The Toronto-based bank announced enterprise-wide and business-specific revenue and expense targets, almost exactly one year after it was hit with more than $3 billion in fines and an asset cap for money-laundering-related blunders.

Delaware, whose business-friendly laws have lured more than half the country's publicly traded corporations and more than 60% of the Fortune 500 to incorporate in the state, is now vying to become a hub for blockchain technology.

-

Wars in Ukraine and the Middle East. Fiercely polarized U.S. politics. Rapidly multiplying payments options on social media networks and elsewhere. Those factors and more are making it harder than ever for banks to combat illicit financial transactions.

-

Despite further delays, the country has taken two key steps to opening up access to its Real-Time Rail, including allowing payment companies to participate without a bank partner, but it has yet to commit to a date for the project to go live.

-

M&T Bank creates new chief communications officer role, Citi cuts London investment banking jobs as deal drought persists, new report by McKinsey advises banks to institute artificial intelligence from headquarters rather than by divisions, and more in our weekly news roundup.

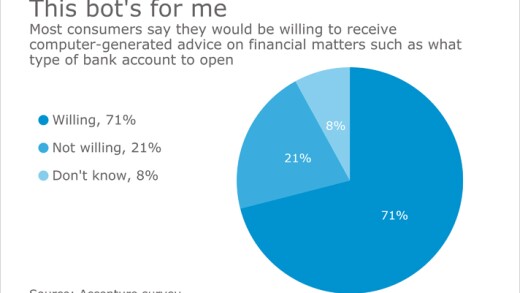

For banks, which stake their business on being trustworthy and reliable, there's a certain amount of risk to putting a chatbot out there that could make embarrassing or serious gaffes.

ChoiceOne Financial Services would pay about $180 million to acquire Fentura Financial in a bid to expand in Detroit's suburbs. The deal would create a bank with more than $4 billion of assets.

A study sponsored by America's Credit Unions finds that removing credit unions' tax-exempt status could raise consumer costs by $234.6 billion over 10 years, hurt GDP and result in job losses.

-

The Consumer Financial Protection Bureau has taken an important step in saying that it would work to root out unfair practices in all banking services. This is will help ensure all customers are treated fairly.

-

The Consumer Financial Protection Bureau is attempting to make broad changes to its authority and expand what counts as discrimination. This could lead to banks to cease offering important services.

-

Government-operated payment systems aren't necessary and reduce choice, competition, innovation and value for consumers, businesses and banks.

-

Stanley oversees 7,000 clients spanning six core businesses worth a combined $14 billion.

-

The long-serving CEO's North Star is a commitment and dedication to the community.

-

As part of a 10-year growth strategy, Reid is looking to reduce the average age of the bank's customers.

-

Despite a couple of bank acquisitions in the last year, Tedesco said Atlantic Union remains committed to organic growth.

-

Chung has led the development of new initiatives to enhance the bank's ability to help small business owners, increasing revenue and aiding the community in their excitement and their struggles.

-

The Consumer Financial Protection Bureau received pointed pushback from banks in their public comments on a proposed rule that would slash the number of nonbanks being supervised in four key markets.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Moving on-chain isn't just a technology lift; it's about rethinking culture, compliance and coordination across legacy systems,

Findings from American Banker's On-Chain Finance Report show how market leaders view digital assets as a permanent fixture in the banking industry.

The 23rd annual ranking of women leaders in the banking industry.

-

-

-

- Sponsor Content from Cardtronics