-

The self-regulatory body says working with data aggregators increases risk of cyber fraud, unauthorized transactions and identity theft. But aggregators say other links in the information chain are more vulnerable.

April 9 -

AI relies on catching the malware itself at a later stage, once it begins to operate in the system, and that's not enough to combat breaches and payment systems, according to Mordechai Guri, chief science officer at Morphisec.

April 9 Morphisec

Morphisec -

Brand and access to capital can suffer if companies don't take proper care of data from payments and other online activities, according to David Thomas, CEO of Evident ID.

April 6 Evident

Evident -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

The one thing more valuable to consumers than their bank accounts might be their internet access — and a new version of the ‘Trickbot’ trojan targets both.

April 4 -

Options include multilayered security solutions that incorporate verification via passive biometrics, without adding friction, by evaluating a consumer’s inherent behavior online during the transaction process, writes NuData Security's Lisa Baergen.

April 4 NuData Security

NuData Security -

Employees still fall for phishing attacks, but there is technology that can remove the offending code before employees even view emails, writes Aviv Grafi, CEO of Votiro.

April 4 Votiro

Votiro -

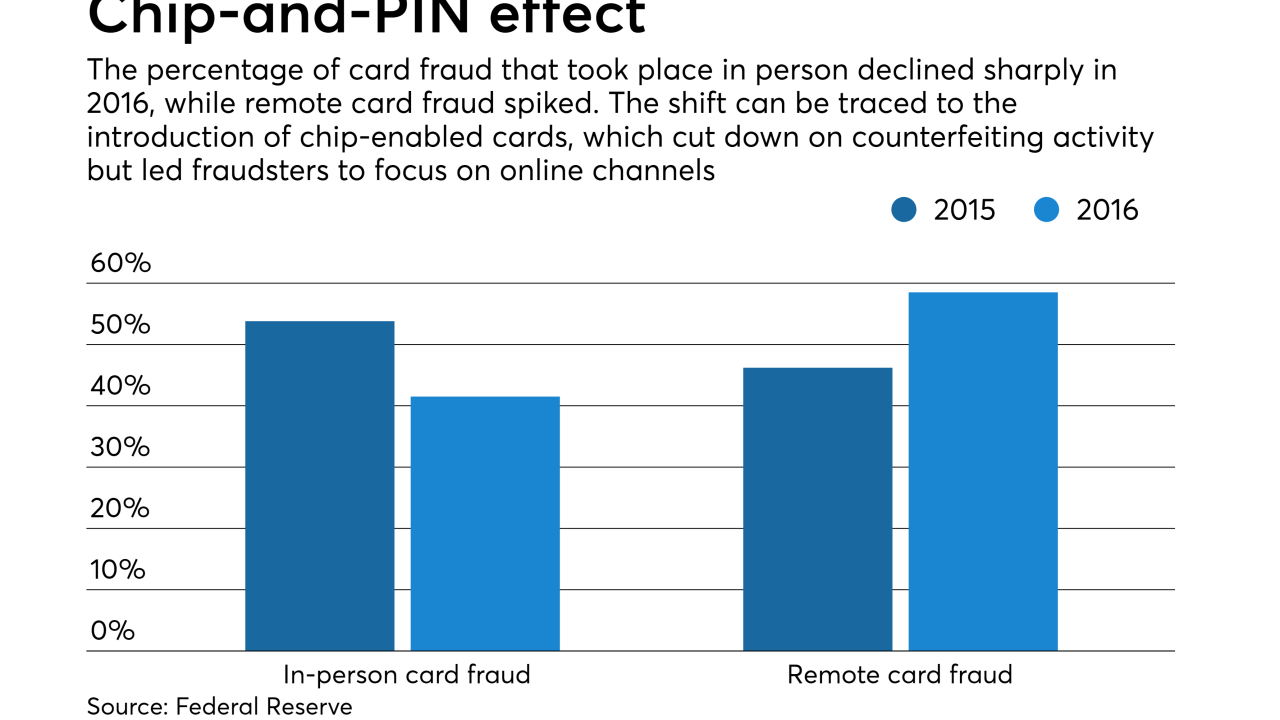

The central bank is taking a lead role in trying to combat the longstanding problem. A broad study by the Fed aims to measure the extent of payments fraud and to foster more collaboration in thwarting it.

April 3 -

Before reports of the data breach at Saks Fifth Avenue, Saks OFF 5th, and Lord & Taylor fade from the news cycle, there's one detail that should alarm merchants, card issuers and consumers — and sets a tone for future data breaches.

April 3 -

Are the incentives for protecting card data so lopsided that merchants feel little need to do more? Or is it wrong to ask merchants to fix the faults in a payment card ecosystem they had little hand in creating?

April 3 -

A new cobranded Uber debit card from Green Dot’s GoBank unit gives drivers 3% cash back if they choose PIN entry when filling their tanks at ExxonMobil stations, affirming the persistence of PINs in an increasingly digital payments environment.

April 3 -

The concept of privacy is evolving in the digital age in ways that demand new attention from policymakers. As stewards of considerable personal information, banks should prepare to take part in this debate.

April 2 Dorsey & Whitney

Dorsey & Whitney -

Fintech firms likely to take a third of traditional bank revenues by 2025, Citigroup report says; Saks, Lord & Taylor say five million card accounts were accessed.

April 2 -

The technology behind how payments are being delivered is advancing quickly. Unfortunately, standards and systems aren’t evolving fast enough to keep up, writes Greg Cohen, president of Paya.

March 30 Paya

Paya -

Like a crime wave, data leaks and vulnerable static identifiers show no sign of abating, as MyFitnessPal became the latest in a string of sites to have users' data exposed trough usernames and hashed passwords.

March 29 -

Northwest CU Association hails victory in all three of the states it represents, including an update to Idaho's Credit Union Act, as well as bills related to data security and municipal deposits.

March 29 -

Mark Begor, a former long-time GE Capital executive, faces lots of challenges as the credit bureau recovers; CEO dismisses “widespread rumors” that the bank wants to replace him.

March 29 -

POS payment encryption products are widely available and have been for many years, from technologies designed to secure card data from the point it is entered into the payment terminal, writes Ruston Miles, founder and chief strategy officer of Bluefin Payment Systems.

March 29 Bluefin

Bluefin -

A startup called Spring Labs has launched a blockchain network with the goal of getting lenders and data providers to share data to help verify customers' identity.

March 27 -

Driven by big breaches like the Equifax incident, all stakeholders in card payments will have to demonstrate multifactor authentication, writes Michael Magrath, director of global regulations and standards at VASCO.

March 26 OneSpan

OneSpan