Lalita Clozel covers fintech regulation, anti-money-laundering, cybersecurity and the Federal Deposit Insurance Corp. in American Banker's Washington bureau.

-

The Conference of State Bank Supervisors has sued the OCC before the agency has finalized the requirements for a fintech charter, fueling speculation state regulators are trying to delay deployment or scare away potential applicants.

April 27 -

The Conference of State Bank Supervisors is suing the Office of the Comptroller of the Currency, arguing it lacks the legal power to create a fintech charter.

April 26 -

The Conference of State Bank Supervisors is suing the Office of the Comptroller of the Currency, arguing it lacks the legal power to create a fintech charter.

April 26 -

Fintech firms, banks, state regulators and consumer protection groups all expressed significant reservations about the Office of the Comptroller of the Currency's latest plan on its fintech charter initiative.

April 25 -

Wells Fargo has “adequately remediated the remaining deficiencies" in the living wills it had originally filed in 2015, regulators said on Monday.

April 24 -

The president’s targeting of the FDIC’s orderly liquidation authority may ultimately heighten concerns about “too big to fail.” Here's why.

April 21 -

The Conference of State Bank Supervisors announced a raft of measures Tuesday designed to simplify multistate licensing and regulatory oversight for fintechs and other companies registered as money-services businesses.

April 18 -

A legal dispute between Wells Fargo and one of the largest bitcoin exchanges underlines persistent doubts U.S. banks have about participating in digital currency.

April 11 -

The Office of the Comptroller of the Currency's top examiner at Wells Fargo was removed last month, according to Reuters.

April 7 -

Comptroller of the Currency Thomas Curry on Wednesday expressed support for community development financial institutions, even as the Trump administration is seeking to cut all government funding for them.

April 5 -

The Office of the Comptroller of the Currency’s proposal to require fintech charter applicants to draft and comply with a financial inclusion plan appears to have more teeth than similar Community Reinvestment Act requirements for banks.

April 3 -

New York State Department of Financial Services Superintendent Maria T. Vullo speaks out on cybersecurity regulation, cracking down on bad actors in the industry and the OCC's fintech charter.

March 29 -

New York State Department of Financial Services Superintendent Maria T. Vullo speaks out on cybersecurity regulation, cracking down on bad actors in the industry and the OCC's fintech charter.

March 29 -

The Trump administration is seeking to immediately shut down the Treasury Department’s grant programs for community development financial institutions.

March 28 -

The administration wants to deal with the concerns of banks of all sizes in its deregulatory efforts, Treasury Secretary Steven Mnuchin said Friday.

March 24 -

Should Joseph Otting be appointed comptroller of the currency, it would be a crucial step in the new administration’s deregulatory efforts.

March 22 -

Democrats, financial services industry executives and even Wall Street reformers are speaking out against President Trump's proposed cuts to the CDFI program.

March 21 -

The Federal Deposit Insurance Corp. said the Deposit Insurance Fund is projected to reach 1.35% of insured deposits next year, well ahead of a 2020 deadline.

March 21 - Finance and investment-related court cases

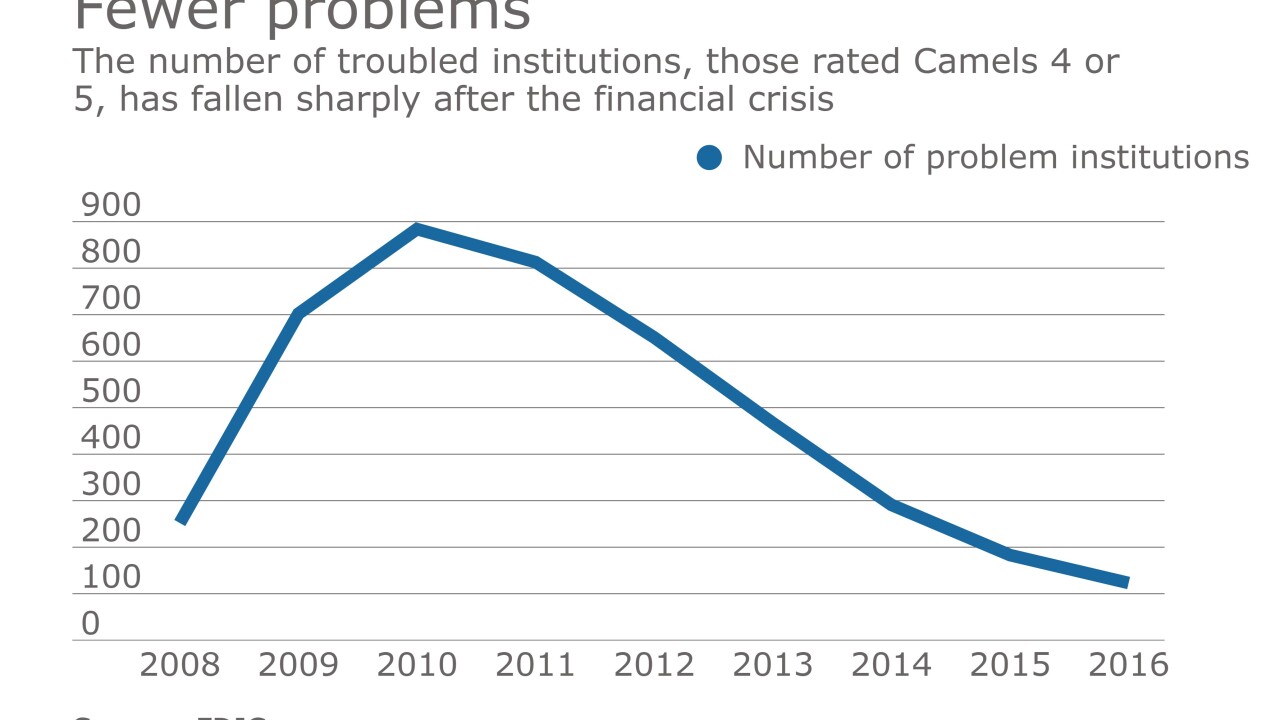

A bank took the unusual step of suing the FDIC over its Camels rating of 4 in a case that could set an important precedent for the industry.

March 20 -

Some in the industry are faulting The Clearing House Association's plan to make anti-money-laundering rules more efficient.

March 17