-

Most big banks are launching robo-advisers to compete for a new breed of wealth management customer. The risk is that automated services will disappoint traditional customers.

June 5 -

The $142-billion asset bank expects to deepen relationships with existing customers and add new ones, by collaborating with Intellect Global Transaction Banking to develop new services.

May 31 -

Comprehensive analysis of the banking industry's first big legislative victory since the crisis; lawsuits target banks with websites in violation of the Americans with Disabilities Act; what a homegrown app for millennials has to teach Wells Fargo; and more from this week's most-read stories.

May 25 -

While industry officials welcomed a bulletin from the Office of the Comptroller of the Currency encouraging banks to develop alternatives to payday loans, they are making no commitments to offer such products.

May 24 -

Investing in technology has been an important focus for banks. But big questions remain about these investments, including how best to pay for them.

April 19 -

SunTrust's new IT chief preaches collaboration; will CRE securitizations return to haunt?; Amazon here, there and everywhere; and more.

March 23 -

The bank will enable customers to access its 2,500 ATMs via mobile banking.

March 19 -

A public-private coalition, including Citigroup and disability advocates, is testing financial literacy strategies in New York City that they hope will be used nationwide to improve the financial lives of Americans with disabilities.

February 20 -

The Pew Charitable Trusts has released a set of 10 standards for banks and credit unions that want to to offer small loans to subprime customers. Among its ideas: keep monthly payments at or below 5% of the borrower’s paycheck and make loans available quickly through digital channels.

February 15 -

The Pew Charitable Trusts has released a set of 10 standards for banks and credit unions that want to offer small loans to subprime customers. Among its ideas: keep monthly payments at or below 5% of the borrower’s paycheck and make loans available quickly through digital channels.

February 15 -

The British banking giant has been testing its new online lending platform with a handful of its U.S. customers and plans to roll it out in full force next year. It's all part of a broader effort to expand its U.S. consumer business beyond credit cards.

November 21 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

As Fifth Third's chief administrative officer, Teresa Tanner has overseen big changes in employee benefits and led the process to relaunch the bank's brand.

September 25 -

The Trump administration is considering nominating Jelena McWilliams, Fifth Third Bancorp's top lawyer, to lead the Federal Deposit Insurance Corp., people familiar with the matter said.

July 28 -

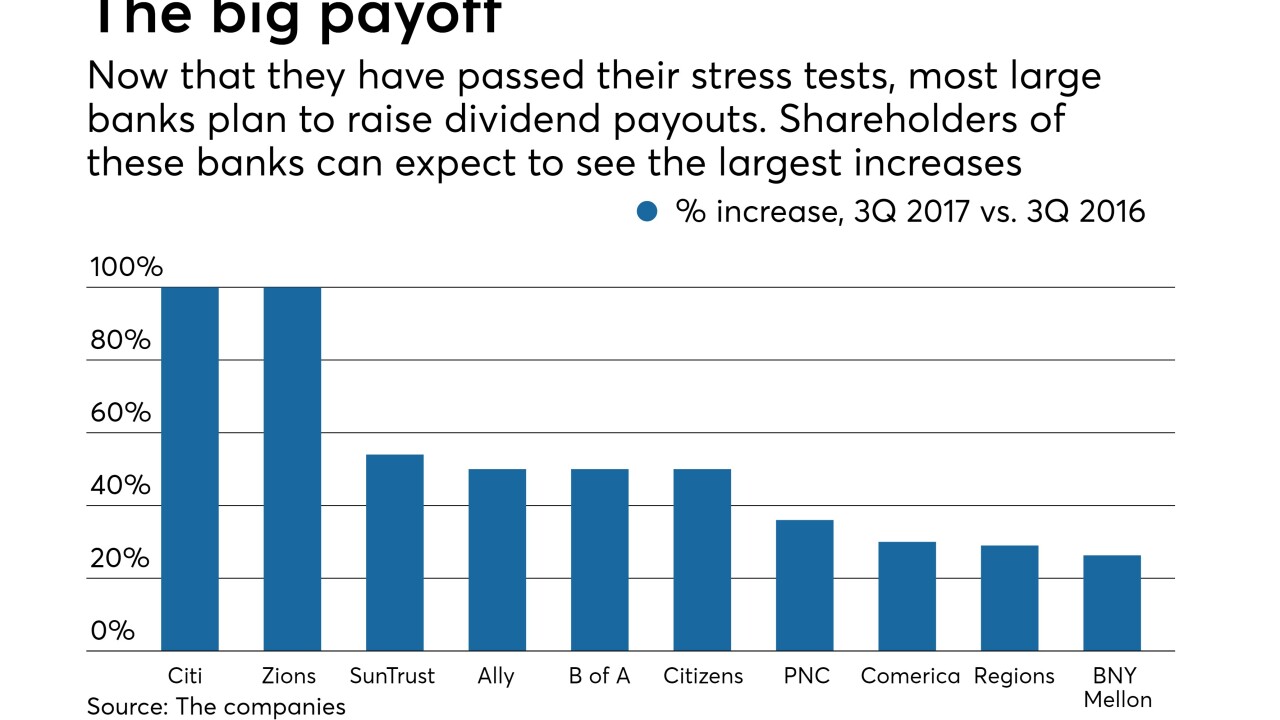

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

The following are some of the noteworthy things we heard at American Banker’s Digital Banking 2017 conference held earlier this month in Austin, Texas.

June 26 -

With the first half of 2017 drawing to a close, bank executives gathered this week at the Morgan Stanley Financial Services conference to discuss their companies’ performance thus far and, more important, outline their priorities for the rest of the year and beyond. Here are some of the highlights.

June 15 -

Banks have warmed up to digital wealth management tools but will need to use their human advisers, too, to beat fintechs.

May 10 -

The San Antonio company named Chad Borton, previously head of consumer banking at Fifth Third Bancorp in Cincinnati, for the role. Fifth Third has named Philip McHugh as his successor.

April 7 -

Financial institutions of all sizes are overhauling benefits policies and promoting work-life balance to better compete for millennial recruits with the hipper tech sector. The big changes include longer periods of paid time off for new parents.

March 27