At the start of 2020, the overriding security concern when it came to payments was fraud. After all, before the days of the global coronavirus pandemic, no one had really viewed hygiene as being a particular selling point.

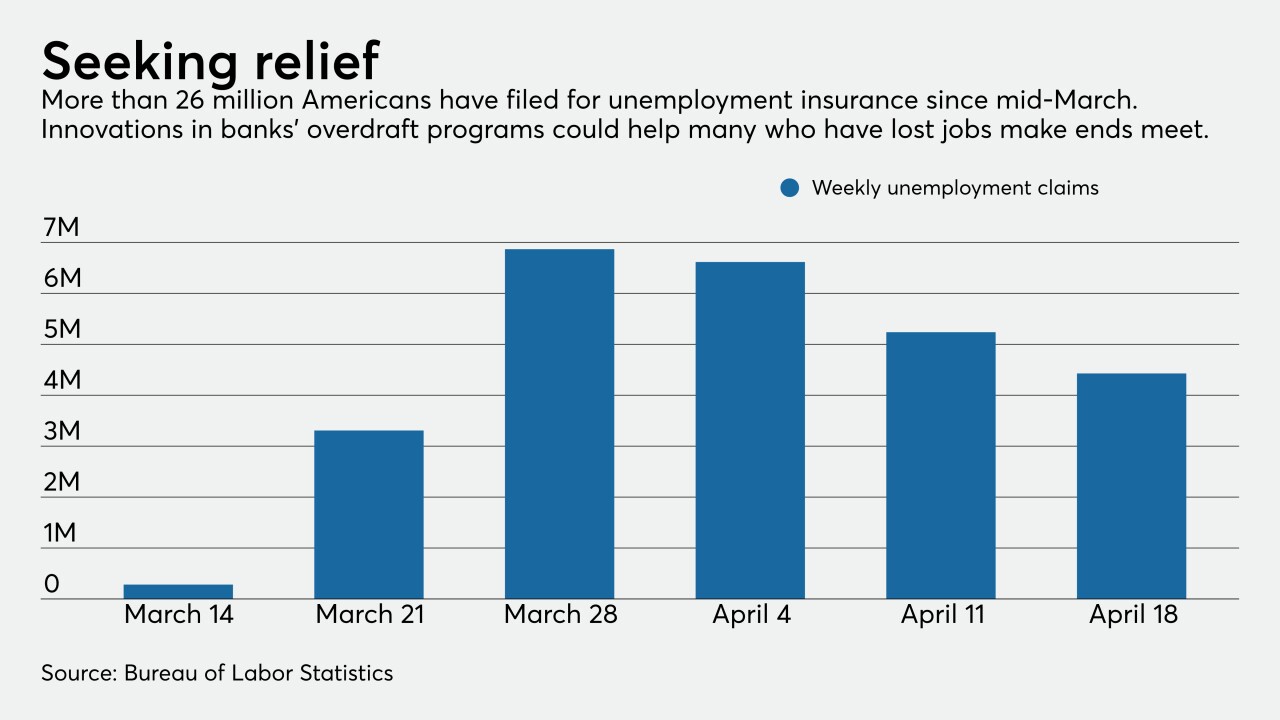

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

Unlike recent affairs that were marred by protests, this year's meeting — held online because of the coronavirus outbreak — went smoothly as investors overwhelmingly approved the bank's slate of directors and executive compensation plan.

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

Barclays has experienced an incremental £264 million (about $330 million) in contactless spend in the month since it raised its per-transaction limit in response to the coronavirus pandemic, which has created an aversion to cash and contact payments.

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

While the entire economy will slow due to stay-in-place orders and temporary economic shutdowns, payments fintech is expected to fare much better than other investment sectors due to these trends.

-

At the start of 2020, the overriding security concern when it came to payments was fraud. After all, before the days of the global coronavirus pandemic, no one had really viewed hygiene as being a particular selling point.

April 29 -

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

April 28

-

Unlike recent affairs that were marred by protests, this year's meeting — held online because of the coronavirus outbreak — went smoothly as investors overwhelmingly approved the bank's slate of directors and executive compensation plan.

April 28 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Barclays has experienced an incremental £264 million (about $330 million) in contactless spend in the month since it raised its per-transaction limit in response to the coronavirus pandemic, which has created an aversion to cash and contact payments.

April 28 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28