Industry stakeholders say the Federal Reserve's renewed focus on reforming the discount window — the central bank's 'lender of last resort' facility — is welcome. But replacing the system with one that works better is easier said than done.

Banks like Grasshopper are already starting to use AI agents where in the past they would have bought software as a service.

-

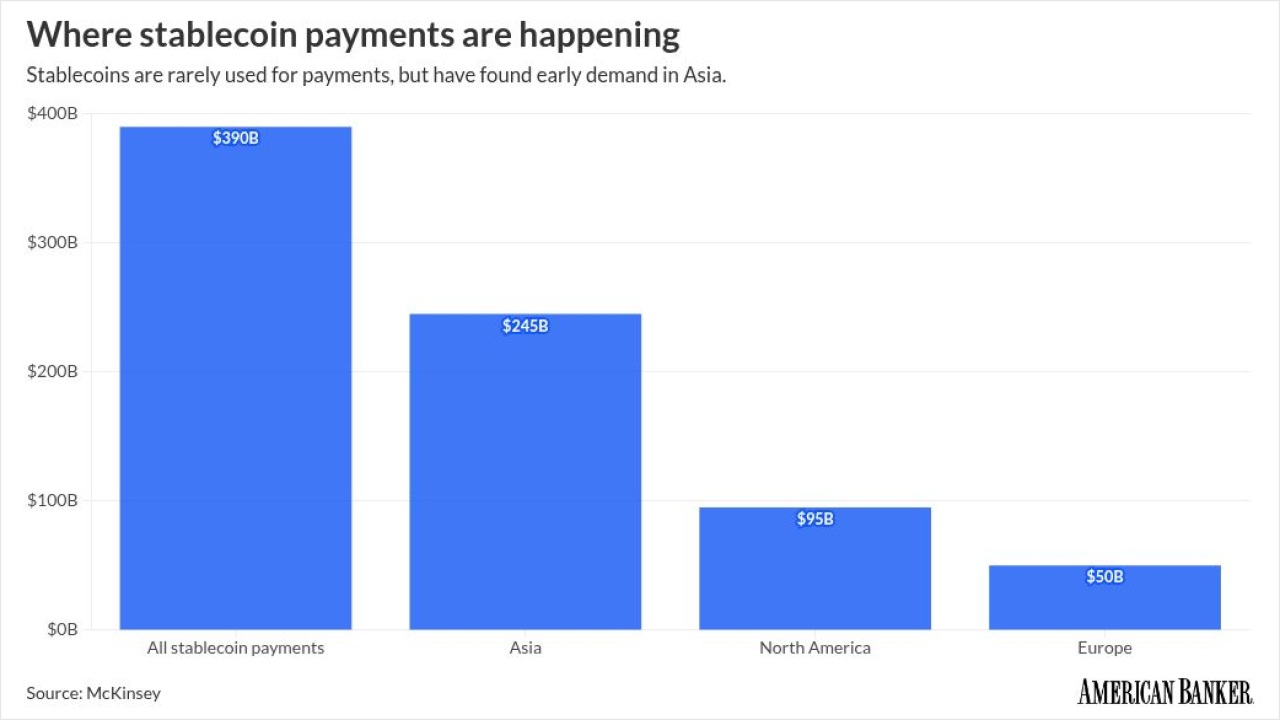

Fintechs and the technology behind cryptocurrency are becoming popular, putting trillions in transaction value at risk for banks, according to Accenture.

-

Federal Reserve Vice Chair for Supervision Michelle Bowman played down the significance of Kraken Financial receiving a master account, saying the central bank is treating it as a pilot program.

-

Panelists at a JPMorganChase webinar said oil shipping security is shaky, creating risk of a new wave of inflation that would impact energy finance. Other analysts said the war will create pressure for some parts of the payments industry.

Stripe has expanded its Shared Payment Tokens, a foundational building block to protect agentic commerce, to work with Visa and Mastercard's tokens. It's also added Affirm and Klarna.

The Phoenix-based bank said that affiliates of Jefferies had stayed current on the loan agreement until last week. The suit is the latest example of private credit-related problems at banks.

The Bureau of Labor Statistics reported that the economy lost 92,000 jobs in February while unemployment held steady at 4.4%, a development that could spur the Federal Reserve to question whether interest rates are truly in balance.

-

If we allow algorithms to inherit yesterday's incentives — maximizing return, minimizing empathy — then tomorrow's system will be flawlessly efficient at reproducing inequality.

-

Romance scams and other "pig butchering" frauds are growing rapidly. Should banks refund the stolen money? Not all agree on the answer to that question.

-

Morgan Stanley wants to get into crypto, and Kraken is getting inside the Fed. Plus Banco Santander faces a dilemma, and prediction markets make some questionable bets.

-

While this only shows a 2-basis-point rise in the 30-year fixed since last week, the Lender Price product and pricing engine data is 30 basis points higher.

-

The Chicago-based lender service provider, which has helped build Northeast Bank in Maine into an SBA powerhouse, has expanded its capacity with an AI-driven technology upgrade.

-

By acquiring the ATM firm, Brink's hopes to expand in retail commerce. Plus, Revolut issues a card to compete with Amex; Standard Chartered has a new payments chief; and more in American Banker's global payments and fintech roundup.

-

The blockchain technology firm has added new processing tools for digital assets and traditional money, pitching itself as a destination for crypto-curious banks.

-

Banco Santander's bid to buy U.S. regional bank Webster Financial could face surprise challenges following a dustup between President Trump and Spain's leaders over the war in Iran.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

-

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

-

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

-

Think your credit union has one of the best workplaces in the country? Here's how to apply for American Banker's ranking of the Best Credit Unions to Work For.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Partner Insights from Finzly

-