Consumer banking

Consumer banking

-

In partnership with the startup Hope Trust, the Chicago bank is piloting tools that will help people with disabilities, their families and caregivers manage their finances, government benefits and medical care.

May 11 -

Michael Moeser, senior analyst at PaymentsSource, talks to Simon Powley, head of advisory services at Diebold Nixdorf, about the importance of cash as the economy recovers from the coronavirus pandemic.

May 11 -

Small-bank executives are more optimistic about future loan demand than at any point since 2017, but they have mixed feelings about how to fund upgrades to the nation's roads, bridges and other infrastructure — if at all — according to a new survey by IntraFi Network.

May 11 -

Priscilla Sims Brown will join the New York company from Commonwealth Bank in Australia.

May 11 -

First Foundation and Suncrest are among the community banks developing platforms that let clients buy, sell and hold increasingly popular digital assets. The goal is to avoid losing business to cryptocurrency exchanges.

May 10 -

On Dec. 31, 2020. Dollars in thousands.

May 10 -

On Dec. 31, 2020. Dollars in thousands.

May 10 -

On Dec. 31, 2020. Dollars in thousands.

May 10 -

The Cincinnati company's new Momentum checking and savings will give customers extra time to avoid overdraft fees, quicker access to paychecks and the option for advances on future direct deposits.

May 7 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7 -

As chief credit officer, Horton oversaw the bank's certification as a Small Business Administration lender and participation in the Paycheck Protection Program.

May 5 -

Khan, who began her banking career as a part-time teller, heads the bank's retail operations in Minnesota and Western Wisconsin.

May 5 -

An Ogan-led effort to overhaul the bank's retail strategy yielded a better-than-expected increase in consumer and business deposits and improvements in cross-selling.

May 5 -

Reissman joined Seacoast in 2014 and led several departments before being promoted to chief marketing officer last year.

May 5 -

Western Union, the world’s largest money-transfer provider, will soon test banking products for its customers.

May 5 -

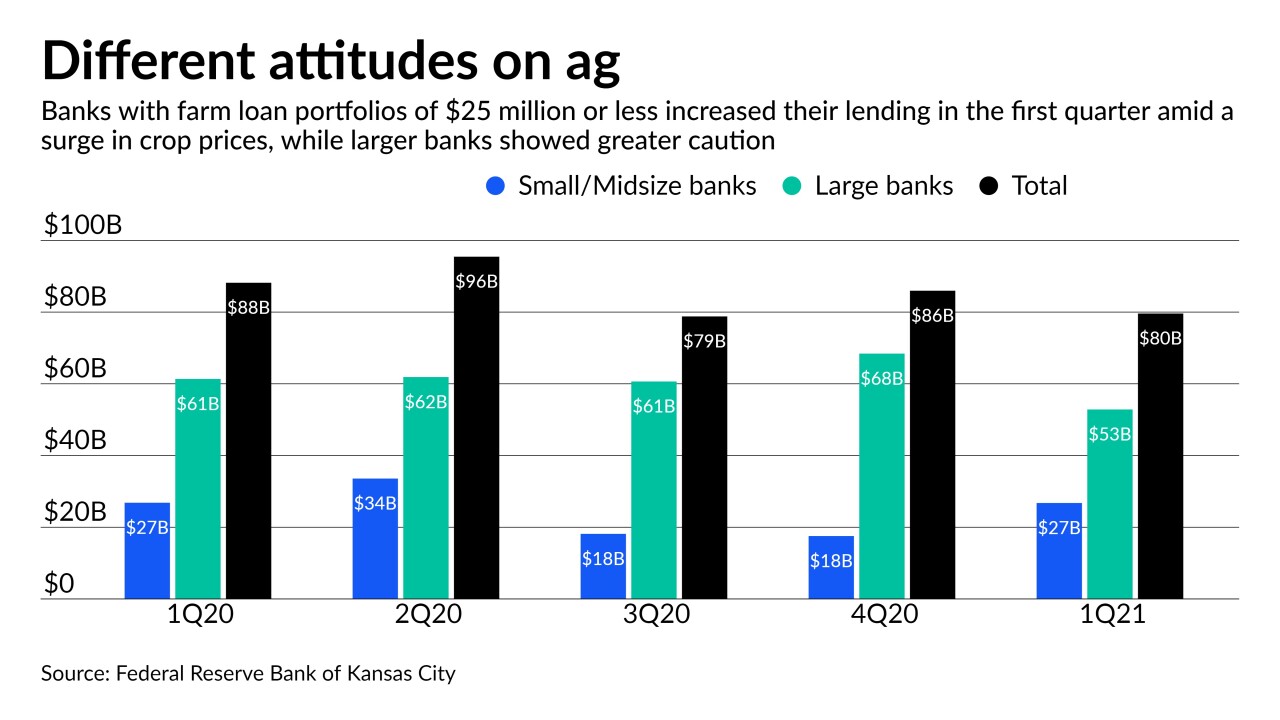

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

May 5 -

The Arkansas company will gain branches around Nashville as part of the acquisition.

May 5 -

The company agreed to pay $104 million for a one-branch bank with $391 million of assets.

May 5 -

More than a year into the pandemic, with the U.S. economy improving and consumers having paid down debt, bankers are finally loosening the reins in auto lending and credit cards.

May 5 -

Lenders including Howard Bancorp and First Carolina Bank are shunning acquisitions as a route into new markets, to avoid overpaying for targets and inheriting potential loan problems.

May 5