Community banking

Community banking

-

From superheroes to witches, Minions, Ghostbusters and more, here's how credit unions are celebrating Halloween this year.

October 31 -

The company plans to use some of the offering's $48 million in proceeds to redeem preferred stock.

October 31 -

Political stalemates have convinced many executives that relief will only come when agency leaderships turn over.

October 31 -

Big banks have raised deposit rates faster than regionals in order to retain depositors; India’s largest payment app wants to expand.

October 31 -

David Ritchie, a regional manager for U.S. Bank, will succeed the retiring David Tabor in early November.

October 30 -

Blood drives, scholarships, helping four-legged friends and other ways credit unions are giving back.

October 30 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

The OCC has terminated orders against three of Fulton's banks. The company and two other banks still have BSA-related orders.

October 30 -

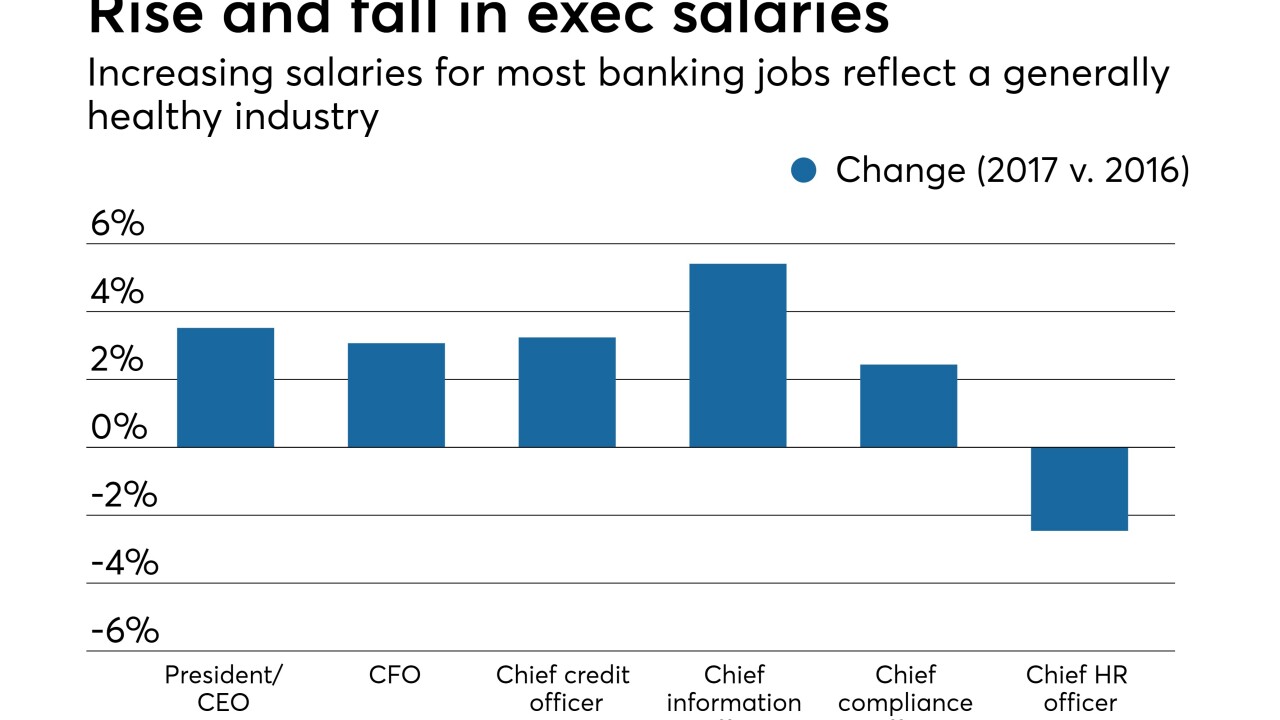

Salaries and benefits are up, as banks work harder to recruit and retain staff. So are casual days, wellness programs and other perks.

October 30 -

The bank is looking to raise $72 million, which it could use for organic growth and acquisitions.

October 30 -

It's tough to be a bank director these days, as the public and elected officials hold the board responsible for misdeeds that occur on their watch. Turnover is up, and filling the seats is more of a challenge than ever.

