Experts say that compliance with a potential executive order being considered by the White House that would require banks to collect citizenship information would be costly, especially for community banks.

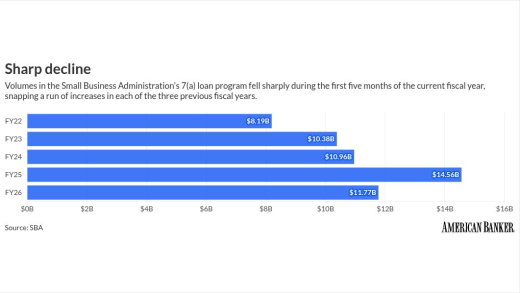

Fintech lenders are positioned to help businesses navigate the latest round of global tariffs announced by President Trump, even as the volatility causes overall decreases in loans.

-

With the likes of Amex and JPMorganChase upgrading card perks, BofA is expanding no-fee access to more customers and products and adding incentives.

-

Recent reports from JD Power suggest that more customers choose payment alternatives to avoid surcharge fees.

-

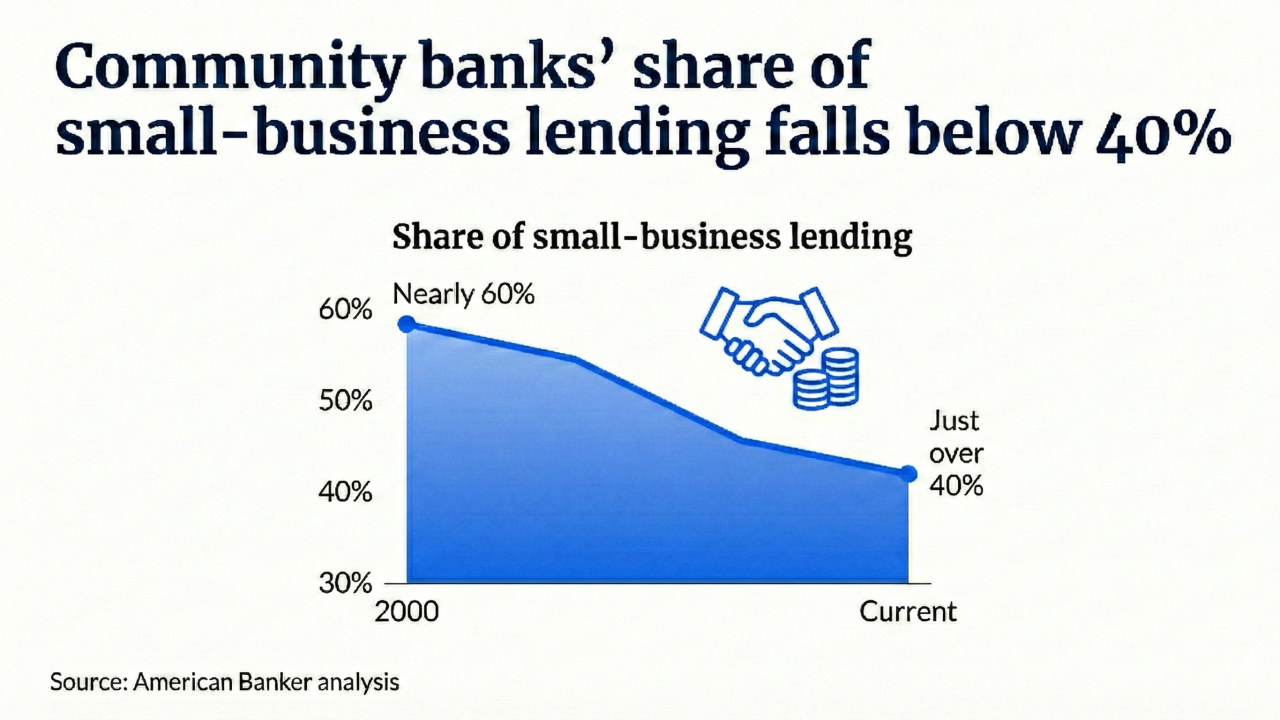

Noelle Acheson argues that stablecoins can help community banks deepen relationships with their customers, help them explore new forms of capital formation and strengthen their own exposure to risk.

Block last week cut 40% of its staff and attributed the layoffs to artificial intelligence, leaving many to wonder whether Jack Dorsey's payments company was a bellwether for widespread AI-driven layoffs, or a one-off.

The financial advisory firm initially sought an industrial loan charter back in 2020. It's the third company to receive the necessary approvals this year, joining General Motors and Ford.

Markets were bracing for the chaos of a regional war; banks may be the target of sophisticated cyberattacks, experts warn.

-

If the next phase of digital money policy is to succeed, it must grapple with a simple truth: People do not experience money through legal categories. They experience it through use. That's a fact that supervision must account for.

-

The Iran conflict is more likely to have an indirect effect on banks, one that may take years to show up as the ramifications filter through the economy

-

The responsible gathering of data on consumers is intrinsic to the verification tools that keep everyone safe from identity theft and other forms of fraud. Blanket attacks on "data brokers" will harm consumers, not help them.

-

Think your credit union has one of the best workplaces in the country? Here's how to apply for American Banker's ranking of the Best Credit Unions to Work For.

-

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

-

The Royal Bank of Canada's base outlook is that tariffs will remain at their current levels. But it also sees a possibility that U.S. trade policy will bring on a severe North American recession.

-

The Toronto-based bank reported higher revenue across the entire company, including in the U.S., and kept expenses in line with its previous projections.

-

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Partner Insights from iQuanti

-