Zorana Milovanovic, MBA, is a senior accountant specializing in ERP implementation, financial systems optimization and compliance in high-growth, regulated environments. She has supported end-to-end system transitions, often acting as a liaison between accounting, IT and audit teams. With business degrees from both the U.S. and Europe, she brings a cross-cultural perspective to internal controls, SOX readiness and policy design.

-

The Texas attorney general has accused WEX Bank of "debanking" a firearm supplier, but the Maine-based bank said it does not discriminate against any industry.

June 25 -

Pulaski Savings Bank's failure will cost the FDIC's Deposit Insurance Fund 57.6% of its total assets.

June 25 -

Der Spiegel and other European publications say the company continued to serve porn sites and money launderers even after regulators cracked down on it.

June 25 -

Regulators proposed a rule to replace the 2% enhanced supplementary leverage ratio with a capital charge equal to half of a bank's global systemically important bank surcharge. Low-risk assets will continue to count toward leverage requirements under the proposal.

June 25 -

As the Federal Reserve considers changes to the supplemental leverage ratio, Fed Board Chair Jerome Powell said that effort is one piece of a broader deregulation package that will also address the Basel III capital rules.

June 25 -

The pending sale of the branches in eastern Pennsylvania to a central New York-based bank comes amid Santander's planned closure of 18 branches this summer and its continued focus on building out a national digital bank.

June 25 -

The government's instant processing rail hopes to enable new use cases, while Klarna adds to its network.

June 25

12 states have laws governing earned wage access, also known as on-demand pay, and while many follow similar general guidelines, small – yet critical – distinctions are emerging with each new regulation.

Zorana Milovanovic, MBA, is a senior accountant specializing in ERP implementation, financial systems optimization and compliance in high-growth, regulated environments. She has supported end-to-end system transitions, often acting as a liaison between accounting, IT and audit teams. With business degrees from both the U.S. and Europe, she brings a cross-cultural perspective to internal controls, SOX readiness and policy design.

Big banks with the strongest financial performance varied in asset size, geographies and services.

Each of the top-performing banks with more than $50 billion of assets used their own mix of revenue streams to drive performance.

Among banks with between $10 billion and $50 billion of assets, those that targeted narrow lending markets rose to the top.

Zorana Milovanovic, MBA, is a senior accountant specializing in ERP implementation, financial systems optimization and compliance in high-growth, regulated environments. She has supported end-to-end system transitions, often acting as a liaison between accounting, IT and audit teams. With business degrees from both the U.S. and Europe, she brings a cross-cultural perspective to internal controls, SOX readiness and policy design.

The largest bank in Missouri, which completed the acquisition of Heartland Financial USA early this year, is on track to switch Heartland's systems over to UMB's systems in mid-October. The conversion should help realize "the next big slug" of expense savings, UMB's CFO said.

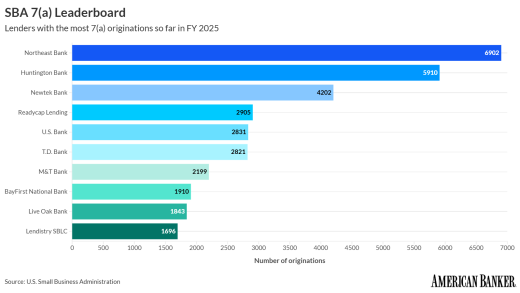

Northeast Bank and its fintech lending partner Newity have engineered a surge in 7(a) loans that has helped the Portland, Maine-based bank boost profits as tightened regulatory standards made the loans harder to get.

12 states have laws governing earned wage access, also known as on-demand pay, and while many follow similar general guidelines, small – yet critical – distinctions are emerging with each new regulation.

Zorana Milovanovic, MBA, is a senior accountant specializing in ERP implementation, financial systems optimization and compliance in high-growth, regulated environments. She has supported end-to-end system transitions, often acting as a liaison between accounting, IT and audit teams. With business degrees from both the U.S. and Europe, she brings a cross-cultural perspective to internal controls, SOX readiness and policy design.

The largest bank in Missouri, which completed the acquisition of Heartland Financial USA early this year, is on track to switch Heartland's systems over to UMB's systems in mid-October. The conversion should help realize "the next big slug" of expense savings, UMB's CFO said.

Northeast Bank and its fintech lending partner Newity have engineered a surge in 7(a) loans that has helped the Portland, Maine-based bank boost profits as tightened regulatory standards made the loans harder to get.

Alan Childs pleaded guilty to using straw borrowers and falsified loan records to help a timber businessman secure millions in fraudulent loans.

Bankers are concerned about stablecoins gaining traction due to the passage of the GENIUS Act, and also continue to sound the alarm about the failure to resolve check fraud disputes, according to the latest quarterly survey from IntraFi.

Pulaski Savings Bank's failure will cost the FDIC's Deposit Insurance Fund 57.6% of its total assets.

Most Influential Women in Payments honorees say the dramatic expansion in technology presents new opportunities and challenges as employers evolve away from traditional business models.

Honorees from American Banker's Most Influential Women in Payments discuss spotting tangible uses for innovation, rather than buying into hype.

Each year, American Banker recognizes the women who are advancing the payments industry in banking, retail, acquiring, processing and more.

- Richard Cordray, the first director of the Consumer Financial Protection Bureau, says the Trump administration seems intent on shutting the agency down, even though it has a legal mandate to exist.Sponsored by IntraFi

- Crypto-as-a-service, stablecoins and tokenized deposits all present opportunities for banks, according to Nathan McCauley, co-founder and CEO of Anchorage Digital.Sponsored by IntraFi

-

Carvana and Plaid, with the help of Cross River Bank, have launched Request for Payment, which combines billing with The Clearing House's RTP Network. The option has been slow to gain traction, but the companies are betting large-ticket purchases, such as for an automobile, will be popular.

June 26 -

Lenders have been working to shrink their rent-regulated real estate loan portfolios since a watershed state law passed in 2019, but those plans may be accelerated.

June 26 -

Consumer spending and exports fell slightly in the latest estimate, leading to a downward revision. Imports, which dragged down overall output during the first three months of the year, also came in smaller.

June 26 -

Lenders have been an underdog in the broader market's rally. Now, with stress-test results and the easing of bank capital rules on the horizon, there's a chance for bank stocks to break out.

June 26 -

Banking has long been overseen by independent agencies, though that independence has been waning for years. With the Supreme Court poised to weigh in, experts are questioning where — and whether — to redraw the line between politics and policy.

June 26