-

SEG-based CUs could see a particularly big benefit from the rules, observers say, but community-chartered institutions and others could also see a significant boost.

April 10 -

The company took aim at Institutional Advisory Services, which recommended on Friday that shareholders vote against 12 of the company’s 15 board members.

April 7 -

The deal, which is expected to close in the fourth quarter, should significantly increase PacWest's operations in Southern California.

April 6 -

The Houston company was formed in 2009 to buy struggling banks in the wake of the financial crisis.

April 5 -

Live Oak Bancshares in North Carolina has hired Scott Custer to run its bank. Custer recently resigned as a consultant to F.N.B. Corp. in a move that took place days after F.N.B. bought Yadkin Financial, where he had been president and CEO.

April 3 -

Coast Capital Savings, Canada's biggest credit union by membership, plans to expand beyond British Columbia to challenge the dominance of the nation's banks.

March 31 -

In addition to 11.5 percent loan growth and membership rising at its fastest rate since 1987, membership at Michigan's CUs is growing faster than the state's population.

March 31 -

Scott Custer resigned as a director and paid consultant to F.N.B. days after the Pittsburgh company bought Yadkin to enter North Carolina.

March 31 -

Get Bank of Montreal's best tips for real results on gender diversity, then try not to get disheartened by other big banks. Plus: Amy Brady, Mary Navarro and Donna Demaio.

March 31

-

Tiny HECU had just 55 members, $170,000 in assets.

March 30 -

The California company will lease space on three floors of the building, while keeping a branch at the location.

March 30 -

Unlike most credit union conferences, if you’re under 40, you were too young to “crash” the Louisiana CU League’s annual meeting.

March 30 -

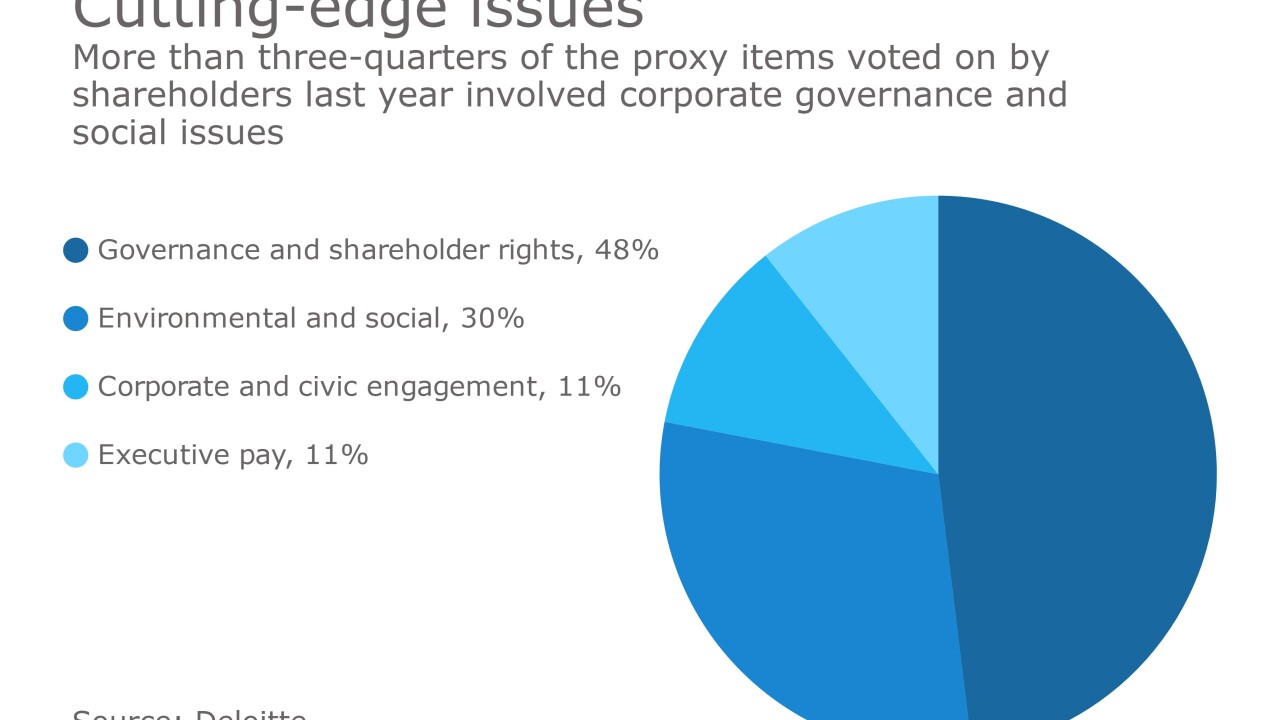

Investors concerned about the impact on banking of climate change, the pay gap and ethics matters are pushing back against a coalition of the heads of the biggest U.S. banks and other public companies that wants to limit small investors’ access to proxy ballots.

March 30 -

Mid Penn agreed to pay $59 million for Scottdale Bank in a deal that is expected to close in the third quarter.

March 29 -

The New Jersey company added a representative of Blue Harbour Group in Connecticut to its board.

March 29 -

First Bank, based in New Jersey, will pay about $27 million for Bucks County Bank in a deal that is expected to close in the third quarter.

March 29 -

James Lockhart, former director of the FHFA, is replacing Wilbur Ross, who resigned when he became Commerce secretary, on the New Jersey company's board.

March 29 -

Proposals to split the chairman and CEO roles at banks have rarely succeeded. But new developments — including a proposal to require separate roles for the next generation of managers — are helping concerned shareholders slowly make inroads.

March 28 -

Creative growth strategies are helping banks with $10B to $50B of assets — including Webster and TCF — improve profitability. These ‘tweeners’ deal with tougher regulations than smaller competitors without the scale larger ones have to absorb the expense.

March 27 -

The more vocal millennial generation is pushing companies like Bank of America to redefine diversity in the workplace to include more freedom of expression.

March 24