-

The central bank said Wednesday that it will assess a range of options regarding its operational role in a modernized payment system, an issue that divides large and small banks.

September 6 -

The creators of Dash, a bitcoin rival whose price has increased nearly 3,400% in 2017, plan to entice thousands of white-hat hackers to inspect the project’s code for flaws.

September 6 -

The first compliance deadline fell last week for the state’s strict new regulation. Banks are struggling with certain elements, such as multifactor authentication.

September 5 -

The agency awarded grants in three areas: digital security, leadership development and technology aimed at enhancing a CU's capacity to serve the underserved.

September 5 -

The internet wasn't built to accommodate identity, which challenges initiatives to balance security with user efficiency.

September 5 -

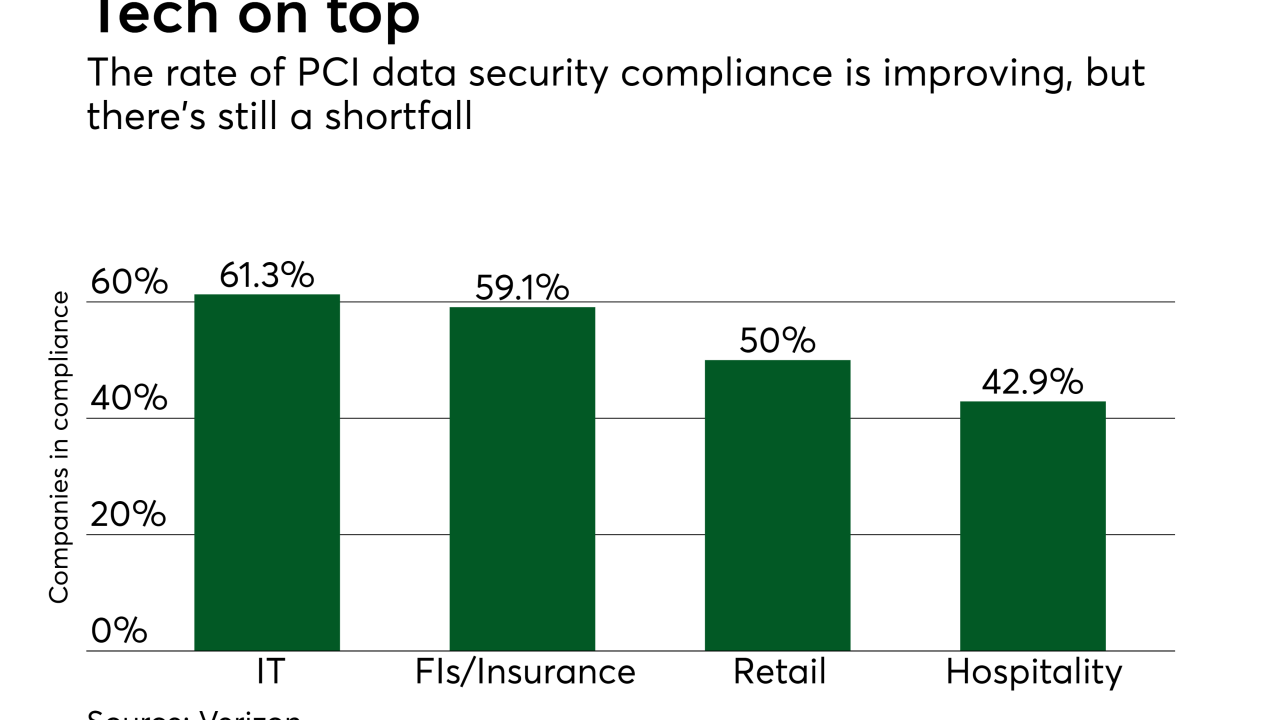

Compliance is improving, but more than 40% of companies still have work to do, according to a new Verizon report.

August 31 -

Can the internet giants peek at bank data, or eavesdrop on conversations with customers, sent over their gadgets? Here are the facts and the fuzzy areas.

August 29 -

The National Institute of Standards and Technology is telling agencies and companies that collect or store data to change the way they have been protecting their networks — and its guidance is likely to soon spill over to financial services and payments.

August 24 -

All business categories are vulnerable to breaches, but hotels seem to attract the most attention.

August 22 -

Artificial intelligence is helping detect breaches the human eye can’t. But it also gives hackers an edge.

August 17 -

The commercial potential of internet-connected devices appears bound only by imagination and comfort. For security companies, there's a similar broad horizon as watches, refrigerators and other everyday items become tools for payments.

August 17 -

If tokenization can help us recapture liquidity not only for currencies, but by digitizing the value of all assets, time and work in a more flexible, fair exchange, that’s exciting, writes Jason English, vice president of protocol marketing for Sweetbridge.

August 17 Sweetbridge

Sweetbridge -

An encrypted website and secure network aren’t very helpful when customers have been unknowingly routed to a criminal’s lookalike site, writes Simon Thorpe, director of product for Authy at Twilio.

August 14 Twilio

Twilio -

The ransomware threat is likely to get a lot worse before it gets better — if it ever does. And small merchants and ATMs may be the most at risk.

August 10 -

Point-to-point encryption (P2PE) advanced with the Payment Card Industry data security standard's updated guidelines in 2015, but the technology has not held the spotlight much since then.

August 9 -

As the digital age reduces the wear on physical cards, how is it that some consumers are requesting new cards more frequently?

August 4 -

Readers react to USAA teaming up with Amazon’s Alexa, how a new Wells Fargo’s scandal could affect arbitration rules, a digital identity startup’s ambitions, and more.

August 4 -

A "smart" token is a regular token on steroids, transmitting the information needed to authorize the transaction together, including enhanced counterpart identity, transaction and invoicing data, writes Marten Nelson, vice president and co-founder of Token.

August 4 Token

Token -

San Francisco-based startup UnifyID is developing an “implicit authentication” platform that requires no conscious actions by users to authenticate identities, and it’s just closed $20 million in fresh funding to support its growth.

August 1 -

A jumble of security vendors and lack of cohesive planning weaken many banks’ cybersecurity defenses, experts say.

August 1