-

The Illinois company, four months removed from its last bank acquisition, just announced the biggest purchase in its history. Alpine Bancorp. will add low-cost deposits and scale to Midland States' wealth management business.

October 18 -

Profits at the custody bank rose 16%, but it announced a new streamlining program that is expected to generate yearly savings of $250 million by 2020.

October 18 -

Frederick Waddell will retire as CEO of the Chicago custody bank at the end of 2017 but will remain chairman.

October 17 -

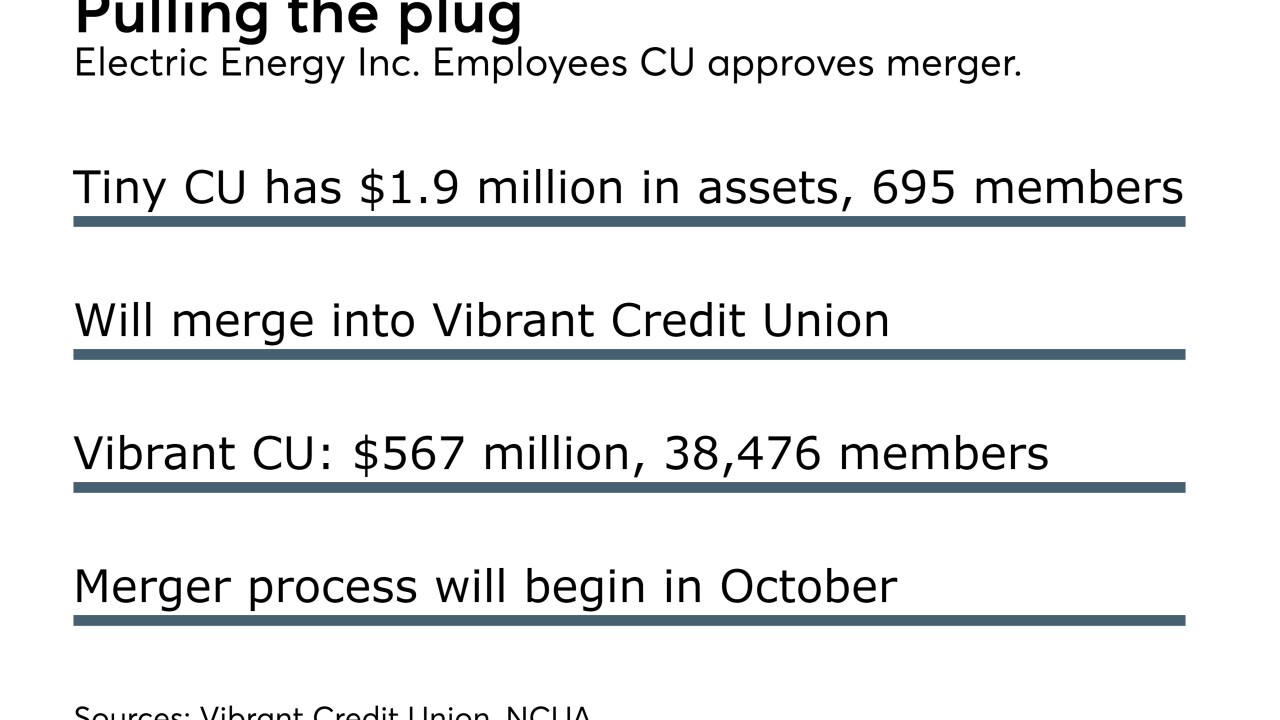

Electric Energy Inc Employees CU will become part of larger credit union.

September 22 -

The cash acquisition allows First American to expand its operations in Kenosha, Wis.

September 20 -

New clients will use vendor’s KeyStone core processing system.

September 13 -

Associated's agreement to buy Whitnell & Co. comes just weeks after the company lined up its first bank deal since the financial crisis.

September 11 -

Amendments mean parity with federal law, other changes allowing efficient CU operations.

August 31 -

Rising taxes, declining population and the political landscape in Illinois have led several bankers to put more money and resources into nearby states.

August 1 -

The move will explore the risks and opportunities of the new technology, and the group membership allocation across agencies and stakeholder groups seems to be a reasonable way to include a range of opinions, writes Rob Viglione, co-founder of ZenCash.

July 18 ZenCash

ZenCash -

The Canadian bank twice sweetened its bid for PrivateBancorp, raising the stakes. Now it must gain traction in the hypercompetitive Chicago market while hunting for more acquisitions.

