-

The company will pay $66 million for the parent of BloomBank.

October 5 -

The agency has a relatively new program designed to quickly get funds into disaster-stricken areas. The problem is that many banks and credit unions don't know it exists.

October 5 -

George Sutton, now an attorney in Salt Lake City, will sit on several Glacier Bancorp committees, including audit and compliance.

October 4 -

The merger will create a bank with 13 branches and roughly $950 million in assets.

October 3 -

You thought love triangles were complicated. The CEO of Sunshine Bancorp in Florida spoke with nine banks about buying the converted mutual while eyeing three possible acquisitions. The company sold to a buyer that bought another bank at the same time.

October 3 -

The Seattle company, which has cut about 130 positions in the business in recent months, pointed to lower originations tied to a shortage of new and resale housing.

October 2 -

Leslie Ireland, a former assistant secretary for intelligence and analysis at the Treasury Department, was also elected to the bank's board.

October 2 -

The Federal Reserve's nationwide preparedness plan for cash emergencies is being put to a unique test in Puerto Rico. Stocks are being replenished with daily flights, but the lack of power to ATMs and branches is contributing to reports of cash shortages.

October 2 -

Aberdeen Proving Ground FCU updates brand, honors roots.

September 29 -

The Ohio-based credit union relies heavily on employee input and an open-door policy to better craft the organization's strategic planning.

September 29 -

A partnership between the National Credit Union Foundatoin and the New York Credit Union Foundation will also aid CU members and employees in Puerto Rico.

September 28 -

Arthur Levitt says seemingly daily scandals highlight the lack of oversight and corporate governance shortcomings of financial technology firms, but two marketplace lending executives responded that more mature companies have just as many problems.

September 28 -

Ned Handy, who will take the helm in March, wants to be more aggressive luring deposits in the company's home state. That should reduce its reliance on other funding sources to support loan growth.

September 28 -

As eye-catching as the scandals at Wells Fargo are, the most shocking thing is that federal regulators have taken no meaningful action against the bank’s executives.

September 28 Calvert Advisors LLC

Calvert Advisors LLC -

Wells Fargo is extending a 6-year-old fight with a whistleblower, despite a government order to immediately reinstate the former employee.

September 27 -

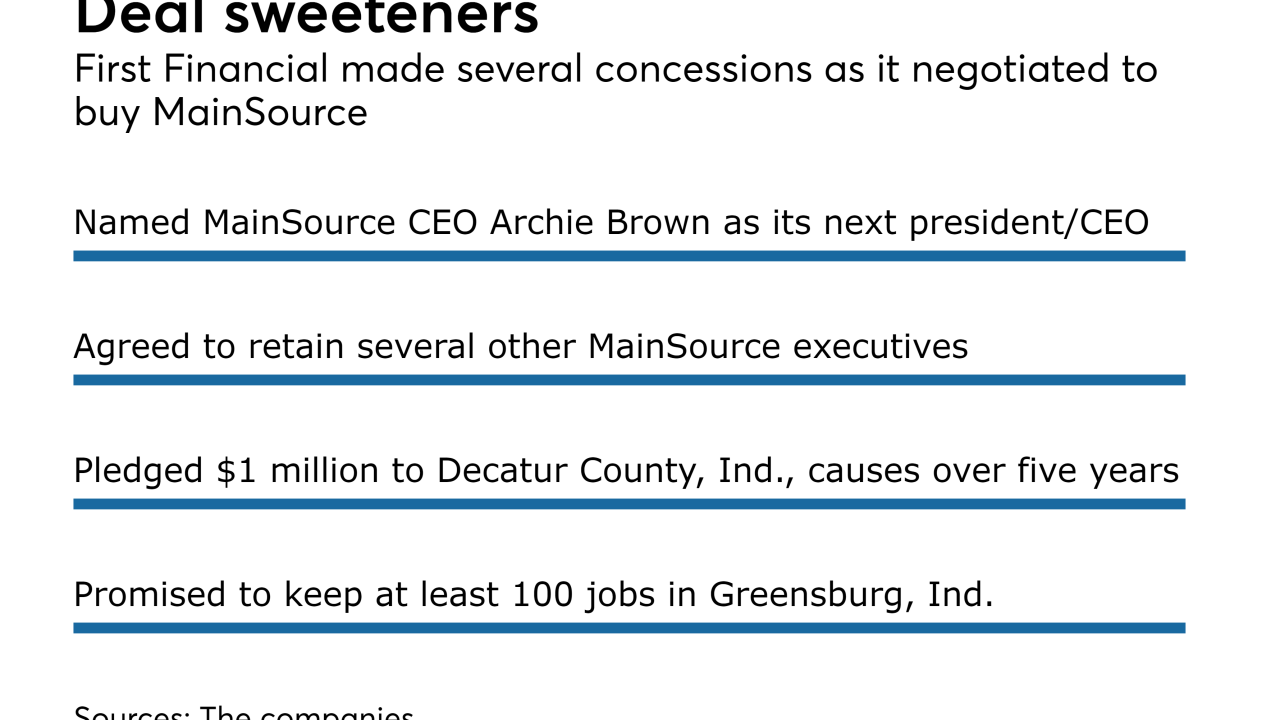

The Indiana company's board knew what it wanted from a potential buyer, and that helped it as it negotiated one of this year's biggest bank deals.

September 26 -

Joseph MarcAurele will retire as chairman and CEO in March. The company's president and chief operating officer, Ned Handy, will take the helm.

September 26 -

Mark Thompson had previously been a CenterState regional president overseeing the South Florida market.

September 26 -

The Lake Jackson, Texas-based CU is the largest CU in Houston and the fourth-largest in Texas.

September 26 -

The U.S. commonwealth has eight federally chartered credit unions, as well as a number of cooperativas, similar to state-chartered CUs.

September 26