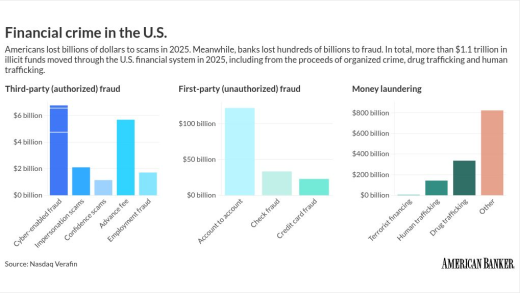

Criminals are using AI and professional crime networks to scale attacks, yielding massive operational risks for banks, according to a new report from Nasdaq.

The credit union closed three of its overseas locations in response to the conflict. Military-focused financial institutions are instead offering digital banking to deployed service members.

-

Visa is using AI agents to streamline payment disputes, while Mastercard launched "digital executives" for small businesses.

-

Cari has lined up five banks so far to support tokenized deposits for transactions such as real-time payments.

-

The London-based neobank plans to invest $500 million in the U.S. over the next few years amid stiff competition from fintechs, other neobanks and legacy banks.

Stripe has expanded its Shared Payment Tokens, a foundational building block to protect agentic commerce, to work with Visa and Mastercard's tokens. It's also added Affirm and Klarna.

Dean Bass, who served as CEO at two Houston community banks, plans to acquire Lone Star Bank in a deal expected to close this summer.

Federal Deposit Insurance Corp. Chair Travis Hill said in a speech Wednesday morning that the agency will move to codify stablecoins as ineligible for deposit insurance — which is required under the GENIUS Act — and that the prohibition likely will include pass-through deposit insurance arrangements.

-

There's a huge difference between short-term volatility and true systemic risk. The current rash of redemptions from private credit funds betrays a misunderstanding of the strengths underlying the business model.

-

Kraken's limited account with the Fed raises as many questions as it answers; bank executives worry about the war; Nubank hires a TikTok executive; and M&T CEO Rene Jones joins the Leaders series

-

Mortgage servicing rights are one of the most notoriously volatile assets in financial markets. The Federal Reserve's plan to loosen their capital treatment could foretell major problems in the future.

-

Federal Deposit Insurance Corp. Chair Travis Hill said in a speech Wednesday morning that the agency will move to codify stablecoins as ineligible for deposit insurance — which is required under the GENIUS Act — and that the prohibition likely will include pass-through deposit insurance arrangements.

-

In the highest-priced housing markets, some buyers see adjustable-rate mortgages as the only loan they may initially qualify for, Cotality found.

-

TransUnion cuts VantageScore 4.0 to $0.99, aiming to boost lender choice and affordability as FHFA pushes mortgage score modernization and competition.

-

Cybercriminals say they stole sensitive records by exploiting an unpatched vulnerability known as React2Shell and using the password Lexis1234.

-

The Phoenix-based bank said that affiliates of Jefferies had stayed current on the loan agreement until last week. The suit is the latest example of private credit-related problems at banks.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

-

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

-

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

-

Think your credit union has one of the best workplaces in the country? Here's how to apply for American Banker's ranking of the Best Credit Unions to Work For.

The 23rd annual ranking of women leaders in the banking industry.

-

- Partner Insights from Box

- Partner Insights from Akoya

- Partner Insights from Alloy