-

Donations to support hospitals and health care organizations, and other ways credit unions are giving back to their communities.

July 11 -

Fallout from the Equifax breach is coming into clearer focus as more companies begin pinpointing its effects over the last several months.

July 11 -

CU executives are taking the reins at one corporate credit union, plus more news of new hires, promotions and accolades at CUs across the country.

July 10 -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 9 -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 6 -

Another look at how credit unions are giving back and making a difference in consumers' lives.

July 6 -

One firm's inability to access bank data shows how fragile fintechs can be; payments processor Square quietly withdraws bank application; turnover of chief risk officers is on the rise; and more from this week's most-read stories.

July 6 -

Readers weigh in on inequality in financial services, opine on falling bank reputations, chime in on the evolving role of the chief risk officer and more.

July 5 -

Regardless of which party controls the House or Senate after the midterm elections, the financial services panels in both chambers could have new leaders.

July 4 -

Donations to improve kids' lives, branch expansions, helping the less fortunate and other ways credit unions are making a difference.

July 3 -

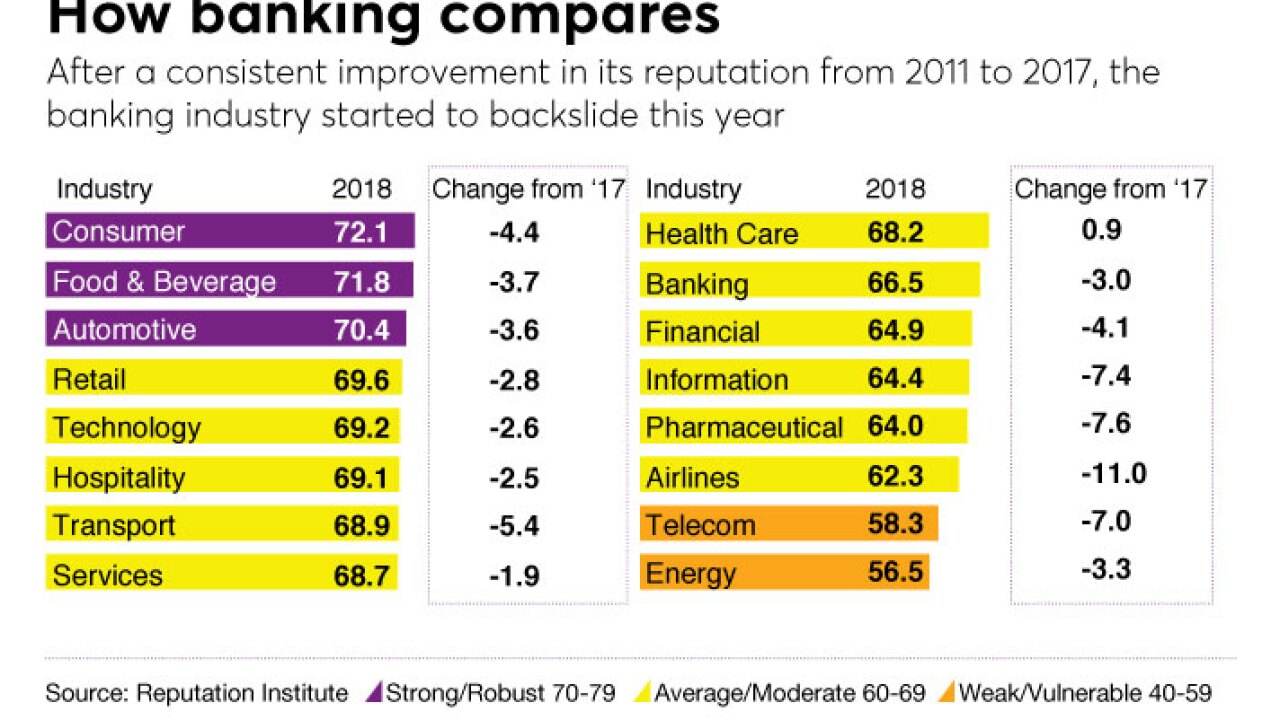

USAA reigns, Wells Fargo, well, doesn't. Here's a look at the highs and lows in this year's survey, as well as the trends that drove the results.

July 1 -

A look at the highlights of CUNA's 2018 ACUC in Boston.

June 29 -

Bank reputations fall for the first time in five years, according to our 2018 survey; tallying the scorecard after the Supreme Court's credit card ruling; 10 questions for California bank commissioner; and more from this week's most-read stories.

June 29 -

In the era of digital and mobile payments, many banks and tech companies have strived to completely do away with cash, checks and cards. But quite a few have had to concede that the market isn't quite ready to give up the physical trappings of payments.

June 29 -

Readers react to Capital One restricting data access, opine on whether or not the Consumer Financial Protection Bureau's structure is unconstitutional, weigh in on Rep. Maxine Waters as Financial Services Committee chairman and more.

June 28 -

One CU executive gets her breakthrough moment, up-and-comers earn accolades, plus promotions and new hires across the country.

June 28 -

Disruptive upstarts. Glitches galore. Open banking adoption. Financial institutions are being challenged on multiple fronts — here’s a look at how they’re coping.

June 28 -

The Trump administration's plan to end the conservatorship of Fannie Mae and Freddie Mac marked its first effort to solve a problem left over from the financial crisis, but ultimately raised more questions than it answered.

June 27 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

From the new business lending officer at one credit union to the controller at another, plus special recognition and more.

June 26