Chief Innovation Officer Don Relyea and Head of Applied Foresights Todder Moning described what interested them at this year's Consumer Electronics Show, and which technologies are getting close enough to become bank-ready.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

It isn't lost on Fiserv that consumers increasingly are moving to digital financial services. Its deal to acquire Ondot Systems, a digital card solutions platform, aims to capitalize on the shift.

-

Demand for food delivery has been strong during the pandemic, building on what already had been a strong demand for the $27 billion industry, according to NPD Group.

-

A pleasing look, or even allowing consumers to design their own cards, can help build brand and uptake, says Fingerprints' Lina Andolf-Orup.

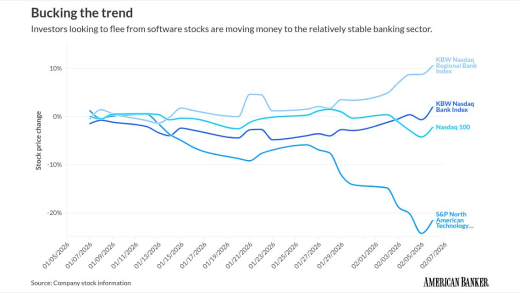

Artificial intelligence developments are stoking investor fears about software companies. Banks' limited exposure to the sector and general stability is proving attractive to investors.

Institutions are hiring aggressively or buying up competitors to take part in an equipment finance boom as the economy continues to heal.

The Federal Reserve's quantitative-tightening program risks being propelled toward an early end as U.S. politicians bicker in Washington over raising the national debt limit, according to some economists and bond market participants.

-

Universities are starting to offer courses in bitcoin and other cryptocurrency skills, and that's just the start, according to David Uhryniak, blockchain services leader at Crowe LLP, and Brian T. Zygmunt, a partner at Crowe LLP.

-

Events like the recent government shutdown present opportunities for banks to help customers when they need it most.

-

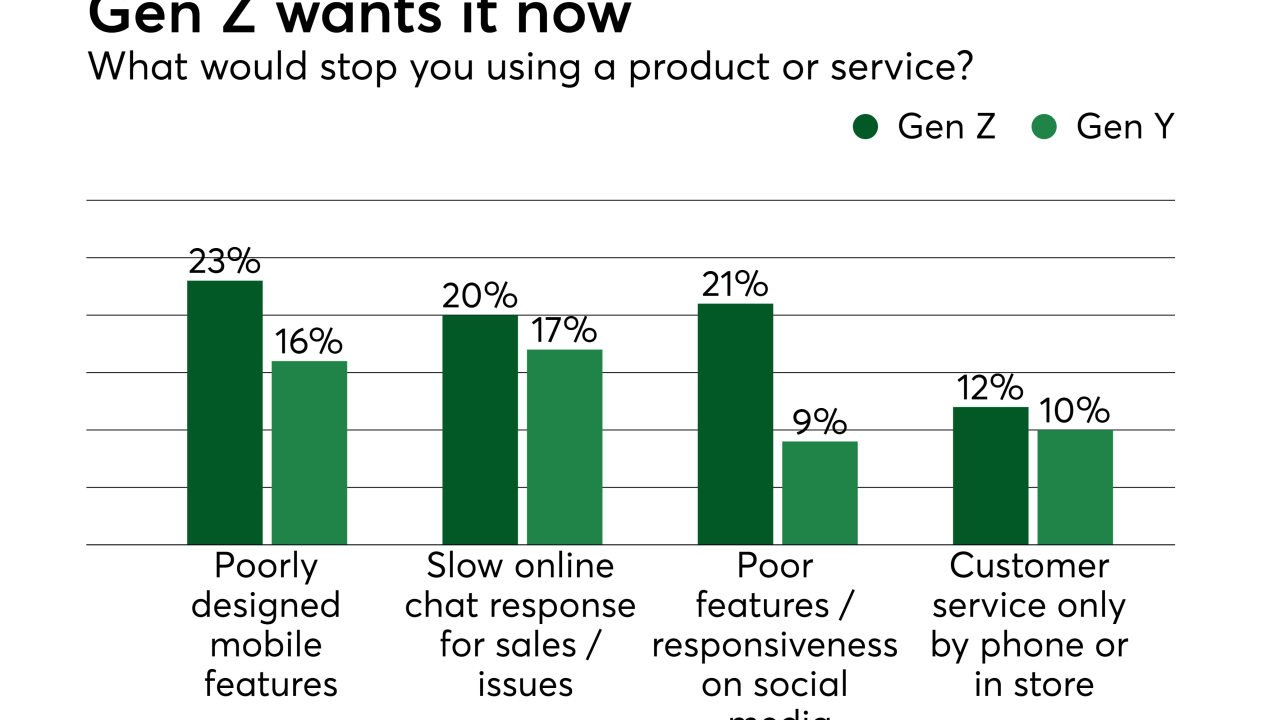

To keep up with demands for instant digital payments, retailers should explore options to make their payment processes quick and easy, according to Steve Davidson, vice president of warranty products at Fortegra.

-

A midweek rally followed robust bottom-line results from JPMorgan Chase, Wells Fargo, Bank of America and several other large banks. But further interest rate cuts may be needed to sustain momentum.

-

The insurance market going into the Jan. 7 catastrophe already had been hit with non-renewals and cancellations -- and an overburdened state-supported insurance plan. A Morningstar analyst said the state insurance commissioner's reform strategy could have turned it around but now faces new obstacles.

-

The bank, which owns a minority stake in Viva Wallet, can take over the company in June if its valuation falls before a certain level — which has resulted in a legal dispute with Haris Karonis, the fintech's owner. That and more in American Banker's weekly global payments roundup.

-

With the Federal Reserve touting a slower pace of easing, markets are expecting a longer pause. But Gov. Christopher Waller said the next interest rate reduction could come as soon as March because of inflation data.

-

The bank is "very optimistic" that Trump will appoint financial regulators who are "more balanced" than current agency heads, CFO Daryl Bible said.

-

The Biden administration is asking the Supreme Court to overturn a lower court injunction against the Corporate Transparency Act, which requires businesses to disclose their beneficial owners. The outcome has significant implications for banks' AML compliance burdens.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The card issuing fintech has worked for years to expand its business outside of Block. Mike Milotich, who in February became the third person to hold the fintech's top job in as many years, has been tasked to do just that.

House Financial Services Committee ranking member Maxine Waters joined fellow Democrats in introducing a bill barring the president, vice president, members of Congress or their families from owning so much of a cryptocurrency that they are able to influence the market.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado