The maneuver could delay efforts by Senate Majority Leader Mitch McConnell, R-Ky., and Treasury Secretary Steven Mnuchin to add another $250 billion to the Paycheck Protection Program.

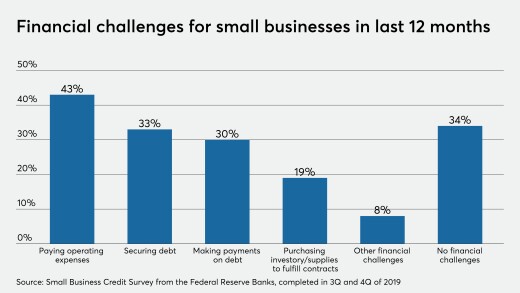

The majority of small businesses faced a financial challenge last year and that was before the pandemic curtailed consumer demand and forced nonessential companies to close.

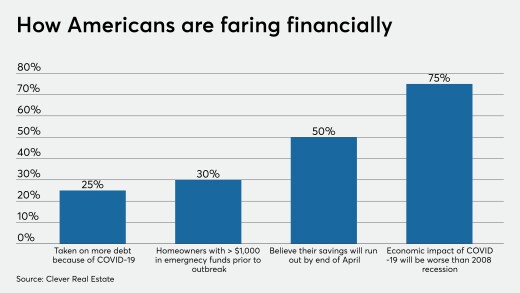

Critics who argue this crisis mirrors the 2008 financial panic when Congress bailed out banks have it wrong. The new relief package in response to the coronavirus pandemic was necessary to save livelihoods, and more can be done.

The coronavirus e-commerce push is likely to be permanent as consumers get used to digital payments, but that also gives rise to new fraud threats.

The Fed's actions are designed to ensure the flow of credit to midsize businesses and state and local governments hit hard by the economic impact of the coronavirus pandemic.

The industry is grappling with how to thank member-facing staff while also determining how newly mandated leave laws will impact them.

Fintechs, startups and bank-led projects were already working to excise generations of inefficiencies out of supply chains. The coronavirus has heightened the need for smooth payments.

With the government pumping trillions of new spending into the economy, experts are questioning the Federal Reserve's ability to keep prices stable.

-

The maneuver could delay efforts by Senate Majority Leader Mitch McConnell, R-Ky., and Treasury Secretary Steven Mnuchin to add another $250 billion to the Paycheck Protection Program.

April 9 -

The majority of small businesses faced a financial challenge last year and that was before the pandemic curtailed consumer demand and forced nonessential companies to close.

April 9 -

Critics who argue this crisis mirrors the 2008 financial panic when Congress bailed out banks have it wrong. The new relief package in response to the coronavirus pandemic was necessary to save livelihoods, and more can be done.

April 9 Ludwig Advisors

Ludwig Advisors -

The coronavirus e-commerce push is likely to be permanent as consumers get used to digital payments, but that also gives rise to new fraud threats.

April 9 -

The Fed's actions are designed to ensure the flow of credit to midsize businesses and state and local governments hit hard by the economic impact of the coronavirus pandemic.

April 9 -

The industry is grappling with how to thank member-facing staff while also determining how newly mandated leave laws will impact them.

April 9 -

Fintechs, startups and bank-led projects were already working to excise generations of inefficiencies out of supply chains. The coronavirus has heightened the need for smooth payments.

April 9

!["Let’s take the opportunity to make some bipartisan fixes to allow [the Paycheck Protection Program] to work better for the very people it’s designed to help," said Sen. Chris Van Hollen, a Maryland Democrat.](https://arizent.brightspotcdn.com/dims4/default/94f6f74/2147483647/strip/true/crop/4777x2692+0+246/resize/520x293!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F21%2Ffd%2F4cc30d254e5c8f8b2cf92eabb0d2%2Fvan-hollen.jpg)

!["Let’s take the opportunity to make some bipartisan fixes to allow [the Paycheck Protection Program] to work better for the very people it’s designed to help," said Sen. Chris Van Hollen, a Maryland Democrat.](https://arizent.brightspotcdn.com/dims4/default/473f544/2147483647/strip/true/crop/4777x2687+0+248/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F21%2Ffd%2F4cc30d254e5c8f8b2cf92eabb0d2%2Fvan-hollen.jpg)