Until August, Bell was the executive director for loan guaranty service at the Department of Veterans Affairs, where he was credited with growing the program.

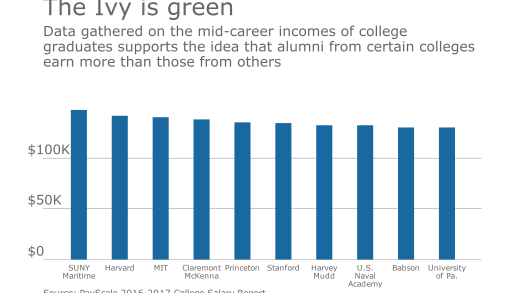

By relying heavily on where a borrower went to college, online lenders may run afoul with regulators and could be missing out on good credits.

-

Micro-, small- and medium-sized businesses have traditionally been a tough nut to crack when it comes to serving up actionable insights. Payment data is helping to change that.

-

The use cases are growing and banks don't want to risk being left behind, especially with younger customers who are more open to the technology.

-

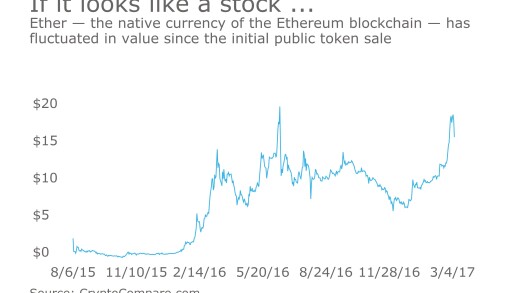

The bank and payment company are using the technology that underpins digital assets to improve interoperability for international transactions, a major point of friction in trade finance.

Readers respond to how Congress should address AI, concerns on Facebook's Libra and its logo, a report challenging card fraud prevention and more.

Wells Fargo CEO Charlie Scharf validates some of the optimism, telling analysts he feels "really great about our progress." But he said executives "don't want to get ahead of ourselves."

The Supreme Court blocked a lower court injunction reinstating two Democrats who had been fired without cause from the National Labor Relations Board and Merit Systems Protection Board, explicitly holding that Federal Reserve Board members would not be affected by the case.

-

With dominant industry personalities suddenly swept offstage, the evolving rules and regulations that will dictate the industry's future will be in the spotlight.

-

The nation's largest credit union allegedly engaged in racial discrimination resulting in calls for further investigations and regulations. Had Navy Federal been subject to the Community Reinvestment Act it may have avoided this problem.

-

Policymakers should ignore the legislative calendar and draft a proposal that will stand up to bipartisan scrutiny, even if it takes time.

-

The payment company launched new tools for merchants and entered artificial intelligence collaborations with OpenAI and Mastercard ahead of the company's second quarter earnings, which beat analyst expectations.

-

A proposal from the Office of the Comptroller of the Currency would roll back Biden-era recovery planning rules for banks, leaving them with broad discretion to determine their own recovery protocols.

-

Capital One, PNC, Truist and, U.S. Bancorp are urging regulators to cut duplicative calculations and align U.S. rules with global standards, a longstanding preference for banks but one that will likely find a warm reception from a deregulation-focused Trump administration.

-

In an environment of persistent economic unease, banks have a unique opportunity to help small businesses, Sekou Kaalund, U.S. Bank's head of branch and small business banking, said at American Banker's 2025 Small Business Banking conference.

-

A national bank charter will help UBS Bank USA to expand offerings for wealth management clients, according a company memo.

-

The New York-based bank, which works with many Democratic campaigns, faces investor concerns that it might be targeted by the Trump administration. CEO Priscilla Sims Brown says the bank's "strong profitability" is its best shield from political threats.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Circle's Dante Disparte and Block's Owen Jennings discuss how blockchain, crypto and AI can combine to open new lanes for international commerce. Payment experts say banks need to play catch up.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from FintechOS

-

-

-