-

Expenses also rose, as well as the provision for loan losses, but credit quality remained spotless at the lender to the wealthy.

July 14 -

The app allows users, many of them first-time investors, to get started for as little as $5.

July 13 -

A community bank gets taken to task by the Equal Employment Opportunity Commission. Tennis player Andy Murray makes his mom — and lots of other women — proud at Wimbledon. Also, the Bank of England's Charlotte Hogg and Morgan Stanley's Naureen Hassan.

July 13

-

Artificial intelligence can help wealth managers serve clients better, but some say the technology is too immature to be useful right now.

July 13 -

The companies will use an application programming interface to let Chase customers send the data to the apps Finicity supports, including personal financial services apps and income verification tools.

July 11 -

The nearly 200-year-old firm wants to help clients access, organize, transmit and use data more effectively.

July 5 -

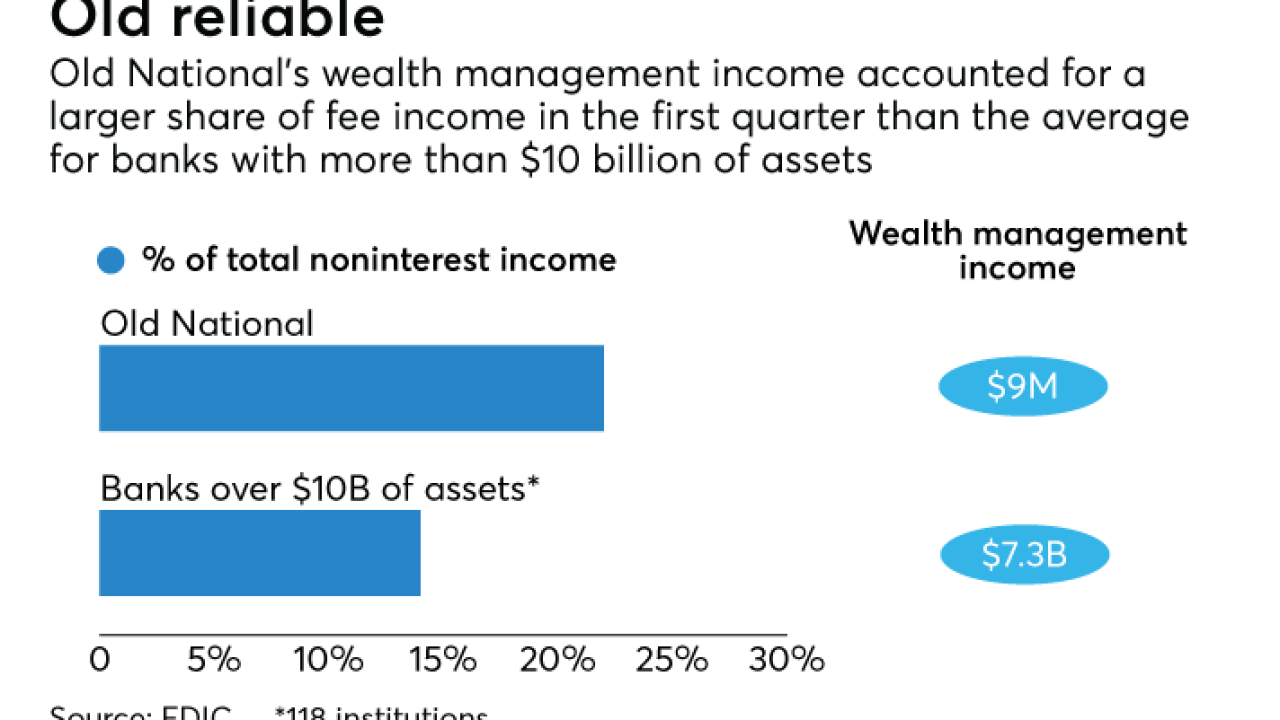

It might seem unusual for an Old National Bancorp to lure away a regional executive from the much larger Fifth Third, but not in wealth management, where competitiveness can be as much about emphasis as size.

July 3 -

Greenlight Financial Technology offers a card that enables parents to control where their kids spend money.

June 29 -

Imagine if we could take all the data that's coming from the real economy and use that to discern price, predict performance, understand risk and make better investment decisions. The only feasible way to do this is through artificial intelligence.

June 27 FirstCapital

FirstCapital -

Do impact investments — which are made with the intention of fostering social or environmental benefits — underperform? Those involved in the sector answer with a resounding "no."

June 27

-

Dr. Dan Geller, behavioral economist and author of "Money Anxiety," explains why Americans are more stressed about money than ever before and how fear affects their decisions about financial products and banks.

June 27 -

CIBC plans to spend two years focusing on internal growth at PrivateBank except for some targeted wealth management acquisitions, but ultimately capital outlays or takeovers will be necessary to meet its growth ambitions.

June 23 -

Digital banking services should solve consumers' problems and offer them advice, and they must rely on artificial intelligence and other cutting-edge technology, bankers from TD, RBC and Bank of the West said.

June 13 -

Vault and Retiremap are launching products this week that are designed to help people stash cash where they can.

June 8 -

Services with simpler fees and intuitive digital designs might appeal to younger users, but millennials have much more on their minds than saving for retirement.

June 7 CCG Catalyst

CCG Catalyst -

TIAA, the nearly 100-year-old retirement and insurance company, is starting an online robo-adviser this week, making it the latest firm to use automated advice to win customers in a rapidly changing asset-management industry.

June 6 -

Wells Fargo's David Carroll, who had pay clawed back after the bank's fake-accounts scandal, will retire and be succeeded by Jonathan Weiss as wealth and investment management chief.

June 1 -

KeyCorp is acquiring HelloWallet, a personal financial management product it has offered its bank customers since 2015, from the investment research firm Morningstar.

May 31 -

The price of bitcoin continues to rise in volatile trading; Wells Fargo, still reeling from its phony accounts scandal, is boosting signing bonuses for brokers just as competitors decrease theirs.

May 26 -

Long Game uses behavioral economics and the mass popularity of lottery games to redirect lottery spending toward savings.

May 23