June 23 -

CIBC plans to spend two years focusing on internal growth at PrivateBank except for some targeted wealth management acquisitions, but ultimately capital outlays or takeovers will be necessary to meet its growth ambitions.

June 23 -

Byline Bancorp's decision to go public sends a message that it plans to dangle a more liquid stock in front of potential sellers. It also provides a way for certain shareholders to cash out.

June 20 -

The offering would be a big milestone for Byline Bancorp, which was recapitalized in 2013 by a group led by former Banco Popular North America CEO Roberto Herencia.

June 19 -

The Illinois company agreed to pay $44 million to buy Guaranty Bank, the biggest institution based in Cedar Rapids, Iowa.

June 9 -

The bank is the second failure in Illinois so far in 2017. Seaway Bank was closed in late January.

May 26 -

Canadian Imperial Bank of Commerce increased its offer for PrivateBancorp Inc. by $3 a share in cash to offset the decline in the bidder's stock price.

May 4 -

The regulator also provided updates on investment performance, expenses, CAMEL codes and more.

April 20 -

Yman Vien says she lost her job at American Metro Bancorp because of her gender. The bank says the move was tied to poor decisions that led to a regulatory order in 2009.

April 13 -

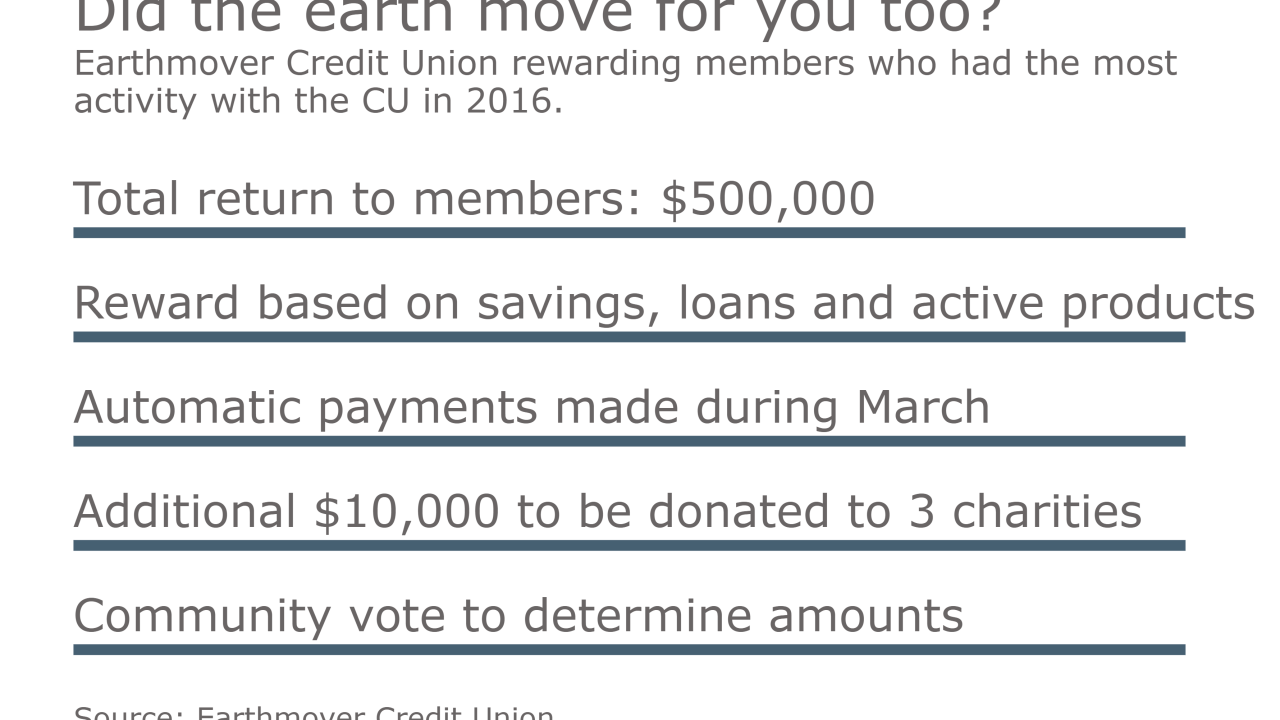

CU is rewarding members for activity in savings, loans and active products.

March 20