Banking trade associations told the Office of the Comptroller of the Currency that regulators should reform rules around third-party risk, saying concentration and limited choice of core service providers places an undue burden on banks.

The financial services company has found that engineers report higher satisfaction and save time when using a copilot to assist with coding.

-

President Trump in Davos, Switzerland, talked about his call for lower credit card interest rates and more affordable housing in a lengthy speech that mostly focused on his plan to take over Greenland.

-

The payment company is betting on agentic commerce to get its checkout tech in front of more merchants and consumers.

-

As artificial intelligence agents play an increasingly large role in enterprise finance, traditional credit card rails will be incapable of handling the speed and volume of transactions. Something new is needed.

In a move some industry observers call "dangerous and irresponsible," the administration is taking down consumer protection guardrails that have been put up by states like California and Colorado.

A New Jersey courier scam highlights the severe liability risks consumers face when using debit cards compared to credit cards.

The buy now/pay later lender is seeking to create Affirm Bank, a Nevada-chartered industrial loan company.

-

The former chief national bank examiner for the Office of the Comptroller of the Currency sees welcome changes in the structure of federal banking supervision, but warns against the dangers of complacency.

-

The chief advocacy officer of the Defense Credit Union Council takes issue with the argument that a proposed increase to federal deposit insurance limits would be a "gift" to the credit union industry.

-

Fintechs are wrong to demand wholesale consolidation of community banks in the U.S. Real innovation doesn't stem from wiping out smaller institutions or forcing consolidation. Innovation comes from fair competition, secure data protocols, and clear rules that apply equally to banks and fintechs of all sizes.

-

Like other payment executives, Steve Squeri expressed concern about affordability, but is not in favor of heavy restrictions.

-

President Trump's announcement Friday morning that former investment banker and Fed Governor Kevin Warsh would be his selection as the next chairman of the Fed ends months of speculation and gives the president a key ally at the central bank.

-

The Office of the Comptroller's interpretation of federal trust powers has opened the door for dozens of charter applications by nonbank crypto firms in recent months. Some experts say the agency's interpretation may push the ambiguous statute beyond its limits.

-

CEO Ryan McInerney reiterated the company's long-held stance that the Credit Card Competition Act was "very harmful" and "just simply not needed."

-

A Government Accountability Office report warns the Office of the Comptroller of the Currency to clarify which records from the Basel Committee on Banking Supervision should be treated as federal records and thus retained according to the Federal Records Act.

-

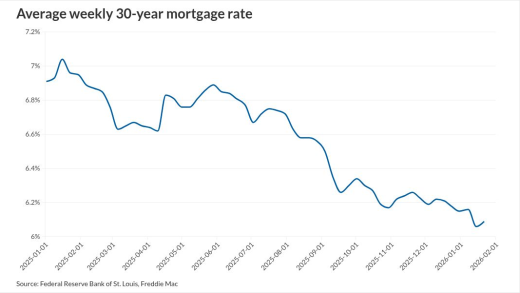

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

At a hearing Tuesday, executives at the Swiss banking giant faced tough questions from both Republicans and Democrats. The lawmakers are unhappy with the bank's recent decision to withhold certain documents from a lawyer who's overseeing research regarding Nazi accounts.

The digital bank added two new board members and raised $123.9 million as it continues to manage regulatory costs amid its push for profitability.

Under Habner's leadership, Citi has become the third largest issuer in the U.S. general purpose credit card market.

- Partner Insights from Jack Henry

- Partner Insights from Abrigo

-

-