In a perfect world, small and mid-size businesses want a single platform to manage online and offline sales and payments seamlessly.

Opus Bank has hired Scarlett Sieber, the former senior vice president in global business development at BBVA, to be its chief innovation officer.

-

Transaction volume and nonpayment services boosted earnings, and the card network expects these trends to continue into 2025.

-

A Supreme Court ruling from earlier this year regarding national bank preemption is already playing a prominent role in the banking sector's challenge to a state law on charge card fees.

-

The processor's sale of medical software firm AdvancedMD comes as it prioritizes small-business payments, according to Cameron Bready.

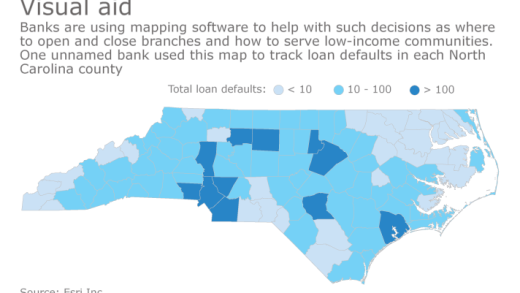

Institutions that fail to embrace AI, machine learning and data analytics could quickly find themselves losing ground to competitors.

The Honolulu-based utility sold a 90.1% stake in American Savings Bank. The deal valued the lender at $450 million.

The Financial Technology Association will now defend the Consumer Financial Protection Bureau's open banking rule after the Trump administration sided with banks that sued the agency.

-

Like a ratchet, price controls in the payments industry move only one way, destroying value and reducing incentives for innovation.

-

The country's largest credit union is learning the hard way that failure to assure inclusivity in lending practices is a recipe for both financial and reputational damage.

-

An initiative in Baltimore to use blockchain tech to track and manage vacant properties is a prime example of how blockchain can help solve stubborn problems, even if it isn't ready to revolutionize the fundamentals of commerce.

-

The Dallas-based regional bank's return on average assets exceeded its goal of 1.1% for the first time, coming in at 1.3% for the third quarter. The bank has been in transformation mode since 2021.

-

U.S. regulators have reached a rock-bottom settlement deal with a former Wells executive accused of wrongdoing in the phony-accounts scandal. The OCC had sought to recover $10 million from Claudia Russ Anderson, a onetime risk executive at the bank.

-

Fraser will succeed John Dugan, who's been Citi's chair for six years. The megabank also granted Fraser a one-time award of $25 million in restricted stock units, and more than 1 million stock options.

-

In addition, John Roscoe and Brandon Hamara have been appointed co-presidents at the government-sponsored enterprise, effective immediately.

-

Farmers National Banc Corp. in Ohio plans to acquire in-state rival Middlefield Banc Corp. in a deal that will deepen the buyer's footprint in Columbus.

-

An apparent increase in large-scale borrower fraud and the hot environment for bank mergers were the key themes as banks discussed their third-quarter results.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

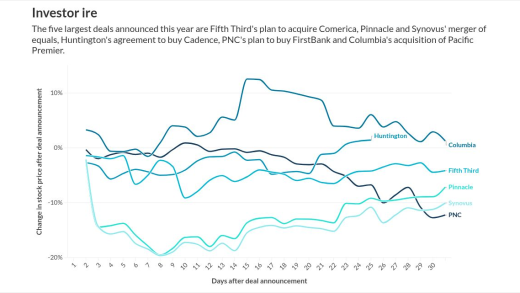

Financial institutions see an opportunity to nab scale after years of tepid dealmaking, but investors are pushing back against such efforts out of concerns about shareholder value.

Now that the Consumer Financial Protection Bureau has refused to request funding from the Federal Reserve System, many experts see the case making its way to the Supreme Court.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

- Sponsor Content from Workday Peakon Employee Voice

-

- Partner Insights from i2c