-

Brown has been with the online lender almost since it was spun off from General Motors, helping it broaden its product offerings and take a stand on overdraft fees. Now he must help Ally confront a looming recession.

November 21 -

Women focused on environmental, social and governance issues are seeing career opportunities open as sustainable finance initiatives become more critical to a bank's success.

October 9 -

Though quantum computing is not quite ready, banks are testing it for portfolio optimization, index tracking, options pricing and other tough mathematical problems.

September 22 -

By taking the manual labor out of data management and upkeep, experts can reach new clients and better serve their existing ones.

July 7 -

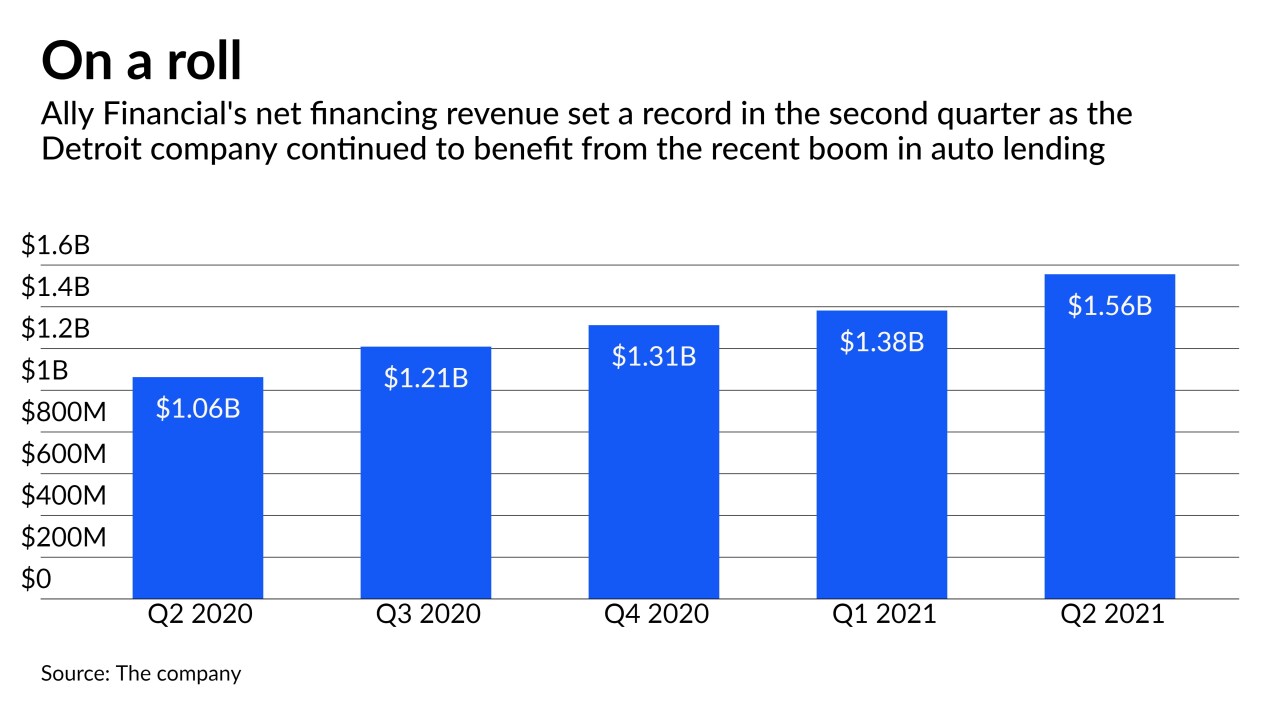

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Ally and Huntington are the latest banks to take steps that will reduce revenue from customers who spend money they don’t have. The moves come at a time when technological, regulatory and social forces are converging to encourage change.

June 3 -

The online bank's decision to stop charging the fees is part of a broader reassessment across the industry. Ally had waived overdraft fees early in the pandemic and has historically been less reliant on them than many other institutions.

June 2 -

Other banks soured on their AR experiments, but Ally Financial says the technology has yielded higher-balance deposit accounts — and heavier social media engagement — in marketing campaigns.

May 10 -

At the brokerage and wealth management arm of Ally Financial, Bell leads the team responsible for shaping the insight on investing and the global markets that is shared with customers.

May 5 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16