Community banking

Community banking

-

The traditional community bank model of "being local and providing good service" no longer provides an competitive edge in a world dominated by online banking, according to Douglas Kennedy, CEO of Peapack-Gladstone.

October 25 -

The company, which agreed to buy Southwest Bancshares in Mobile, also plans to sell $45 million in stock to help fund the deal.

October 24 -

Jim Popp, formerly of JPMorgan Chase, will become CEO of Johnson Financial Group in Racine at yearend. He will succeed the retiring Jim Bolger.

October 24 -

The mutual, which agreed to buy First Colebrook Bancorp, had recently opened a limited-service branch in Portsmouth, N.H.

October 24 -

Banks are swapping out long-term holdings for short-term securities to manage interest rate risk. But in the process, they are sacrificing yield — and ammo they might need to pay more for deposits to retain customers.

October 24 -

The Michigan company's third-quarter results were down slightly from a year earlier despite increased commercial lending and a wider net interest margin.

October 24 -

For community bankers, the current environment is more challenging than ever, with high regulatory burden and tough competition. Four bank CEOs sat down to discuss the future of the industry, and what they are hoping may change.

October 24 -

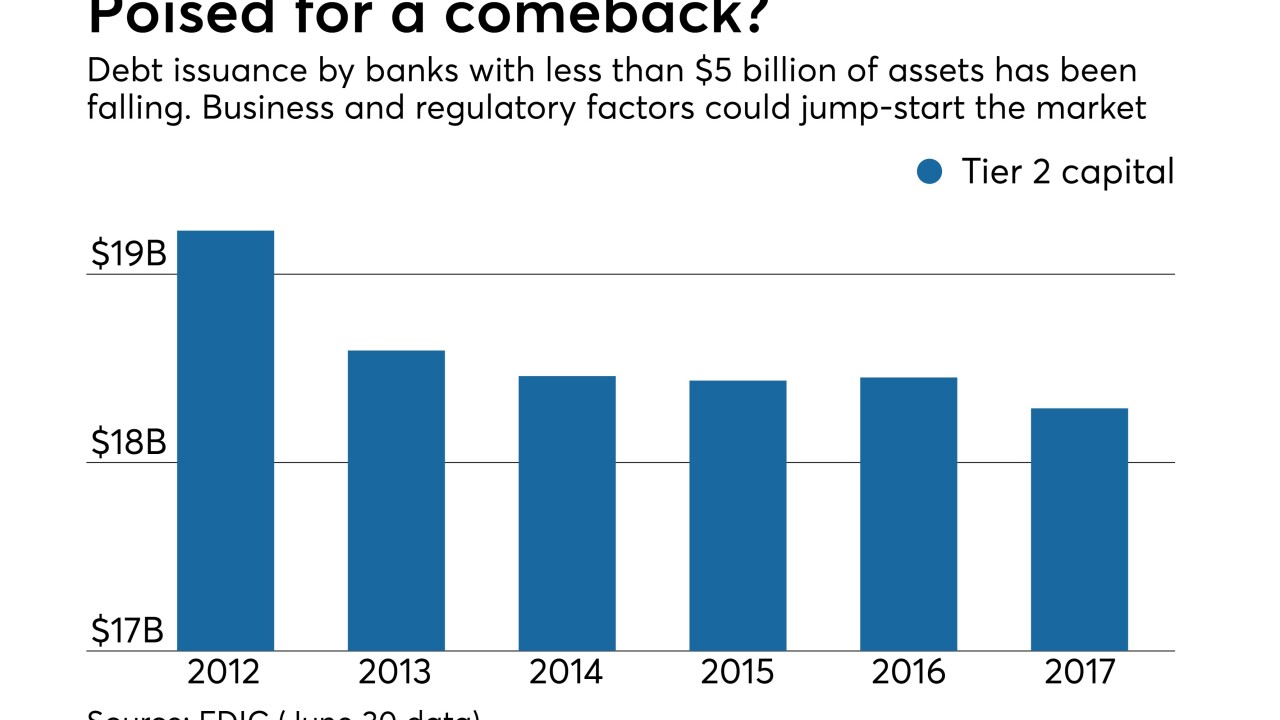

Increased investor appetite and the emergence of specialized debt ratings are expected to spur demand, and community banks are looking for ways to fund expansion and hedge against future economic downturns.

October 23 -

On Jun. 30, 2017. Dollars in thousands.

