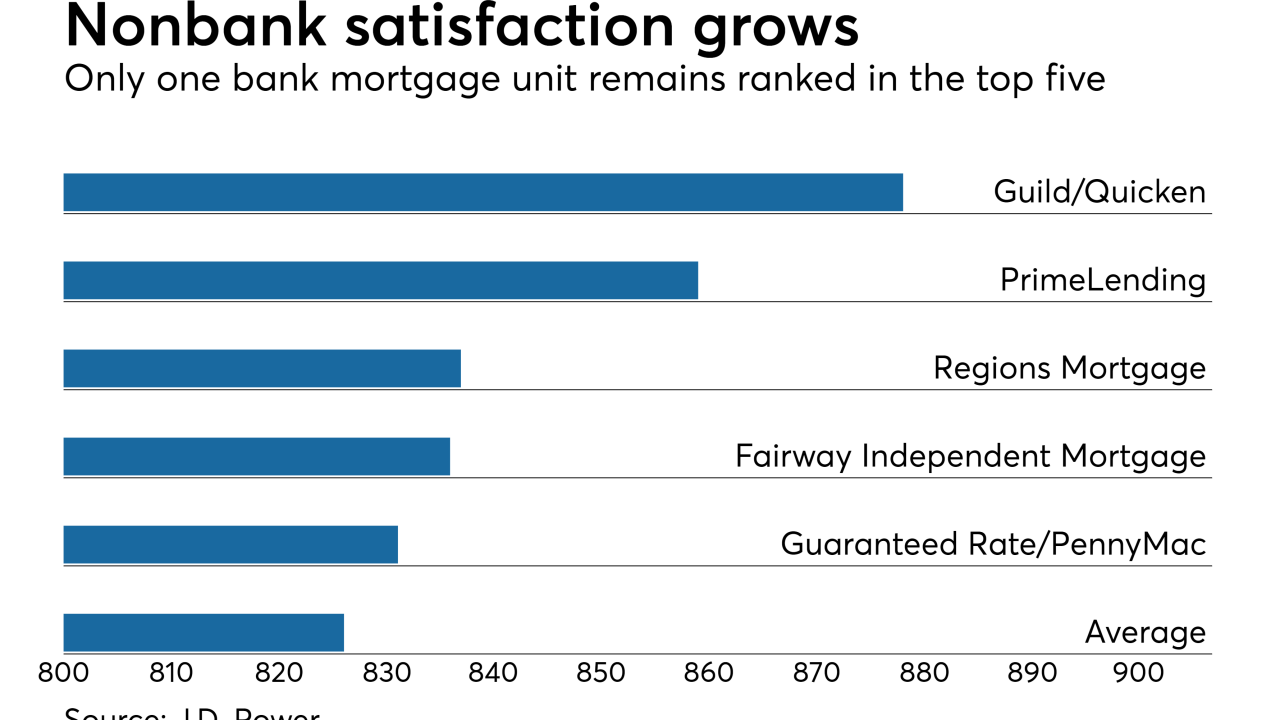

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 9 -

The share of purchase and refinance loans originated by nonbanks are at their highest point since at least 1995, according to an analysis of new Home Mortgage Disclosure Act data.

September 28 -

FHA loans made by millennial home buyers have been steadily decreasing the past four months, indicating they may be able to afford more at the moment.

August 10 -

Credit union mortgage lending may be slowing, even as more millennials -- about 33% of whom purchased their first home out of the desire to have a better space or yard for a dog -- enter the market.

July 27 -

Traditional partnerships with lenders have been eroded by compliance strains and new incentives to control more of the homebuying transaction.

June 21 -

The Federal Housing Administration's gateway to homeownership could be widened if the Trump administration takes actions to reduce mortgage insurance premiums and clarify lender penalties under the False Claims Act.

June 2 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

Bank of the West is using alternative data and the international expertise of its parent company to tap into the lucrative but difficult to underwrite market of middle- and upper-class immigrant mortgage borrowers.

May 23 -

Down payment standards should be relaxed to just 10% to spur homebuying among millennials, Bank of America CEO Brian Moynihan said this week.

May 19 -

The time needed to close a mortgage improved nine days since the start of the year as the market has shifted to doing more purchase loans.

May 19 -

JPMorgan Chase will give its Sapphire credit card customers 100,000 rewards points for closing home-purchase loans with the bank.

May 9 -

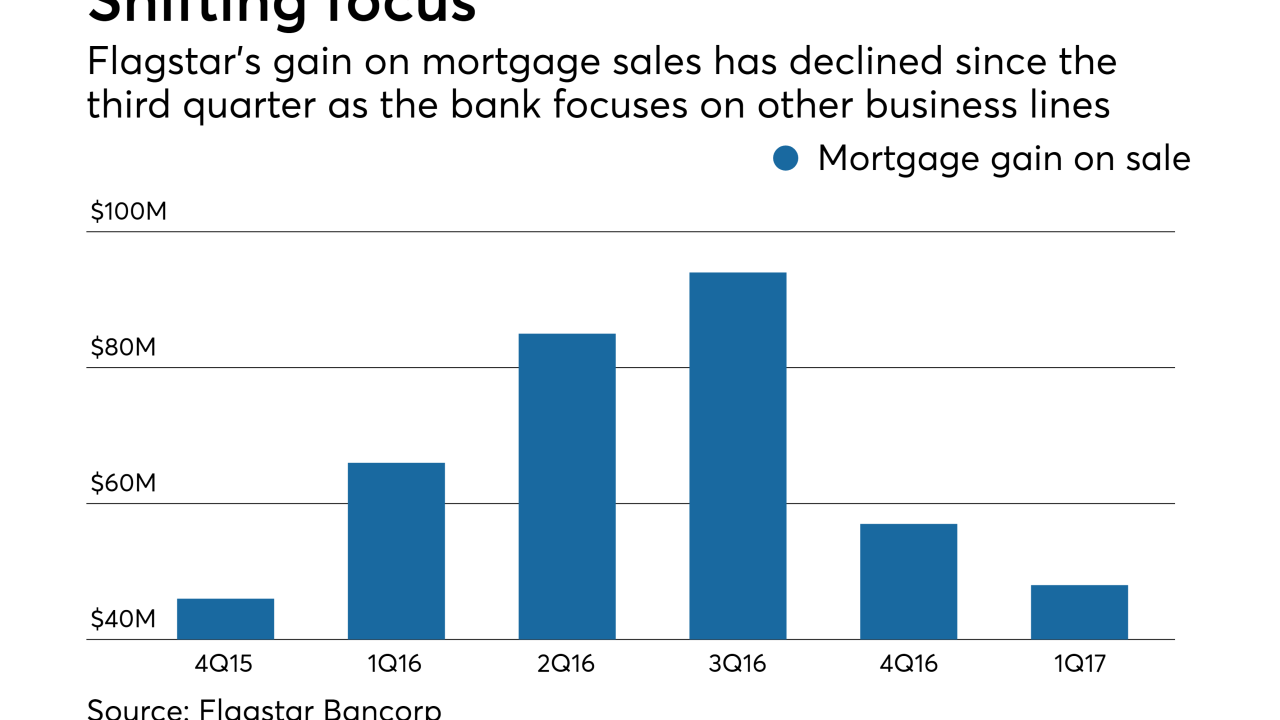

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

After years of sitting on the sidelines of the housing market, a growing population of millennials has begun to embrace the financial benefits of owning a home.

April 13