October 29 -

Banks are revamping and investing in new wholesale systems to solve the frustrations felt by corporate customers.

October 27 -

New branches, big donations and more ways credit unions are giving back to their communities.

October 27 -

Many institutions have delayed planning for a big change to reserve accounting despite a belief that they should start testing systems and methodologies next year.

October 27 -

The Montana company agreed to buy Inter-Mountain Bancorp in an all-stock deal valued at $173 million. The company has lined up nine bank acquisitions in the last five years.

October 27 -

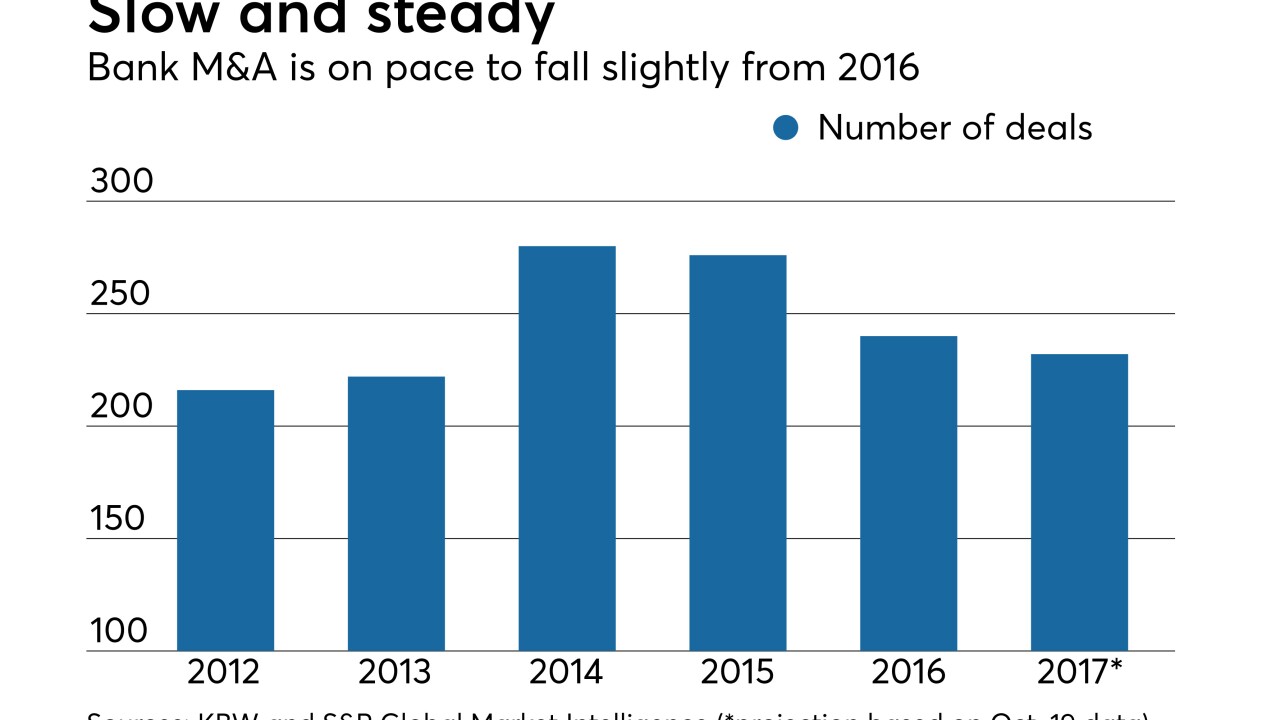

If Congress changes the $50 billion-asset threshold for systemically important financial institutions, big banks could take it as a signal that regulators would be amenable to larger deals.

October 26 -

raising funds for sick kids, giving aspiring scholars a boost and other ways credit unions are giving back to the communities they serve.

October 25 -

The New Jersey company reported lower third-quarter profit that included severance costs from a two-year program to boost its bottom line.

October 25 -

A planned spinoff, combined with several new ventures, should help BankMobile turn the corner, says Luvleen Sidhu, the digital-only bank's president.

October 25 -

Consolidation has led to too few community banks, which is amplified in areas where capital is needed most.

October 25