October 23 -

On Jun. 30, 2017. Dollars in thousands.

October 23 -

The company, which will officially report results later this week, took hits tied to its planned spinoff of BankMobile and losses tied to an overseas investment.

October 23 -

Feeding the hungry, celebrating branch milestones and other ways credit unions are giving back to the communities they serve.

October 23 -

Helping the less fortunate, honoring veterans, recognizing academic achievement and other ways credit unions are giving back to the communities they serve.

October 20 -

The Wyomissing, Pa.-based firm is forgoing cash offers in favor of a more complicated plan that involves spinning the unit off to shareholders, who will then trade their stakes for shares in a Clearwater, Fla., community bank in a tax-free exchange.

October 20 -

Readers weigh in on online lending growth, how President Trump’s healthcare policies affect lenders, regulation’s effects on community banks and more.

October 19 -

With online retailers beginning to challenge the dominance of brick-and-mortar grocery stores, CRE loans to strip mails anchored by them look riskier.

October 19 -

Ditching paper and digitizing tasks help community banks operate more efficiently and write more profitable commercial loans.

October 19 -

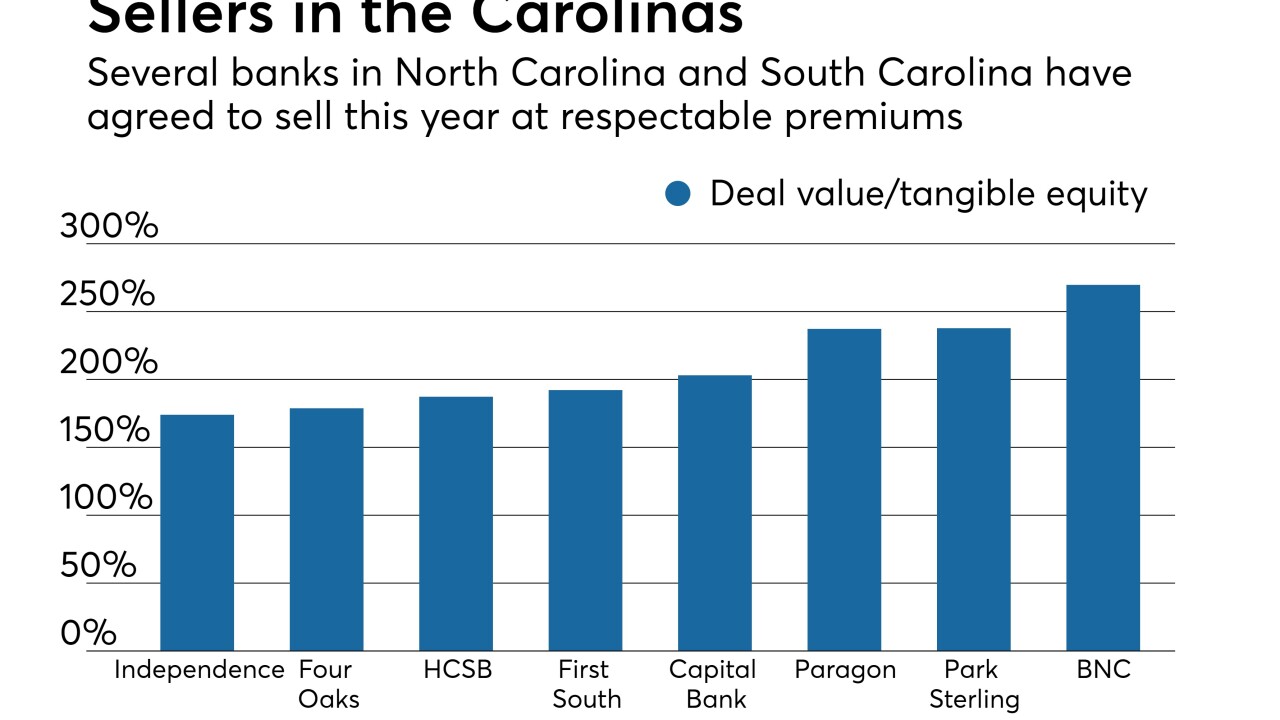

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

First Bank will enter a new market and gain access to low-cost deposits after it completes the acquisition.

October 18 -

From golf outings to scholarship awards, ground breaking ceremonies and more, here's how credit unions are giving back to the communities they serve.

October 18