Artificial intelligence

Artificial intelligence

-

Mastercard is launching AI Express, a service to help companies develop and deploy tailored payment solutions leveraging artificial intelligence.

June 4 -

A broader cross-section of hires and added training could help financial institutions avoid problems with algorithm-based discrimination in lending.

May 30 -

Shari Van Cleave, head of Wells Fargo Digital Labs, says the bank is experimenting with artificial intelligence and augmented reality to create new ways to present data to customers.

May 25 -

Sageworks, a financial services software firm that provides institutions with lending and risk solutions, was sold to Silicon Valley-based Accel-KKR.

May 21 -

On the first day of the 2018 CUNA CFO Council conference, futurist Mike Walsh gave credit unions a hint of the world to come from both a consumer and business point of view.

May 21 -

Bank of America on where its AI hopes (and worries) lie; Zelle founder Paul Finch announces his leave from the payments network; the one area where banks and fintechs want more regulation; and more from this week's most-read stories.

May 18 -

Bank executives say artificial intelligence will create jobs, while analysts say the opposite. Employees are anxious but willing to try to work with it. All agree AI is already making an impact.

May 18 -

Envestnet's aggregator rolls out PFM features meant to appeal to younger clients — and links to Alexa.

May 17 -

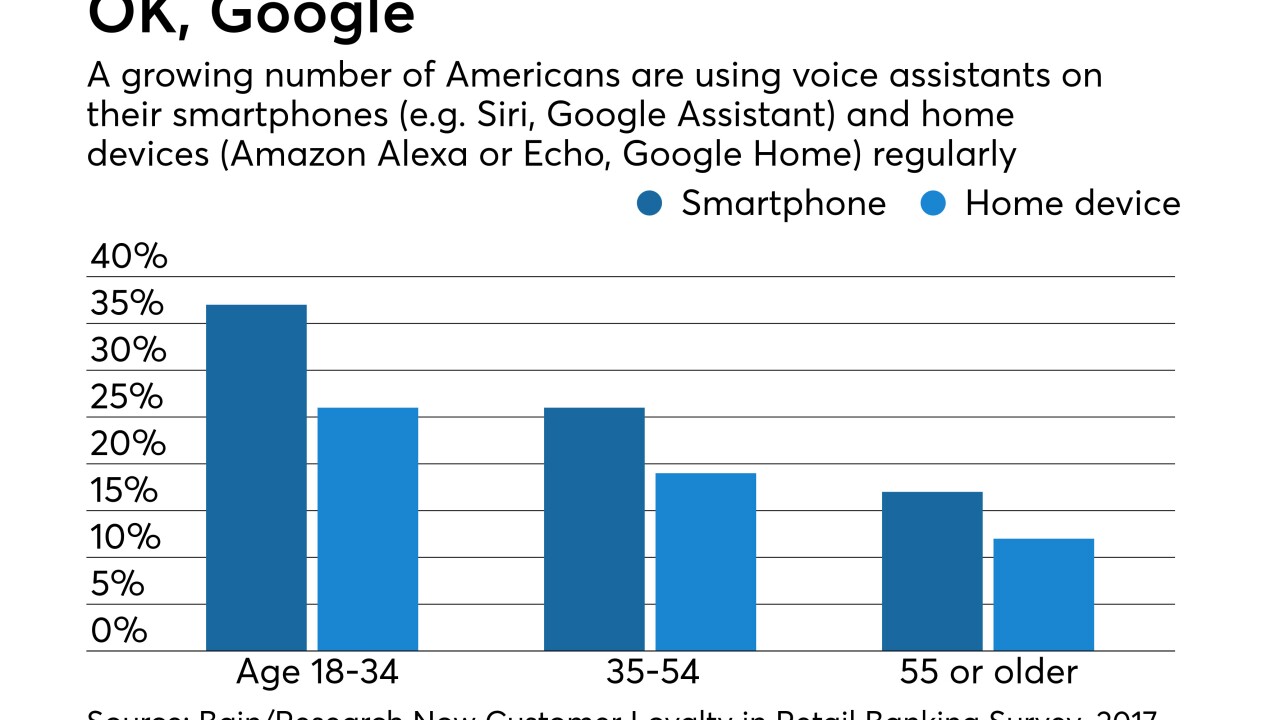

Google's new voice assistant technology may be the best right now at imitating human speech. That makes it a potentially powerful tool for bankers — and for cybercrooks.

May 16 -

Bank executives say artificial intelligence will create jobs, while analysts say the opposite. Employees are anxious but willing to try to work with it. All agree AI is already making an impact.

May 15 -

Marcus unit will start taking deposits in the U.K. next month; the bank uses the technology to complete a trade finance letter of credit for Cargill.

May 14 -

Artificial intelligence will reshape the job landscape at banks; people still want to open accounts at a branch; Mick Mulvaney stacks CFPB bench with political appointees; and more from this week's most-read stories.

May 11 -

It can be difficult for financial services companies to glean customer insights from the abundance of information they have.

May 11 -

The bank is using AI in its chatbot, in trading and other areas. It also has concerns about the potential for bias to creep into the software.

May 11 -

A multilayered approach that allows one type of fraud tool to pick up the slack when another layer fails, according to Robert Capps, a vice president at NuData Security.

May 11 -

Readers weigh in on the role banks play on gun control, chime in on Wells Fargo’s latest brand campaign, slam the idea of postal banking and more.

May 10 -

As chat bots, video assistants and other artificial inteligence tools proliferate, how can humanity – and credit unions – survive?

May 10 -

Welcoming automation into our industry with less friction and fear happens when we understand its overwhelming benefit to our futures and the quality of our work, writes Lauren Ruef, a research analyst for Nvoicepay.

May 10 -

Manuela Veloso, head of the machine learning department at Carnegie Mellon University, will join the bank in July.

May 9 -

From AI's impact on how we live to leadership lessons from an Olympian, making the most of analytics and more, here's a look inside the 2018 THINK Conference.

May 9