-

The regulator issued an urgent call for comments – needed by September 5 – in an effort to close stabilization fund more than three years earlier than expected.

August 9 -

Atlantic Bay Mortgage Group has agreed to buy a majority stake in Virginia Community Bank in a rare instance of a nondepository mortgage company buying a bank, rather than the reverse.

July 26 -

Union Bankshares in Virginia lost several key lending officers after it bought StellarOne. Management as a result has made changes to minimize employee flight from its latest M&A target, Xenith Bankshares.

July 25 -

The $231 million-asset Virginia bank will also double its legal lending limit when it buys CCB Bancshares.

June 28 -

Longtime Apple FCU staffer Andrew Grimm will take the helm from Larry Kelly, who is retiring at the end of June.

June 27 -

The Virginia company told investors that Morgan Davis, its president, will soon succeed founding CEO Robert Aston, who is retiring.

June 22 -

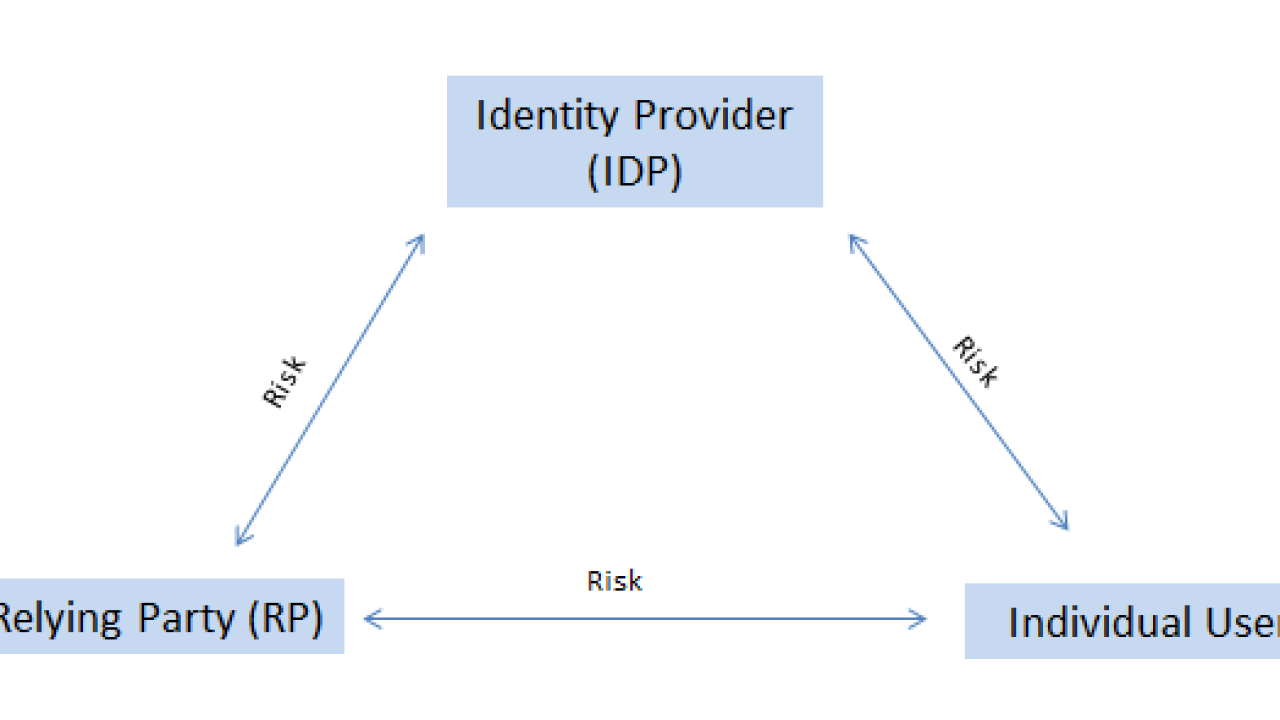

Portable digital identities could improve customer experience, cut costs and generate revenue for banks. But who’s on the hook when something goes wrong?

June 21 -

Casey Crawford, head of the rapidly growing Movement Mortgage, recently recapitalized First State Bank in Danville, Va., with his own money.

June 14 -

Management reports assets, membership continue to grow into 2017.

May 23 -

Of those penalized, 11 had assets of less than $10 million and only one had assets of more than $250 million.

May 23 -

Union Bankshares is poised to become a nearly $12 billion-asset bank in a state that lost most of its midsize institutions in the 1990s and early 2000s.

May 22 -

The $701 million acquisition will make Union the biggest community bank based in Virginia.

May 22 -

The $489 million acquisition is among the ten biggest bank M&A deals announced this year.

May 16 -

The federal regulator has created a new portal offering training courses and other information for free.

May 9 -

Second settlement of the week pushes recoveries by the regulator from MBS suits to $5.1 billion.

May 3 -

Regulator now has recovered nearly $4.8 billion in various suits related to the mortgage meltdown in 2008.

May 1 -

The acquisition will provide South State with more than $3 billion in assets and a larger operation in North Carolina.

April 27 -

TowneBank's acquisition of Paragon Commercial Bank would give it access to several North Carolina markets.

April 27 -

The regulator also provided updates on investment performance, expenses, CAMEL codes and more.

April 20 -

Carter, who built what became Carter Bank and Trust from the ground up, was praised for his “uncanny” credit acumen, devotion to community and family, and willingness to take unconventional risks.

April 11