From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

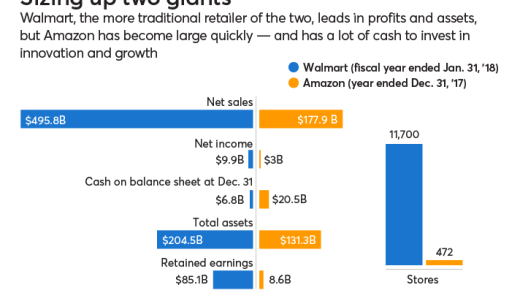

More than a decade ago, bankers fought Walmart tooth and nail as it made forays into banking. But with Amazon making more moves into financial services, the reaction is very different.

-

Affirm and FICO earlier this year took the first steps to incorporate buy now/pay later loans into consumer's credit reports. But it will be some time before lenders start making credit decisions based on the short-term installments, even if holdouts like Afterpay and Klarna decide to report to the credit bureaus.

-

Analysts said trade war-related issues are pressuring the U.S./Mexico remittance corridor, lowering the value of the acquisition. Devin McGranahan told American Banker Intermex's technology and footprint provide a path for future expansion.

-

As the payment technology company diversifies revenue streams, buy now/pay later was a key driver in beating analysts' estimates for Marqeta's second-quarter earnings.

A prominent AI expert says the risk of hallucination and error can never be completely eliminated. Experts at BBVA and Celent say those risks can be mitigated.

The New York-based digital-only bank is seeking to partner with more brands after a recent deal opened the way to serving millions of AAA customers.

After a quarter in which Goldman Sachs beat Wall Street's expectations, CEO David Solomon said he was seeing a "meaningful improvement" in the macroeconomic environment.

-

Current leverage-based capital requirements are outdated, counterproductive and urgently need reform to better serve U.S. taxpayers, capital markets, consumers, businesses and the economy.

-

A proposal before Congress would incentivize the creation of new banks by offering capital relief. This would give de novo banks a competitive advantage over incumbent community banks.

-

The United States is reindustrializing, with a focus on manufacturing and advanced production. For investors willing to move beyond conventional narratives, these sectors offer substantial growth potential, fueled by both policy support and private sector demand.

-

Donald Trump, Taylor Swift and the CEOs of the biggest banks: We checked back to see if our predictions were correct about whether these bankers, regulators and payments execs made an impact on the industry this year.

-

While the term "financial supermarket" may have gone out of fashion, firms still see opportunity to boost profits and keep clients loyal by blurring the lines between banking and wealth management.

-

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

-

The Consumer Financial Protection Bureau in an advisory opinion said that "covered" earned wage access products should not be considered an extension of credit under the Truth in Lending Act. It also said that expedited delivery fees and tips should not be considered finance charges.

-

The cryptocurrency company has entered partnerships with big banks and payment giant Klarna in recent days. Coinbase exec Brett Tejpaul says the GENIUS Act is creating an opportunity to sell a broad range of digital asset technology.

-

Terron T. Brown used stolen mail and social media recruits to defraud banks such as PNC and Bank of America of millions, highlighting a rising industry threat.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The 6-2 vote represents a win for the megabank, which has been fighting a nationwide push to organize its workers. Some 28 branches have voted in favor of unionization, while three have rejected unionization.

San Diego County Credit Union and California Coast Credit Union, which last year announced plans to merge, are now duking it out in court. SDCCU alleges there are widespread compliance problems at Cal Coast, which Cal Coast denies.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from Twilio

-

- Sponsor Content from Mitek Systems

-